Key Takeaways

- Heavy reliance on a few flagship products and reimbursement delays expose Lifeward to margin pressure, cash flow risks, and regulatory or competitive setbacks.

- Expansion opportunities and operational improvements are offset by global pricing pressure, high upfront costs, and required ongoing investment, delaying meaningful profitability.

- Lifeward faces ongoing revenue weakness and margin pressure due to reimbursement uncertainty, operational risks from in-house manufacturing, and concerns over market value versus business fundamentals.

Catalysts

About Lifeward- A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

- While Lifeward is positioned to benefit in the long run from an aging population that demands more advanced rehabilitation devices, near-term growth remains challenged by slow and inconsistent payer reimbursement cycles, especially from Medicare, delaying revenue recognition and cash flows.

- Although expansion into emerging markets and broader healthcare access present significant future opportunities, global healthcare cost containment measures and price sensitivity are creating downward pressure on device pricing, which could limit top-line revenue growth even as unit demand rises.

- Despite ongoing innovation in AI-enabled and robotic-assisted mobility solutions that have potential to command a premium, Lifeward's reliance on a limited number of flagship products leaves the company exposed to both regulatory delays and potential competitive threats, pressuring both net margins and long-term earnings stability.

- While operational improvements, such as the transition to in-house manufacturing, are expected to improve gross margins over time, upfront increases in inventory and resource allocation have dampened near-term margin expansion and elevated cash usage, limiting flexibility if topline growth stalls.

- Even as digital health integration and new channel partnerships could enhance recurring revenue, the need for continued heavy investment in R&D and market development-without immediate payoff-raises the risk that long-term operating losses may persist, slowing net margin improvement and delaying a path to profitability.

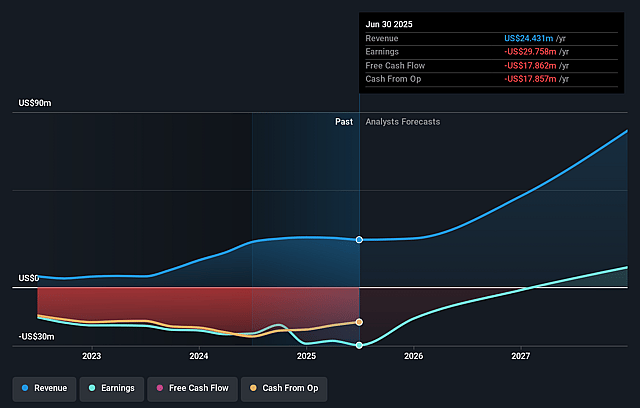

Lifeward Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lifeward compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lifeward's revenue will grow by 45.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -121.8% today to 1.3% in 3 years time.

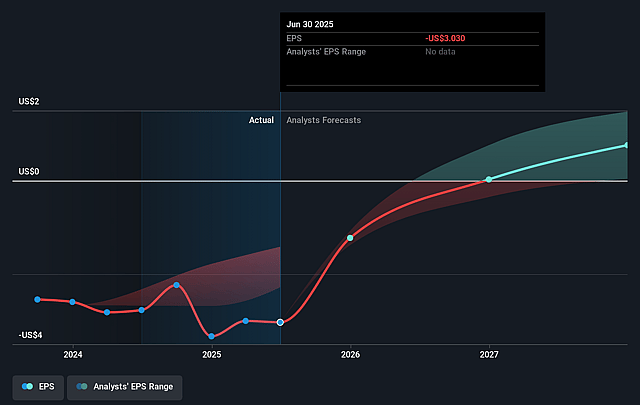

- The bearish analysts expect earnings to reach $953.1 thousand (and earnings per share of $0.06) by about September 2028, up from $-29.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 26.1x on those 2028 earnings, up from -0.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.43%, as per the Simply Wall St company report.

Lifeward Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lifeward reported a 15 percent decline in year-over-year revenue for the second quarter and lowered full-year revenue guidance, reflecting near-term growth challenges and introducing the risk of ongoing revenue weakness if payer approval and lead conversion do not accelerate as anticipated.

- The company remains dependent on slow and unpredictable reimbursement cycles, especially with Medicare administrative contractors, which has caused cash collection delays and increases uncertainty over Lifeward's ability to consistently convert pipeline demand into timely revenue and positive operating cash flows.

- Lifeward's recent transition to in-house manufacturing has increased inventory levels and short-term margin pressure, raising the risk that operational disruptions, excess inventory, or unanticipated costs could persist and impact gross profit margins longer than expected.

- The presence of a significant goodwill impairment triggered by a sustained drop in share price signals the market's concern about Lifeward's ability to close the gap between its perceived market value and underlying business fundamentals, which may hinder shareholder returns and limit future equity financing options.

- Heavy reliance on reimbursement-driven product sales and the need to continually expand payer relationships creates vulnerability to regulatory and policy changes, prolonged coverage determination timelines, and pricing pressure, all of which can suppress top-line revenue growth and compress net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lifeward is $1.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lifeward's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $74.8 million, earnings will come to $953.1 thousand, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 9.4%.

- Given the current share price of $0.57, the bearish analyst price target of $1.0 is 43.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.