Key Takeaways

- Enrollment growth and efficient geographic expansion are positioning the company for sustained revenue gains and scalable growth.

- Operational improvements and alignment with value-based care are driving margin improvements and better medical expense control.

- Accelerating costs, regulatory risks, operational losses from expansion, increased compliance expenses, and management turnover all threaten future profitability and financial stability.

Catalysts

About InnovAge Holding- Manages and provides a range of medical and ancillary services for seniors in need of care and support to live independently in its homes and communities.

- Enrollment growth is accelerating, supported by strong underlying demand for care models that allow seniors to remain at home, directly benefiting from the expanding 65+ demographic in the U.S.; this positions the company for robust future revenue expansion.

- Operational transformation initiatives-including technology investments, cross-functional efficiencies, and the integration of in-house pharmacy and clinical services-are actively reducing per-participant costs and driving improvements in net margins.

- Industry-wide healthcare policy is moving toward outcome-based and value-based care models; InnovAge's integrated PACE model already aligns with these trends, which is likely to support improved reimbursement rates and sustained margin growth.

- Enhancements in clinical management and care delivery, such as proactive preventive programs and in-home care, are reducing high-cost utilization (e.g., assisted living, skilled nursing), leading to better medical expense control and improved earnings.

- Geographic expansion into new markets and underpenetrated states, coupled with improved enrollment efficiency, is enabling InnovAge to leverage its existing infrastructure for scalable growth, setting the stage for higher long-term revenue and operating leverage.

InnovAge Holding Future Earnings and Revenue Growth

Assumptions

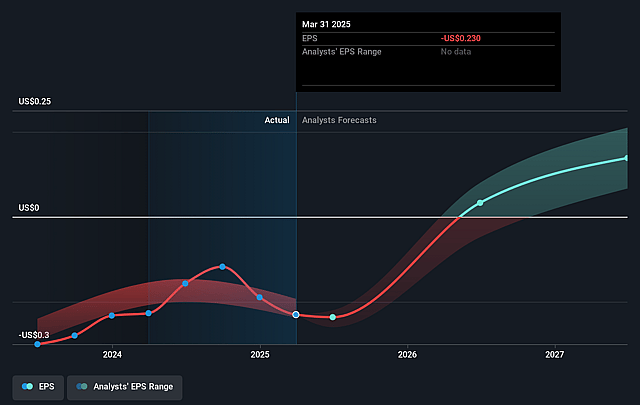

How have these above catalysts been quantified?- Analysts are assuming InnovAge Holding's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.8% today to 1.6% in 3 years time.

- Analysts expect earnings to reach $17.9 million (and earnings per share of $0.13) by about September 2028, up from $-31.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.2x on those 2028 earnings, up from -16.3x today. This future PE is greater than the current PE for the US Healthcare industry at 20.9x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

InnovAge Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high cost growth, with cost of care up 17.6% year-over-year (outpacing 13% revenue growth), reflects rising salaries, benefits, pharmacy expenses, and third-party fees, which may suppress long-term net margins and earnings despite operational efficiency efforts.

- Exposure to regulatory and funding uncertainty is significant given the company's dependence on Medicare and Medicaid capitation rates, and management's acknowledgement of indirect risks stemming from federal/state budget pressures or policy changes that could adversely impact long-term revenue.

- De novo center expansion continues to generate notable losses ($3.5M in Q3, projected $18–20M for FY25), and management highlighted initial ramp-up challenges and cost volatility (e.g., transportation costs); ongoing difficulties in new-market execution could hinder future earnings growth and margin improvement.

- General and administrative costs increased sharply (up 40.1% YOY) due in part to legal settlement accruals and higher compliance staffing, exposing InnovAge to ongoing risks around litigation, compliance costs, and the financial impact of regulatory infractions, all of which may constrain profitability.

- Management turnover, including the departure of the Chief Medical Officer, creates potential risk around continuity in clinical leadership and oversight; instability in senior roles could undermine clinical quality, compliance, and ultimately impact financial results.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.0 for InnovAge Holding based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $17.9 million, and it would be trading on a PE ratio of 45.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $3.77, the analyst price target of $5.0 is 24.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.