Last Update 01 May 25

Fair value Decreased 7.96%CPT Code Change Will Expand Heart Failure Treatment Adoption

Key Takeaways

- Upcoming reimbursement improvements and expanded clinical evidence are set to boost physician adoption, leading to higher procedure volumes and increased revenue leverage.

- Strategic sales force expansion and targeted education will drive sustained demand, better market penetration, and enhanced long-term profitability.

- Persistent losses, salesforce turnover, slow physician uptake, reimbursement uncertainty, and increased competition threaten sustained growth, profitability, and shareholder value.

Catalysts

About CVRx- A commercial-stage medical device company, engages in developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases in the United States, Germany, and internationally.

- The transition of Barostim to a Category I CPT code in January 2026 will eliminate experimental/investigational denials, greatly improve reimbursement, and increase physician adoption due to predictable procedures and payments; this is expected to accelerate top-line revenue growth and enhance operating leverage.

- A rapidly growing addressable market, driven by the aging population and rising prevalence of heart failure and hypertension, positions CVRx for sustained demand, supporting long-term revenue and margin expansion.

- Expansion of the U.S. sales force and a strategic focus on developing sustainable Barostim programs-including deeper penetration of Tier 1/2 accounts and effective entry strategies via Tier 3/4 satellite centers-should increase utilization rates and implant volumes, positively impacting revenue and gross margins.

- Ongoing generation of robust clinical evidence and real-world data (including progress toward a pivotal randomized controlled trial) should further drive Barostim toward standard-of-care status, broadening eligible patient populations and supporting higher adoption rates and top-line growth.

- Improving awareness through targeted educational programs, especially among advanced practice providers and community physicians who manage the bulk of the heart failure population, is expected to fuel patient referrals and increase procedure volumes, boosting both revenue and earnings scalability.

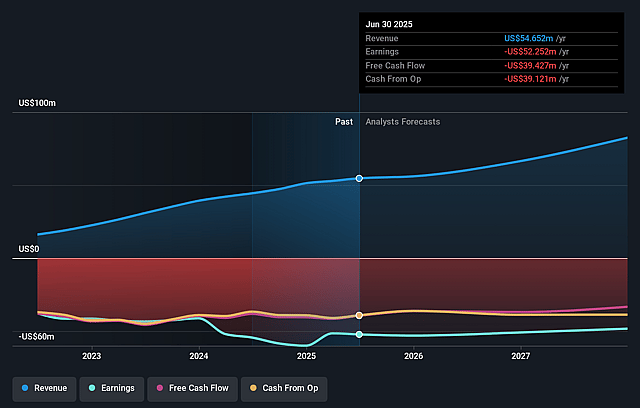

CVRx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CVRx's revenue will grow by 21.1% annually over the next 3 years.

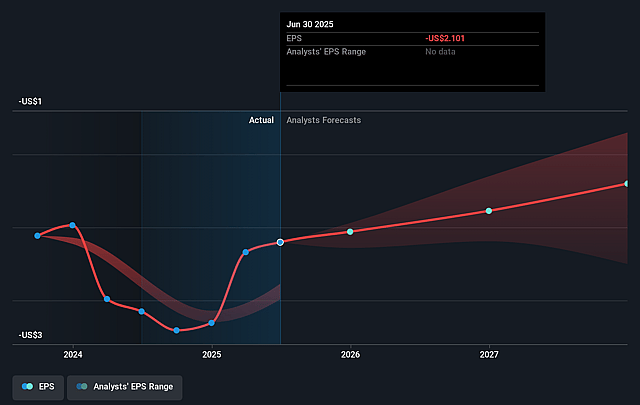

- Analysts are not forecasting that CVRx will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CVRx's profit margin will increase from -95.6% to the average US Medical Equipment industry of 12.5% in 3 years.

- If CVRx's profit margin were to converge on the industry average, you could expect earnings to reach $12.1 million (and earnings per share of $0.38) by about September 2028, up from $-52.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.1x on those 2028 earnings, up from -3.9x today. This future PE is greater than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

CVRx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent net losses, elevated SG&A expenses, and reliance on cash reserves ($95 million cash, ~$14.7 million net loss in the quarter) signal CVRx may continue to burn cash for several years, potentially requiring dilutive equity raises or increased borrowing-risking shareholder value and compressing margins.

- Commercial execution risk remains high: More than 35% of sales territory managers (and over half of area sales directors) are new since January, with productivity taking 6–12 months and future revenue growth heavily dependent on efficient onboarding, training, and the unpredictable development of a less tenured salesforce.

- Heart failure adoption curves are historically slow in medtech, and "changing the way medicine is practiced" represents a long-term secular headwind-as broad acceptance by physicians and entrenched referral networks could hamper Barostim's expansion, limiting top-line revenue acceleration and scale.

- Reimbursement, while improving (Category 1 CPT code, higher outpatient payments), remains vulnerable: Continued U.S. and global cost containment efforts, Medicare and commercial payer budget constraints, or unfavorable final CMS rulings could curtail procedure volumes and put pressure on the addressable market-impacting revenue and gross margin durability.

- Competition and industry consolidation pose risks: Larger device companies with broader portfolios and established distribution may increasingly target heart failure neuromodulation, while technological or regulatory advances by peers erode CVRx's early lead, pressuring long-term revenue share and inhibiting profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.833 for CVRx based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $97.0 million, earnings will come to $12.1 million, and it would be trading on a PE ratio of 36.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of $7.82, the analyst price target of $10.83 is 27.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.