Key Takeaways

- Reimbursement cuts, economic headwinds, and slow adoption are set to limit revenue growth and keep the company unprofitable for an extended period.

- Narrow product indications and rising competition from alternative technologies threaten market share and further constrain long-term growth potential.

- Improved reimbursement, expanding sales efforts, strong clinical positioning, and market trends are driving greater Barostim adoption and supporting sustainable long-term growth for CVRx.

Catalysts

About CVRx- A commercial-stage medical device company, engages in developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases in the United States, Germany, and internationally.

- Despite management enthusiasm for recent reimbursement improvements, the industry faces intensifying downward pricing pressure from both government and private payors, which is likely to lead to reimbursement cuts over the coming years; this would reduce average selling prices and limit revenue growth even as procedure volumes rise.

- Growing macroeconomic uncertainty and sustained high interest rates are expected to restrict hospital and health system budgets, resulting in delayed or canceled capital equipment purchases as well as reduced adoption rates for new device-based therapies, pressuring both near-term sales and long-term revenue trajectories.

- Barostim's limited indications-for heart failure and resistant hypertension-expose CVRx to the risk of stagnation if efforts to expand indications encounter regulatory delays, adverse trial outcomes, or shifting clinical guidelines, constraining the addressable market and stalling top-line growth.

- Persistent high research and development and selling, general, and administrative expenses, together with increased interest costs due to higher borrowing and slow international market penetration, are likely to keep the company deeply unprofitable and erode operating margins for the foreseeable future.

- Technological disruption from less invasive or entirely non-invasive alternatives such as remote digital therapeutics and intensified competition from larger, more diversified medtech firms may lead to market share loss and force deeper price concessions, undermining gross profits and threatening earnings well beyond the near term.

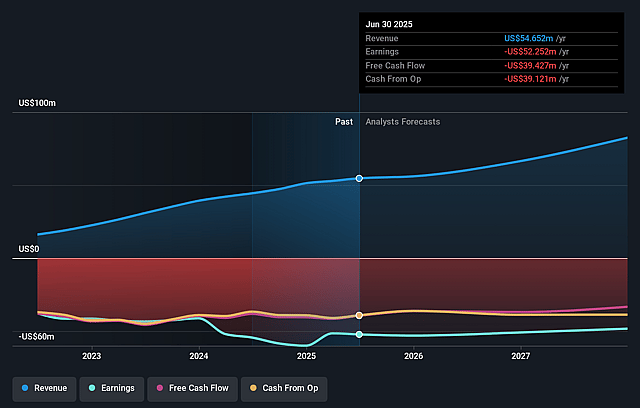

CVRx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on CVRx compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming CVRx's revenue will grow by 13.9% annually over the next 3 years.

- The bearish analysts are not forecasting that CVRx will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CVRx's profit margin will increase from -95.6% to the average US Medical Equipment industry of 12.5% in 3 years.

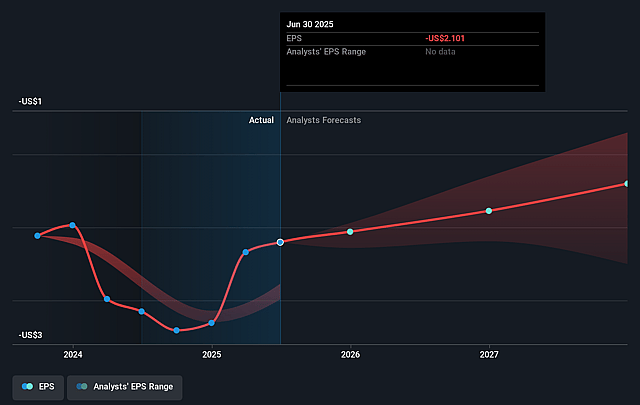

- If CVRx's profit margin were to converge on the industry average, you could expect earnings to reach $10.1 million (and earnings per share of $0.32) by about September 2028, up from $-52.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.0x on those 2028 earnings, up from -3.9x today. This future PE is lower than the current PE for the US Medical Equipment industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.02%, as per the Simply Wall St company report.

CVRx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Momentum in reimbursement improvements, such as the transition to a Category I CPT code and more favorable CMS payment assignments, is reducing a structural barrier to adoption, likely to drive higher and more predictable revenue and enhance net margins.

- The ramping productivity of a newly bolstered and experienced sales force, combined with ongoing center additions and geographic territory expansion, supports sustainable increases in top-line revenue and could eventually deliver operating leverage for improved profitability.

- Strong clinical evidence generation and real-world data collection, together with expanding awareness among both physicians and advanced practice providers, is advancing Barostim toward standard of care status and will likely support higher adoption rates and revenue growth in the long term.

- A large and growing base of implanting centers, combined with a systematic approach to engaging both Tier 1/2 and opportunistically high-potential Tier 3/4 accounts, offers a scalable pathway to penetrate more of the U.S. heart failure therapy market, underpinning potential revenue acceleration and improved earnings.

- Secular trends in an aging population and increased prevalence of chronic heart failure create a favorable tailwind for Barostim adoption, enlarging CVRx's addressable market and supporting long-term revenue, margin, and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for CVRx is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CVRx's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $80.7 million, earnings will come to $10.1 million, and it would be trading on a PE ratio of 28.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of $7.82, the bearish analyst price target of $7.0 is 11.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.