Key Takeaways

- Accelerated account expansion, effective talent strategies, and disease trends position CVRx for growth exceeding current forecasts and analyst expectations.

- Advancements in technology, digital integration, and global reach could significantly enhance both revenue quality and longer-term profitability.

- Sustained losses, adoption hurdles, pricing pressures, competitive threats, and shifting industry trends challenge revenue growth, market share, and long-term profitability.

Catalysts

About CVRx- A commercial-stage medical device company, engages in developing, manufacturing, and commercializing neuromodulation solutions for patients with cardiovascular diseases in the United States, Germany, and internationally.

- While the analyst consensus expects revenue growth from expanded sales territories and more active implanting centers, the rapid acceleration in adding both high-value Tier 1/2 accounts and untapped Tier 3/4 centers-combined with insights-driven targeting-could unlock a level of top-line growth that materially outpaces current market expectations.

- Analysts broadly agree that sales force stabilization and new leadership will drive productivity, but the exceptionally strong recruitment and data-driven training mean CVRx's productivity curve for new hires could steepen much faster, leading to operating leverage and earnings inflection potentially well ahead of consensus timelines.

- Surging global prevalence of heart failure, obesity, and hypertension gives CVRx a multi-year tailwind, positioning Barostim as a core therapy in expanding addressable patient pools, which may enable sustained double-digit revenue growth far beyond what is currently modeled.

- Ongoing investment in next-generation neuromodulation devices and anticipated geographic expansion, particularly into Europe and Asia, offer new high-margin revenue streams that could significantly improve both total revenues and consolidated gross margins over the medium to long term.

- As digital health integration, remote monitoring, and value-based healthcare models gain traction, CVRx is strategically positioned to benefit from improved patient outcomes and recurring revenue opportunities-potentially resulting in higher recurring revenues and improved net margin profile relative to traditional medtech peers.

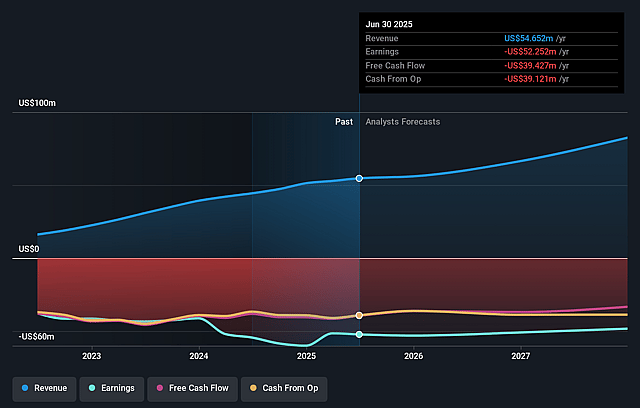

CVRx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on CVRx compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming CVRx's revenue will grow by 23.1% annually over the next 3 years.

- Even the bullish analysts are not forecasting that CVRx will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CVRx's profit margin will increase from -95.6% to the average US Medical Equipment industry of 12.3% in 3 years.

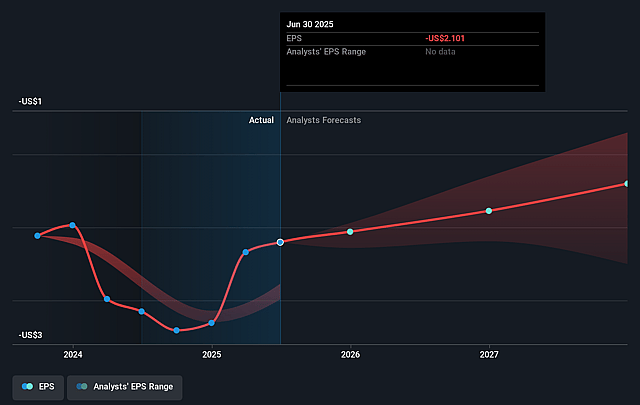

- If CVRx's profit margin were to converge on the industry average, you could expect earnings to reach $12.6 million (and earnings per share of $0.39) by about September 2028, up from $-52.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 44.8x on those 2028 earnings, up from -4.0x today. This future PE is greater than the current PE for the US Medical Equipment industry at 29.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

CVRx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company continues to generate significant net losses, with reported net loss of 14.7 million dollars for the quarter compared to 14 million dollars in the prior year period, and SG&A expenses have increased, which combined with a relatively slow ramp in sales productivity, may prolong reliance on capital raises and dilute existing shareholders, negatively impacting earnings and net margins.

- Persistent challenges in establishing Barostim as a standard of care-given the slow pace of clinical evidence generation, the need for more randomized controlled trial data, and ongoing physician and patient inertia-could hinder adoption and limit revenue growth over the long term.

- The company remains vulnerable to reimbursement risk, including potential long-term pricing pressure as public and private payors seek to control healthcare costs, which could cap procedure volumes and reduce average selling prices, directly impacting future revenues and profitability.

- CVRx's high up-front device cost and reliance on implantable interventions may face headwinds from long-term industry trends toward lower-cost, non-invasive, and remote therapeutics for heart failure, threatening market share and compressing gross profit margins.

- Rising competition from larger medtech companies, consolidation within hospital systems, and strong purchasing group leverage could squeeze pricing, challenge CVRx's ability to expand account penetration, and increase customer acquisition costs, ultimately pressuring revenues and operating margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for CVRx is $14.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CVRx's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $101.9 million, earnings will come to $12.6 million, and it would be trading on a PE ratio of 44.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $8.06, the bullish analyst price target of $14.0 is 42.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.