Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and partnerships in high-growth areas enhance revenue potential and boost net margins through increased market penetration.

- Efforts in operational efficiency, smart capital allocation, and shareholder value enhancement improve operating margins and earnings stability.

- Tactical challenges in brand transition, pricing realization, and inflationary pressures could constrain Keurig Dr Pepper's revenue and margin growth in the short term.

Catalysts

About Keurig Dr Pepper- Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

- The acquisition of a majority stake in GHOST strengthens Keurig Dr Pepper's position in the fast-growing energy drink category. This strategic move is expected to significantly enhance future revenue growth by tapping into a $23 billion beverage market driven by universal demand for energy and alertness.

- The strategic partnership with emerging brands like GHOST and Bloom, coupled with an ongoing collaboration with brands like Electrolit and La Colombe, emphasizes portfolio evolution towards high-growth areas. This approach is likely to boost net margins over time as the company penetrates high-demand consumer segments.

- Keurig Dr Pepper's efforts to optimize portfolio efficiency, such as transitioning distribution assets in Arizona to its DSD network and investing in infrastructure, are anticipated to improve operating margins by leveraging economies of scale and enhancing distribution efficiency.

- Ongoing investments in productivity enhancements, cost discipline, and SG&A overhead leverage are expected to result in a healthy pipeline of ongoing efficiency projects, which will likely lead to operating margins and earnings improvement.

- The company's focus on increasing cash generation and capital allocation, including strategic share buybacks and a 7% dividend increase, demonstrates a commitment to enhancing shareholder value through EPS growth and maintaining a resilient balance sheet.

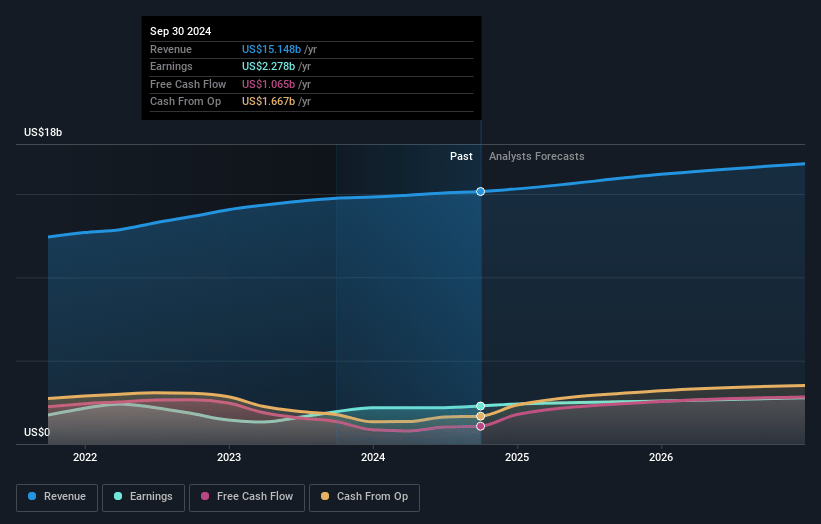

Keurig Dr Pepper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Keurig Dr Pepper's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.0% today to 16.3% in 3 years time.

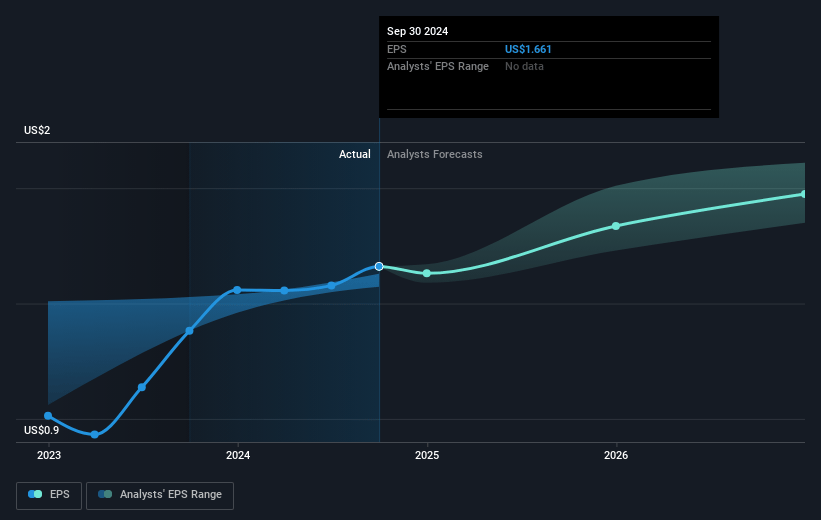

- Analysts expect earnings to reach $2.8 billion (and earnings per share of $2.06) by about December 2027, up from $2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2027 earnings, up from 19.3x today. This future PE is lower than the current PE for the US Beverage industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 0.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.99%, as per the Simply Wall St company report.

Keurig Dr Pepper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Keurig Dr Pepper's transition of the GHOST brand from Anheuser-Busch's distribution system could face execution challenges, potentially affecting revenue and market positioning in the short term.

- The U.S. coffee segment faces challenges with pricing realization due to persistent category promotions, which might pressure revenue and margins until expected structural improvements in the industry take effect.

- The performance of at-home coffee consumption remains muted, and although single-serve is outperforming, the slower-than-expected recovery could limit revenue growth and impact overall earnings.

- Inflationary pressures in key inputs and commodities, especially in the coffee segment, could negatively impact margins and profitability even with planned price increases in 2025.

- The planned portfolio optimization involves tough choices that may result in some net sales trade-off, potentially affecting short-term revenue even if it leads to a more efficient cost structure in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.85 for Keurig Dr Pepper based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $42.0, and the most bearish reporting a price target of just $32.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $17.4 billion, earnings will come to $2.8 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 6.0%.

- Given the current share price of $32.45, the analyst's price target of $37.85 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives