Key Takeaways

- Acquiring Alani Nu and appointing Eric Hanson aim to enhance operations, expand market share, and improve net margins through better partnerships and efficiency.

- International expansion, new products, and increased retail presence seek to boost revenue and brand visibility in high-growth regions and everyday locations.

- Despite margin improvements, rising expenses and competitive pressures in the energy drink market may challenge Celsius Holdings' growth amid reliance on global expansion and key partnerships.

Catalysts

About Celsius Holdings- Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

- The acquisition of Alani Nu and its integration with Celsius Holdings is expected to bolster the company's functional beverage platform, potentially driving increased revenue through a broader product offering and enhanced market share in the energy drink category.

- Appointing Eric Hanson as President and COO, with extensive experience at PepsiCo, could improve operational excellence and partnership efficiencies with PepsiCo, likely impacting net margins positively through better scale and streamlined operations.

- The international expansion efforts, with revenue from international markets growing substantially, suggest potential for increased revenue from geographic diversification, particularly in high-growth regions like the U.K., Ireland, France, Australia, and New Zealand.

- Innovations in product offerings, such as CELSIUS HYDRATION and new beverage flavors, along with broader retail shelf space and point-of-sale availability, are expected to drive future revenue growth by attracting new customers and increasing consumer engagement with both the Celsius and Alani Nu brands.

- Growth in the foodservice channel, including new placements in Subway and Home Depot locations, along with increased marketing initiatives, should enhance brand visibility and consumer reach, potentially boosting revenue as more consumers encounter and purchase the brand in various everyday locations.

Celsius Holdings Future Earnings and Revenue Growth

Assumptions

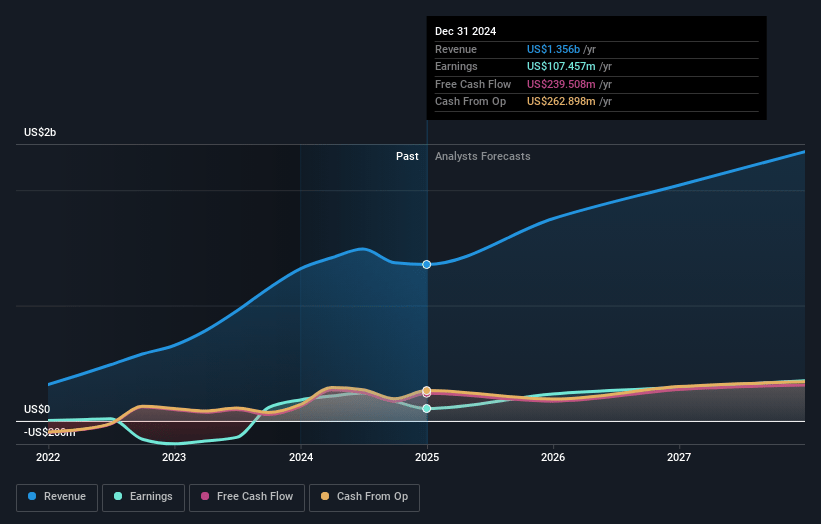

How have these above catalysts been quantified?- Analysts are assuming Celsius Holdings's revenue will grow by 31.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.8% today to 13.3% in 3 years time.

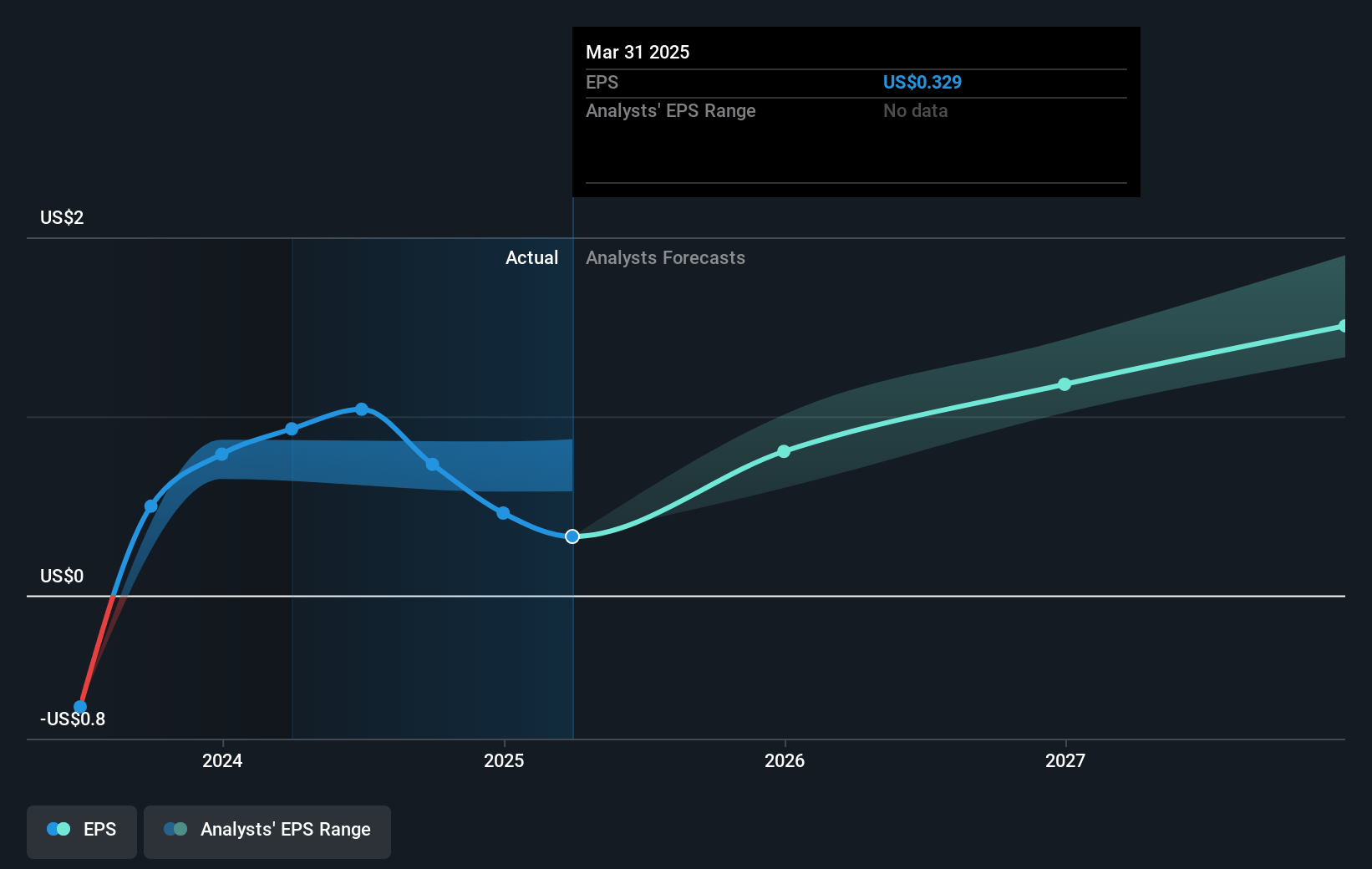

- Analysts expect earnings to reach $402.5 million (and earnings per share of $1.53) by about July 2028, up from $77.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $502 million in earnings, and the most bearish expecting $335.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.7x on those 2028 earnings, down from 148.5x today. This future PE is greater than the current PE for the US Beverage industry at 28.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Celsius Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a 7% decline in revenue for the first quarter of 2025 compared to the prior year quarter, citing soft velocity, timing and structure of distribution partner incentive programs, and increased promotional programs. This highlights potential challenges in maintaining revenue growth.

- Despite improvements in gross margin, the company faced challenges with selling, general, and administrative expenses, which increased to $120.3 million compared to $99 million in the prior year, partly due to the Alani Nu acquisition. This could pressure net margins if revenue growth does not offset these increased costs.

- The company is reliant on favorable global expansion results, notably in newer markets. While international growth was reported as strong, the risk remains that these initiatives may not perform as anticipated, which could impact future revenue streams.

- The increasing competition within the energy drink category, along with a challenging consumer environment, resulted in pressure during the first quarter. Continued competitive pressures and pricing actions by other players may impact market share and revenue.

- The company's financial reliance on its partnership with key distributors like PepsiCo and retail partners could pose a risk if these relationships encounter challenges, potentially affecting earnings should distribution or sales strategies need adjustment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $47.4 for Celsius Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $58.0, and the most bearish reporting a price target of just $32.51.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $402.5 million, and it would be trading on a PE ratio of 44.7x, assuming you use a discount rate of 6.4%.

- Given the current share price of $44.34, the analyst price target of $47.4 is 6.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.