Key Takeaways

- Strategic expansion into international markets and a partnership with PepsiCo are set to drive revenue and market share growth.

- Acquisition of Big Beverages and tech investments aim to optimize supply chains and improve operational efficiency.

- Distributor inventory strategies, margin pressure, and cost management issues challenge revenue growth and profitability, despite market expansion efforts and partnerships like the one with PepsiCo.

Catalysts

About Celsius Holdings- Develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally.

- Celsius Holdings' focus on attracting new consumers, expanding product availability, and increasing consumption frequency is expected to drive future revenue growth as these initiatives enhance market reach and consumer engagement.

- The strategic expansion into international markets such as Australia, New Zealand, and the UK is anticipated to boost revenue and market share by tapping into high volume energy drink markets experiencing similar health and wellness trends as the U.S.

- The partnership with PepsiCo, featuring priority periods and aligned resources, is expected to provide additional revenue and market share growth by enhancing distribution capabilities and shelf placement.

- The acquisition of Big Beverages aims to offer greater control of the supply chain and enable innovative product offerings, leading to potential cost efficiencies and improved earnings through vertical integration.

- Investments in technology and AI-assisted selling tools are likely to enhance operational efficiency and net margins by optimizing sales processes and reducing freight and logistics costs.

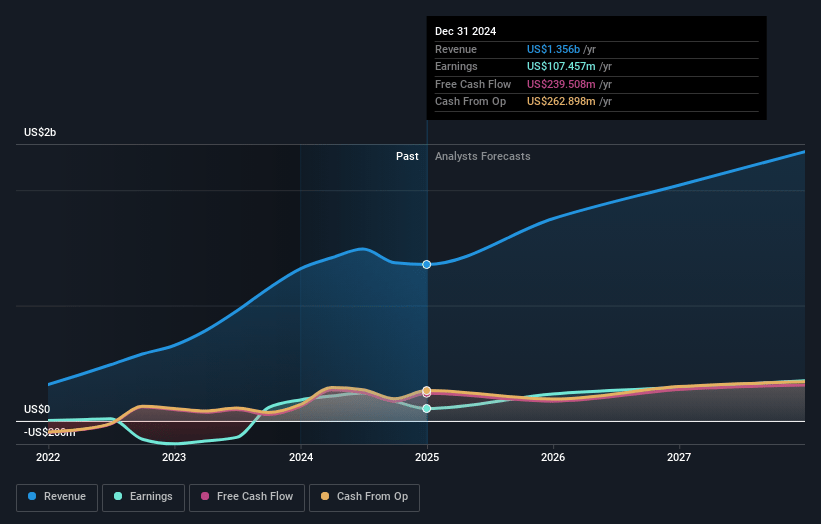

Celsius Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Celsius Holdings's revenue will grow by 12.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.4% today to 16.5% in 3 years time.

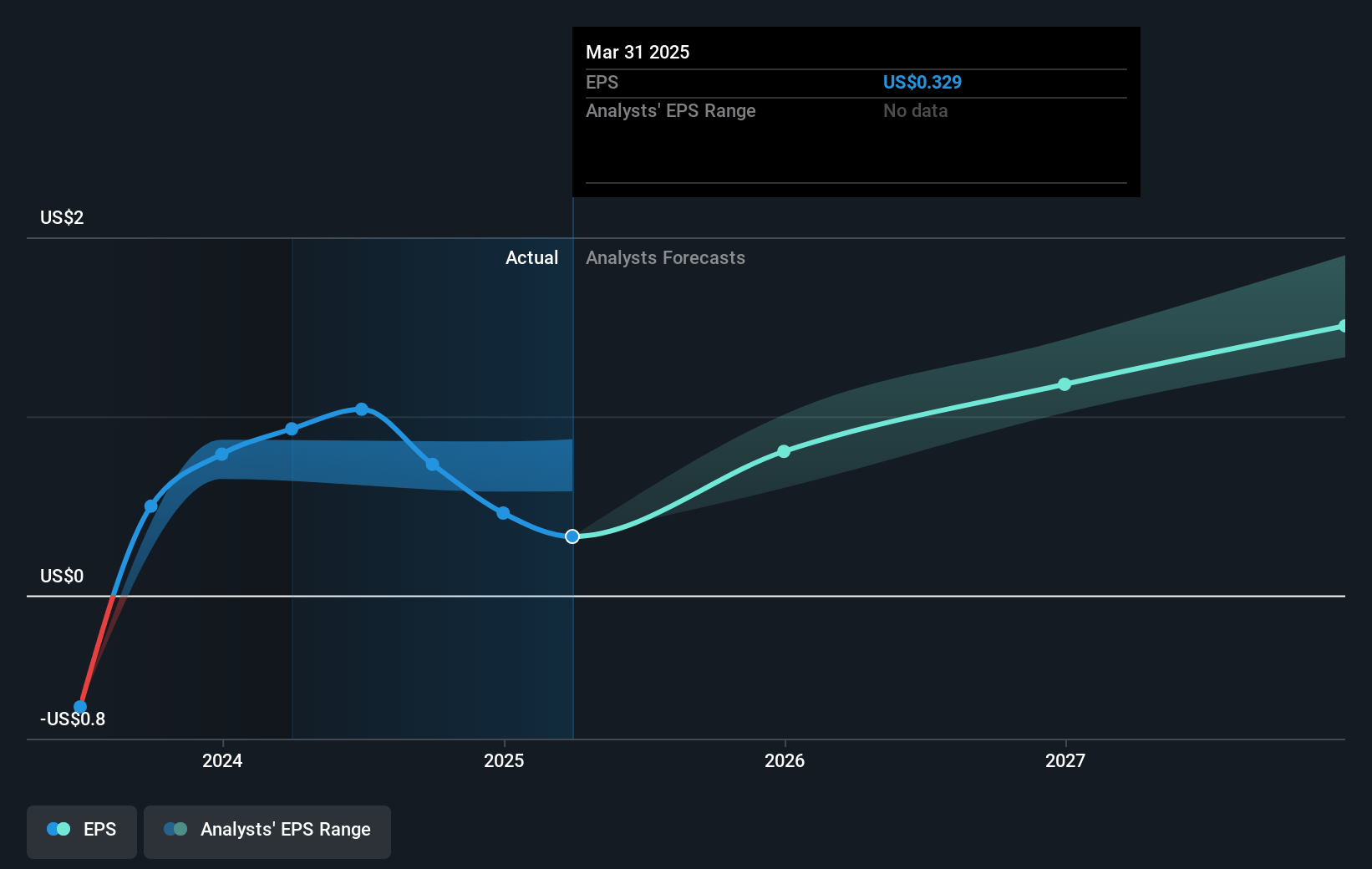

- Analysts expect earnings to reach $325.6 million (and earnings per share of $1.36) by about January 2028, up from $170.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $231.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.4x on those 2028 earnings, down from 34.3x today. This future PE is greater than the current PE for the US Beverage industry at 22.3x.

- Analysts expect the number of shares outstanding to grow by 0.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Celsius Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Celsius Holdings experienced a significant revenue decline of 31% year-over-year in Q3 2024, primarily due to distributor inventory optimization, which could indicate ongoing volatility in revenue due to reliance on distributor strategies.

- The impact of increased promotional allowances and shifts in consumer purchasing patterns led to margin pressure, as evidenced by a decrease in gross profit margins from 50.4% to 46%, suggesting potential risks to maintaining net margins.

- Despite the attempted expansion into new markets, domestic market conditions such as softer macroeconomic factors and reduced retail traffic present challenges to accelerating revenue growth in North America.

- Increased G&A expenses rising by 11%, alongside a 96% decrease in non-GAAP adjusted EBITDA, highlights cost management issues which may impact overall earnings and profitability if not addressed.

- While partnerships like the one with PepsiCo aim to drive category growth and shelf space, the incentive program's impact on margins and unresolved alignment issues with major distributors may continue to affect net earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.3 for Celsius Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $62.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $325.6 million, and it would be trading on a PE ratio of 33.4x, assuming you use a discount rate of 5.9%.

- Given the current share price of $24.88, the analyst's price target of $38.3 is 35.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives