Key Takeaways

- Valero's strategic focus on processing economic crude oils and investing in sustainable fuel projects is set to enhance future margins and earnings capacity.

- Shareholder returns are prioritized with strong payout strategies, potentially boosting investor confidence and future stock price appreciation.

- Declining income and refining margins, along with potential increases in crude oil and natural gas costs, pose significant challenges to Valero's profitability.

Catalysts

About Valero Energy- Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

- Valero's refining systems processed a record volume of heavy sour crude, showcasing the flexibility and capability of their commercial and operations teams. This can help in securing and processing the most economic crude oils, potentially improving future refining margins and earnings.

- The successful startup of the DGD sustainable aviation fuel project and progress on optimizing the SEC unit at St. Charles, which will increase high-value product yield, are expected to enhance revenue and earnings capacity through organic growth investments.

- Anticipated support for refining margins is expected due to low light product inventories leading to potentially better margins and earnings in the driving season. Longer term, the expected demand exceeding supply with announced refinery shutdowns could support refining fundamentals, benefiting revenue and net margins.

- Valero continues to prioritize shareholder returns, maintaining a strong payout ratio, supported by buybacks and dividend increases. This strategy can enhance earnings per share by reducing the share count, boosting investor confidence, potentially leading to future stock price appreciation.

- The limited increase in renewable diesel production contrasted with expected increases in diesel demand due to cold weather and tightening supply-demand balances could potentially enhance refining margins and revenue from diesel products.

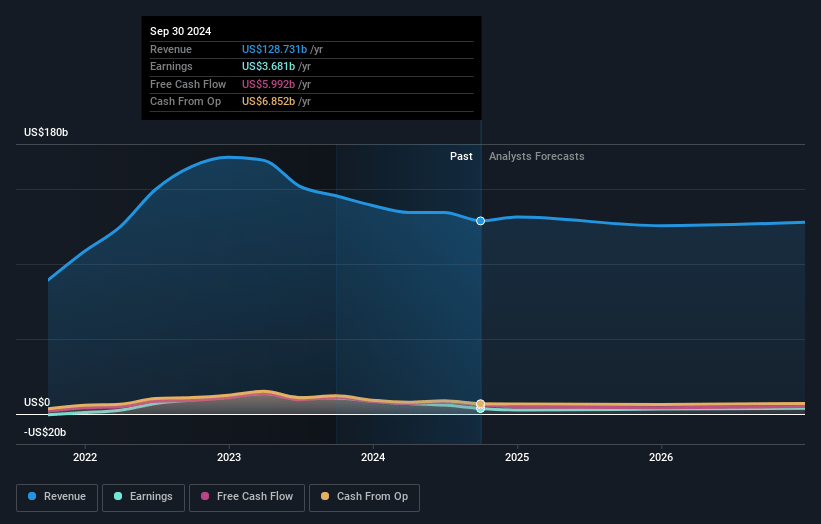

Valero Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Valero Energy's revenue will decrease by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.2% today to 4.0% in 3 years time.

- Analysts expect earnings to reach $4.4 billion (and earnings per share of $15.88) by about March 2028, up from $2.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.5 billion in earnings, and the most bearish expecting $2.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, down from 15.0x today. This future PE is lower than the current PE for the US Oil and Gas industry at 13.1x.

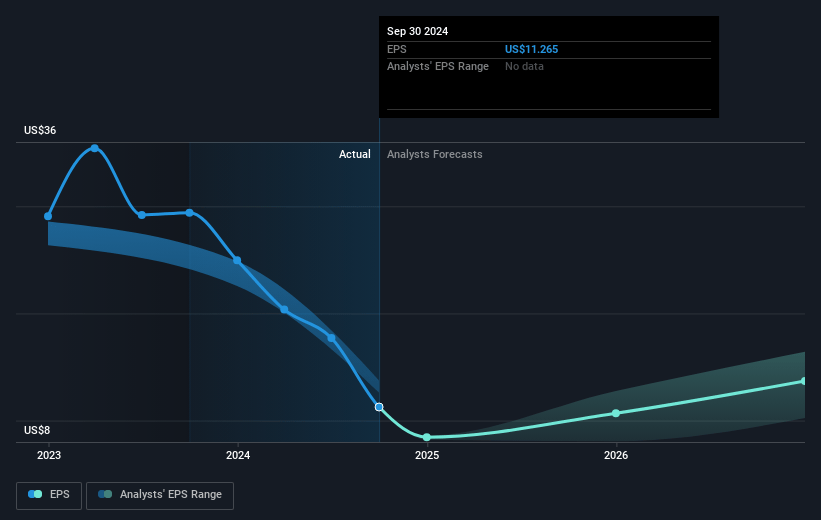

- Analysts expect the number of shares outstanding to decline by 3.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.8%, as per the Simply Wall St company report.

Valero Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Valero's net income for the fourth quarter of 2024 significantly decreased to $281 million from $1.2 billion in the same quarter of 2023, indicating potential challenges in maintaining past earnings levels. The adjusted net income also saw a notable drop, impacting future earnings outlook.

- The company's refining margins operated in a weak margin environment, with operating income for the refining segment dropping from $1.6 billion in Q4 2023 to $437 million in Q4 2024. This decline suggests that adverse market conditions could continue to impact net margins and profitability.

- There are concerns regarding potential tariffs on Canadian and Mexican imports, which could increase costs for crude oil. Such increased costs may affect Valero’s cost structure and lead to reduced net margins if the costs cannot be passed on to customers.

- An increase in the U.S. natural gas prices could negatively impact Valero's energy costs. If costs continue to rise and energy efficiency improvements are difficult to achieve, higher operating expenses could reduce net margins.

- The uncertainty surrounding the transition from the BTC to the PTC for renewable diesel incentives could result in variable earnings for Valero's renewable diesel segment, impacting the stability of revenues derived from this segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $149.421 for Valero Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $174.0, and the most bearish reporting a price target of just $128.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $110.7 billion, earnings will come to $4.4 billion, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 7.8%.

- Given the current share price of $132.0, the analyst price target of $149.42 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives