Key Takeaways

- Undervalued operational strengths and strategic acquisitions could drive sustained, high-margin growth and extend competitive advantage beyond current market expectations.

- Disciplined capital allocation and share buybacks are set to compound shareholder value, supporting outsized EPS and margin expansion regardless of commodity price volatility.

- Structural shifts toward renewables, regulatory burdens, and concentrated operations threaten Magnolia's profitability, capital access, and long-term sustainability amid accelerated energy transition pressures.

Catalysts

About Magnolia Oil & Gas- An independent oil and natural gas company, engages in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquids reserves in the United States.

- While analyst consensus expects strong production growth with less capital, the market significantly underappreciates that Giddings' improving well performance and expanding development acreage could drive durable double-digit production growth for multiple years, even as capital intensity falls-meaning both revenue and free cash flow could structurally exceed expectations far beyond 2025.

- Analysts broadly agree the Giddings field offers low-cost, high-margin growth, but they underestimate Magnolia's demonstrated ability to consistently discover and integrate bolt-on acreage with superior economics; this "appraise, acquire, grow" strategy can extend Magnolia's high-return inventory for years, amplifying top-line growth and expanding net margins.

- Global energy demand remains structurally resilient amid underinvestment in new supply, positioning Magnolia to benefit disproportionately from any tightening in oil or natural gas markets, which could create sustained upside to realized prices, materially accelerating revenue and EBIT growth through the decade.

- Magnolia's rigorous capital discipline, low leverage, and persistent buyback allocation could compound shareholder value even faster than consensus models suggest; continued share count reduction at current undervalued prices could translate into meaningful supercharged EPS growth when combined with rising free cash flow.

- Ongoing operational efficiency gains-in drilling, completions, and opex-supported by continuous adoption of advanced technologies, are structurally lowering Magnolia's cost base and boosting recovery rates, setting the stage for superior EBITDA margin expansion and peer-leading returns as commodity prices recover.

Magnolia Oil & Gas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Magnolia Oil & Gas compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Magnolia Oil & Gas's revenue will grow by 6.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 27.2% today to 28.7% in 3 years time.

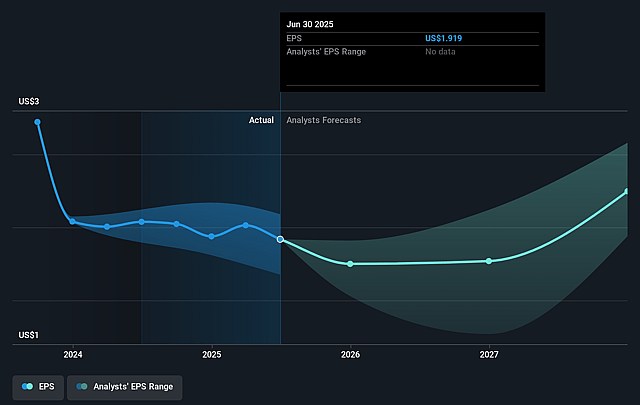

- The bullish analysts expect earnings to reach $465.3 million (and earnings per share of $2.7) by about September 2028, up from $361.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.5x on those 2028 earnings, up from 11.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 3.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

Magnolia Oil & Gas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Magnolia's operational and financial outlook is highly exposed to long-term declines in oil and gas demand as global energy transitions accelerate towards renewables, which could structurally reduce their future revenue and compress net margins.

- Persistent policy and regulatory shifts targeting emission reductions and stricter drilling oversight may raise Magnolia's compliance costs and limit drilling flexibility, increasing the risk of higher operating expenses and lower profitability.

- Concentration of operations in the Eagle Ford and Austin Chalk basins heightens exposure to regional drilling constraints, resource depletion, and localized commodity price swings, potentially leading to volatile earnings and diminished reserve growth over time.

- Continued reliance on continuous drilling to sustain production, as indicated by the need to defer and preserve well completions, may drive up long-term capital expenditures, reducing free cash flow generation and threatening dividend growth and sustainability.

- Growing investor focus on ESG criteria and the risk of long-term oil price stagnation may limit access to capital, depress share valuations, and make Magnolia less attractive in capital markets, adversely impacting its future cost of capital and market capitalization.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Magnolia Oil & Gas is $34.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Magnolia Oil & Gas's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $34.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $465.3 million, and it would be trading on a PE ratio of 15.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $23.32, the bullish analyst price target of $34.0 is 31.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.