Key Takeaways

- Structural decline in oil demand and stricter environmental regulations threaten Magnolia's revenue growth, margins, and profitability.

- Concentrated assets and lagging technological innovation expose Magnolia to operational and financial risks relative to larger, more advanced competitors.

- Operational efficiency, disciplined capital allocation, and successful expansion efforts strengthen financial resilience, underpin long-term earnings growth, and support an attractive valuation.

Catalysts

About Magnolia Oil & Gas- An independent oil and natural gas company, engages in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquids reserves in the United States.

- With the global energy transition accelerating and increasing adoption of electric vehicles and advanced battery technologies, oil demand growth is at significant risk of structural decline over the coming decade, which could place long-lasting downward pressure on commodity prices and severely limit Magnolia Oil & Gas's ability to deliver top-line revenue growth.

- As governments worldwide enact more aggressive decarbonization policies and stricter emissions regulations, Magnolia faces mounting compliance costs, both in emissions mitigation and water disposal, which threaten to erode operating margins and require substantial capital expenditures, undermining long-term profitability.

- The company's highly concentrated asset base in the Eagle Ford and Austin Chalk leaves Magnolia acutely exposed to localized geological challenges, operational disruptions, or state-level regulatory changes that could quickly impair production stability, putting future revenue and earnings at greater risk.

- Continued escalation in ESG standards across global capital markets may drive large institutional investors to reduce exposure to fossil fuel producers, raising Magnolia's cost of capital and reducing access to financing, which in turn could curtail share repurchases and dividends, directly impacting earnings per share and return on equity.

- Technological disruption in the upstream energy sector risks leaving Magnolia behind, as larger peers and integrated majors with superior R&D budgets and digital capabilities gain cost, efficiency, and recovery advantages, thereby compressing Magnolia's net margins and reducing its competitive edge in a rapidly evolving industry landscape.

Magnolia Oil & Gas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Magnolia Oil & Gas compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Magnolia Oil & Gas's revenue will grow by 2.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 27.2% today to 26.1% in 3 years time.

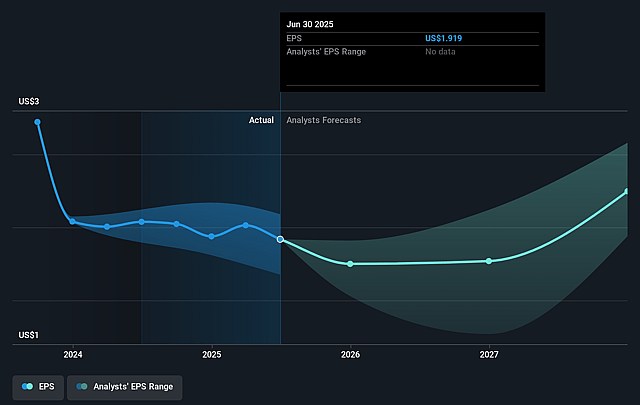

- The bearish analysts expect earnings to reach $375.7 million (and earnings per share of $2.03) by about September 2028, up from $361.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 12.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 3.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.94%, as per the Simply Wall St company report.

Magnolia Oil & Gas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continuous operational and capital efficiency improvements, such as reducing drilling and completion capital while still increasing production guidance, point to higher free cash flow and improving net margins, which support better long-term earnings.

- Successful execution of bolt-on acquisitions and ongoing expansion of core acreage in Giddings at low entry costs provide a durable growth runway and the potential for higher future production and revenue.

- Resilient well performance, including instances of wells significantly outperforming expectations, demonstrates underlying asset quality and management's ability to unlock upside, which can drive sustained earnings growth and potential re-rating of the share price.

- Prudent capital allocation, combining disciplined reinvestment rates with a growing dividend and active share buybacks, strengthens return on equity and can attract long-term investors, supporting valuation.

- A robust balance sheet, significant liquidity, and a focus on moderate, sustainable production growth reduce financial risk and position Magnolia to benefit from stable or improving energy prices, protecting both earnings and share value through cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Magnolia Oil & Gas is $19.56, which represents two standard deviations below the consensus price target of $26.81. This valuation is based on what can be assumed as the expectations of Magnolia Oil & Gas's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $34.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $375.7 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $24.29, the bearish analyst price target of $19.56 is 24.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.