Key Takeaways

- Tight market conditions and rising contract renewals could significantly boost revenue and cash flow beyond what analysts expect.

- Favorable fleet expansion, disciplined refinancing, and premium pricing position KNOT for rapid earnings growth and superior capital returns.

- Rising decarbonization, fleet renewal costs, concentrated contracts, debt pressures, and stricter emissions rules threaten revenue stability, capital access, and long-term profitability.

Catalysts

About KNOT Offshore Partners- Acquires, owns, and operates shuttle tankers under long-term charters in the North Sea and Brazil.

- Analyst consensus sees Brazilian FPSO-driven shuttle tanker demand supporting strong day-rates, but they may be underestimating just how dramatic near-term rechartering uplifts will be as several vessels roll off legacy charters into a structurally tighter market; this could drive step-changes in contracted revenue and cash flow well above current estimates.

- Analysts broadly agree that fleet drop-downs from the sponsor could modestly modernize the fleet, but given rising newbuild costs, substantial backlog, and accretive swap structures, KNOT may rapidly expand its modern fleet at favorable terms, which would amplify EBITDA growth and improve net margins more quickly than assumed.

- The slow pace of new shuttle tanker deliveries, escalating regulatory requirements, and persistent underinvestment in global offshore infrastructure position KNOT's young, energy-efficient fleet as a long-term de facto standard, enabling premium pricing power on future contracts and above-peer utilization rates, which will drive superior topline and margin expansion.

- Management's demonstrated ability to refinance debt ahead of schedule, coupled with significant paydown rates and untapped refinancing potential, could unlock incremental liquidity for accelerated accretive investments and potentially higher distributions, supporting rapid earnings growth and capital returns.

- The current severe disconnect between trailing price-to-free-cash-flow multiples and underlying asset values-buoyed by steady or even rising secondhand vessel valuations despite fleet aging-suggests any capital deployment to buybacks or drop-downs at these levels would be materially EPS accretive, providing a floor for the unit price and setting up a powerful re-rating when market sentiment shifts.

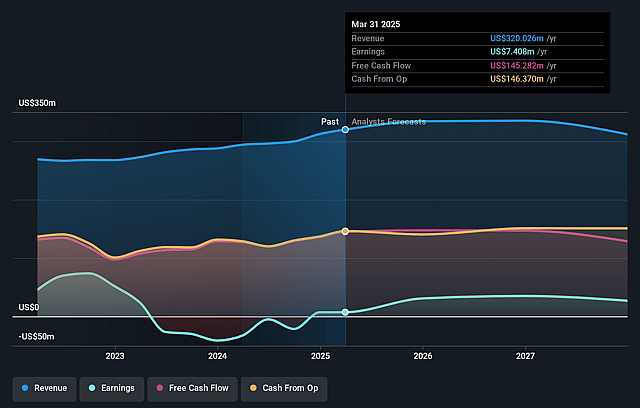

KNOT Offshore Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on KNOT Offshore Partners compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming KNOT Offshore Partners's revenue will decrease by 0.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.3% today to 10.7% in 3 years time.

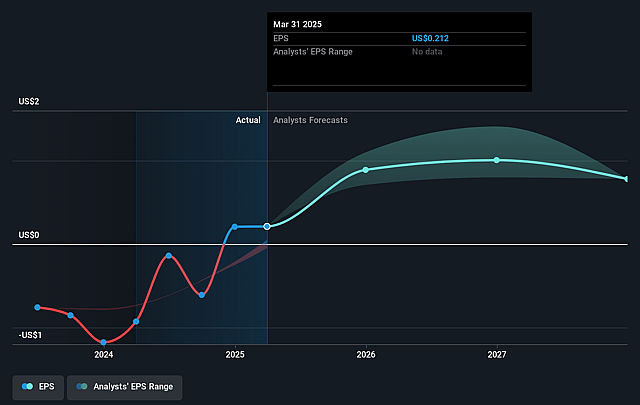

- The bullish analysts expect earnings to reach $33.4 million (and earnings per share of $0.96) by about September 2028, up from $7.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 39.9x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.28%, as per the Simply Wall St company report.

KNOT Offshore Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global energy transition and increased decarbonization efforts threaten to erode long-term demand for shuttle tanker services like those of KNOT Offshore Partners, potentially leading to future declines in revenue as oil demand falls.

- Persistent, large-scale capital requirements for maintaining and renewing an aging fleet may drive higher maintenance, drydocking, and replacement costs over time, weighing on net margins and free cash flow if not offset by higher charter rates.

- The company's significant reliance on a concentrated portfolio of long-term contracts with major oil companies exposes it to counterparty and renewal risk; any non-renewal or early termination could cause sudden revenue and cash flow disruptions.

- Looming large balloon debt repayments in 2025 and 2026 combined with ongoing high leverage and expiring interest rate hedges could sharply increase financing and interest costs, directly threatening earnings stability and dividend sustainability.

- Secular shifts toward environmental, social, and governance priorities, and tightening regulations on shipping emissions, may hinder KNOT's access to capital and force costly vessel upgrades or replacements, eroding profitability and increasing required capital expenditures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for KNOT Offshore Partners is $15.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of KNOT Offshore Partners's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $8.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $312.6 million, earnings will come to $33.4 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 13.3%.

- Given the current share price of $8.45, the bullish analyst price target of $15.0 is 43.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.