Key Takeaways

- Exposure to energy transition, sector concentration, and evolving regulations threaten long-term contract renewals, margins, and revenue stability.

- Heavy reliance on debt markets and fossil-fuel assets risks higher financing costs and increased earnings volatility.

- Elevated refinancing risk, rising interest costs, regional contract concentration, and fleet-focused capital allocation constrain shareholder returns and threaten long-term investor confidence.

Catalysts

About KNOT Offshore Partners- Acquires, owns, and operates shuttle tankers under long-term charters in the North Sea and Brazil.

- Although the ramp-up in deepwater production in Brazil and the North Sea is driving strong near-term shuttle tanker demand and supporting revenue growth, KNOT Offshore Partners remains highly exposed to a global energy transition, which over time may structurally reduce offshore oil transport demand and put pressure on long-term contract renewals, ultimately threatening the sustainability of recurring revenues.

- While fixed charter coverage through 2025 is robust and current market tightness strengthens charter renewal prospects, the partnership continues to face significant refinancing and debt amortization obligations, and its dependence on debt markets could increase interest costs and erode net margins due to rising investor aversion to fossil-fuel linked assets.

- Even as vessel values have remained stable year-on-year, supported by high demand and elevated newbuild prices, KNOP faces growing regulatory and carbon compliance requirements which are set to increase maintenance and operating costs, potentially putting downward pressure on future net margins despite any revenue uplift.

- Despite opportunities for fleet expansion through drop-downs from its sponsor, KNOP's concentrated exposure to the shuttle tanker segment, especially in Brazil and the North Sea, leaves it vulnerable to sector-specific downturns and the risk of idle time if contract coverage weakens, creating volatility in EBITDA and distributable cash flow.

- Although market conditions are currently favorable for higher charter rates on contract renewals, technological advances and increased pipeline infrastructure in key oil-producing regions could ultimately reduce reliance on shuttle tankers, creating longer-term headwinds for contract volumes and fleet utilization, with adverse implications for both revenue and earnings stability.

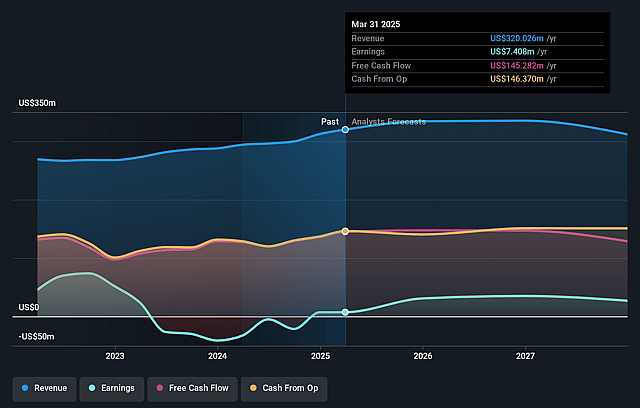

KNOT Offshore Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on KNOT Offshore Partners compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming KNOT Offshore Partners's revenue will decrease by 0.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.3% today to 10.6% in 3 years time.

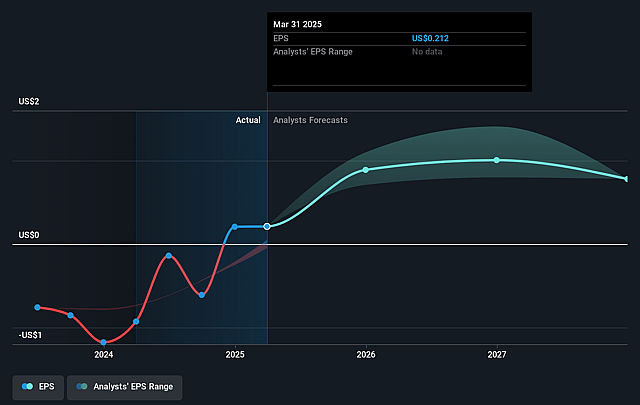

- The bearish analysts expect earnings to reach $33.3 million (and earnings per share of $0.96) by about September 2028, up from $7.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, down from 38.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.28%, as per the Simply Wall St company report.

KNOT Offshore Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Substantial refinancing needs with multiple debt facilities and material balloon payments due in both 2025 and 2026 pose significant refinancing risk, as higher interest rates or tighter lending conditions could increase interest expense and reduce net earnings in the future.

- Interest rate hedges currently in place will expire over the next year, exposing the company to higher prevailing market rates; new hedges are expected to be set at levels well above the expiring swaps, which will lead to higher interest costs and negatively impact net margins and free cash flow.

- The company's heavy reliance on long-term contracts in concentrated geographic regions (notably Brazil and the North Sea) makes it vulnerable to contract non-renewals or delayed recharterings; lapses could lead to increased vessel idle time and downward pressure on revenue and asset utilization.

- Management continues to prioritize fleet growth via accretive vessel dropdowns over share repurchases or increased dividends, suggesting that future cash flows may be allocated toward asset expansion and debt, rather than directly benefiting unit holders, which could limit earnings per share and total shareholder return.

- Persistently low distribution per unit, despite improved earnings and cash flows, may reflect a cautious approach due to uncertain industry dynamics, high leverage, or limited access to capital, which could undermine investor confidence and limit the share price appreciation over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for KNOT Offshore Partners is $8.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of KNOT Offshore Partners's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $8.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $312.6 million, earnings will come to $33.3 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 13.3%.

- Given the current share price of $8.1, the bearish analyst price target of $8.9 is 9.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.