Last Update 14 Dec 25

Fair value Decreased 9.09%GRNT: Future Outlook Will Balance Rising Production With Tighter Profit Margins

Analysts have modestly reduced their price target on Granite Ridge Resources from approximately 5.50 dollars to 5.00 dollars, citing a higher assumed discount rate, slower projected revenue growth, and lower forecast profit margins that are only partially offset by expectations for a higher future price to earnings multiple.

What's in the News

- Reported strong third quarter 2025 net oil production of 1,492 MBbl, up from 1,164 MBbl a year earlier, highlighting continued growth in liquids output (company operating results).

- Third quarter 2025 natural gas production increased to 8,668 MMcf from 6,912 MMcf year over year, contributing to higher overall hydrocarbon volumes (company operating results).

- Total production for the third quarter 2025 rose to 2,937 MBoe compared with 2,316 MBoe in the prior year period, underscoring robust volume expansion (company operating results).

- For the first nine months of 2025, net oil production reached 4,277 MBbl versus 3,129 MBbl a year ago, reflecting sustained growth over the year to date period (company operating results).

- Nine month 2025 total production climbed to 8,443 MBoe from 6,589 MBoe in the comparable 2024 period, signaling meaningful scale gains in the company’s asset base (company operating results).

Valuation Changes

- The fair value estimate has been reduced modestly from approximately 5.50 dollars to 5.00 dollars per share, reflecting a slightly more conservative intrinsic value assessment.

- The discount rate has risen slightly from about 6.90 percent to 6.96 percent, implying a marginally higher required return and risk premium.

- The revenue growth forecast has fallen significantly from roughly 13.6 percent to 9.2 percent, indicating tempered expectations for top line expansion.

- The net profit margin outlook has been reduced meaningfully from about 18.0 percent to 10.6 percent, pointing to a less favorable profitability profile.

- The future P/E multiple assumption has increased substantially from roughly 8.2 times to 13.7 times, partially offsetting weaker fundamentals through a higher expected valuation multiple.

Key Takeaways

- Global decarbonization and stricter regulations threaten Granite Ridge's pricing power, profitability, and long-term cash flows.

- Aggressive spending, unreliable third-party execution, and rising ESG risks could limit financial flexibility and access to growth capital.

- Strategic acquisitions, disciplined partnerships, and prudent financial management position Granite Ridge for sustainable growth and resilience despite market volatility and industry shifts.

Catalysts

About Granite Ridge Resources- Operates as a non-operated oil and natural gas exploration and production company.

- Accelerating global decarbonization efforts and government policies supporting renewables are expected to structurally depress long-term oil and gas demand, creating the risk that Granite Ridge's recently acquired and developed inventory will face sustained lower pricing, which would reduce both revenue per barrel and future cash flows.

- Emerging regulatory frameworks targeting carbon emissions and waste management are likely to drive up compliance and operational costs across all U.S. basins, directly pressuring Granite Ridge's net margins and undermining the economic viability of the company's scaled-up asset base.

- The company's reliance on acquiring non-operated working interests exposes it to execution shortfalls from third-party operators, especially as the industry faces increasing cost pressures and well productivity declines in mature shale regions, making it likely that production growth and earnings stability will prove unreliable over the medium and long term.

- Granite Ridge's outspending of operating cash flow to fund aggressive acquisition and development could lead to mounting debt levels and eventual erosion of financial flexibility, increasing the risk of shareholder dilution or forced reductions in dividends if commodity prices remain weak for an extended period.

- Intensifying environmental, social, and governance scrutiny, along with the ongoing divestment by institutional investors from fossil fuel assets, threatens to compress Granite Ridge's valuation multiples and limit its access to growth capital, which would lower the company's potential for sustainable earnings and future share price appreciation.

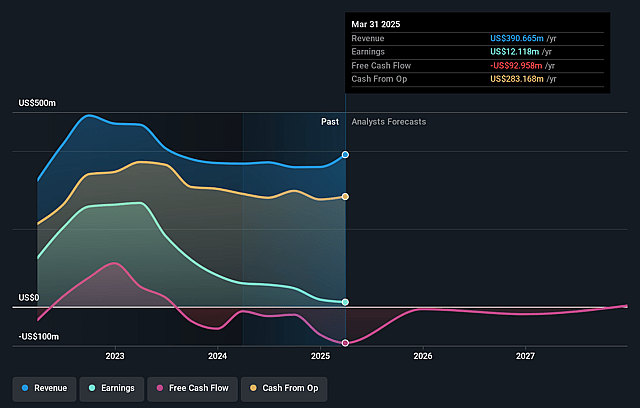

Granite Ridge Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Granite Ridge Resources compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Granite Ridge Resources's revenue will grow by 13.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.8% today to 18.0% in 3 years time.

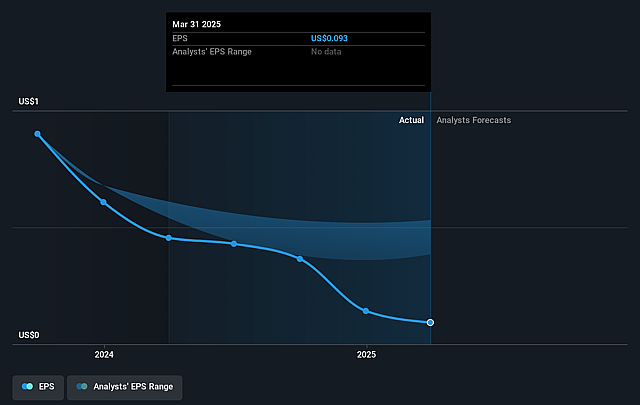

- The bearish analysts expect earnings to reach $108.2 million (and earnings per share of $0.83) by about August 2028, up from $32.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, down from 21.5x today. This future PE is lower than the current PE for the US Oil and Gas industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Granite Ridge Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Granite Ridge's continued ability to source off-market acquisitions at attractive entry costs in the Permian and Appalachian basins, combined with a rising inventory runway and accelerated production, positions the company for sustained long-term revenue growth and earnings expansion.

- The strategic shift toward high-quality, diversified operator partnerships with proven management teams has enabled above-expectation production increases and may provide resilience and consistent net margin improvement even in volatile commodity price environments.

- The company's disciplined capital allocation, conservative leverage (with a target range up to 1.25 times net debt to EBITDA), and strong liquidity provide flexibility to pursue accretive growth and fund dividends, supporting valuation and potential total shareholder return.

- Structural changes in the upstream market, such as reduced private equity competition for mid-sized deals and rationalization among large operators, have left Granite Ridge well-placed to aggregate smaller transactions at favorable valuations, enhancing long-term asset quality and underlying free cash flow.

- The company's hedging program, which covers approximately 75 percent of current production, mitigates the impact of commodity price swings and helps stabilize operating cash flow and earnings, supporting capital programs and dividend payments through industry cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Granite Ridge Resources is $5.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Granite Ridge Resources's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $600.2 million, earnings will come to $108.2 million, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $5.26, the bearish analyst price target of $5.5 is 4.4% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Granite Ridge Resources?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.