Key Takeaways

- Strategic acquisitions and proprietary partnerships position Granite Ridge for outperformance in production growth, margin expansion, and asset value beyond current expectations.

- Robust financial flexibility and access to capital support accelerated shareholder returns and enable continued value-accretive growth.

- Aggressive growth spending, reliance on non-operated partnerships, and sector risks-such as declining demand, regulatory pressures, and geographic concentration-threaten margins and financial stability.

Catalysts

About Granite Ridge Resources- Operates as a non-operated oil and natural gas exploration and production company.

- Analyst consensus appreciates Granite Ridge's margin stability and production growth, but the company's current acquisition environment-driven by a historic withdrawal of private equity and uniquely low entry prices-could yield a multi-year step-change in both reserve base and per-share earnings, positioning it for market-leading production growth rates and margin expansion that well exceed consensus expectations.

- While consensus expects commodity price resilience to support Granite Ridge's revenues, the global underinvestment in new hydrocarbon supply suggests that any sustained demand shock or supply disruption could result in structurally higher oil and gas prices, disproportionately enhancing Granite Ridge's top-line revenue and generating significant operating leverage.

- The rapid expansion and maturation of Granite Ridge's proprietary operator partnership model-now adding additional high-caliber teams and capturing off-market deals-has created a flywheel for repeatable high-return investment, which could drive outperformance in earnings growth and asset value well beyond what current forecasts imply.

- Granite Ridge's ability to consistently source and execute small, attractively priced acquisitions in prolific basins leverages a largely untapped segment of the market, enabling accelerated inventory duration and compounding production growth that is likely underappreciated in current valuation multiples.

- The company's blend of robust financial flexibility, including a strong balance sheet, low leverage, and expanding liquidity options through both bank and credit markets, grants unparalleled optionality to pursue value-accretive growth and return capital to shareholders-supporting a faster trajectory for both dividends and earnings per share than is factored into prevailing models.

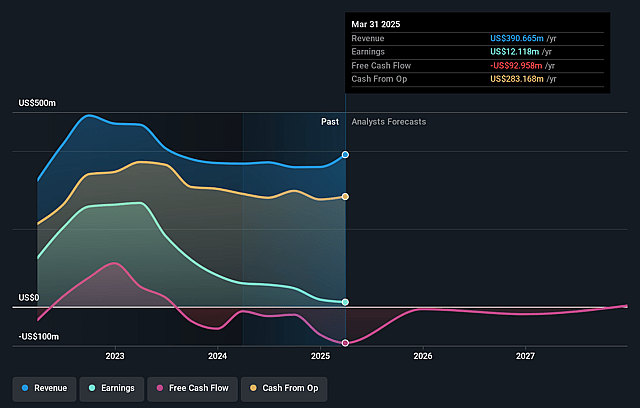

Granite Ridge Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Granite Ridge Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Granite Ridge Resources's revenue will grow by 13.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.8% today to 18.2% in 3 years time.

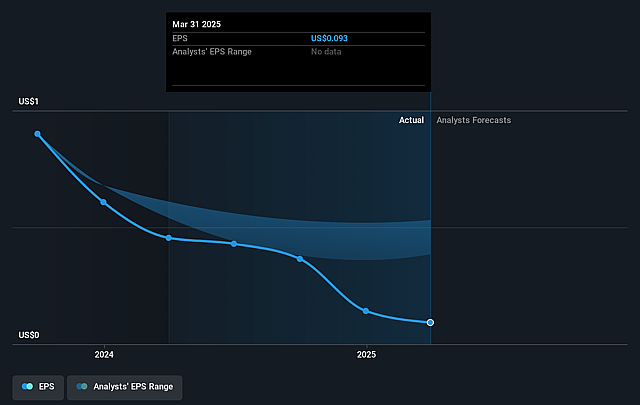

- The bullish analysts expect earnings to reach $110.4 million (and earnings per share of $0.85) by about September 2028, up from $32.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, down from 21.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.04%, as per the Simply Wall St company report.

Granite Ridge Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Granite Ridge Resources is persistently outspending its cash flow to fund aggressive inventory growth and acquisitions, a strategy that could lead to higher leverage and increased financial risk if commodity prices fall, thereby impacting free cash flow and future earnings.

- A significant portion of Granite Ridge's capital is allocated to non-operated positions and partnerships, exposing the company to reduced control over project timelines, capital allocation, and operating practices, which raises the risk of cost overruns and places downward pressure on net margins.

- As global energy transitions accelerate, secular declines in long-term oil and gas demand due to electrification and renewable adoption will erode market opportunities and could drive persistently lower realized prices, negatively affecting revenue generation.

- Anticipated increases in environmental and regulatory scrutiny, including the potential for new carbon taxes or stricter operating requirements, threaten to raise operating expenses across the industry, which may compress Granite Ridge's operating margins and profitability over time.

- Granite Ridge's relatively limited scale and concentration in particular regions, such as the Permian and Appalachian basins, make it more vulnerable to local production declines, commodity price volatility, and industry consolidation that favors larger competitors, adding to the risk of volatile earnings and diminished EBITDA.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Granite Ridge Resources is $9.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Granite Ridge Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $9.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $605.3 million, earnings will come to $110.4 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 7.0%.

- Given the current share price of $5.19, the bullish analyst price target of $9.0 is 42.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Granite Ridge Resources?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.