Last Update05 Oct 25Fair value Decreased 2.32%

Analysts have reduced their price target for Plains GP Holdings to $21.00 from $21.46, citing updated views on sector dynamics and expectations for more moderate revenue growth in light of continued market uncertainty.

Analyst Commentary

Recent analyst perspectives on Plains GP Holdings reflect a balanced outlook, with both positive developments and ongoing concerns shaping their revised price targets and overall sentiment on the company's prospects.

Bullish Takeaways- Bullish analysts note that a potential Federal Reserve rate cut in September could serve as a short-term catalyst for midstream stocks and enhance valuation appeal for the sector.

- They see updates to price targets for infrastructure companies as an indicator of the firm's resilience in adapting to evolving market conditions.

- Continued recovery in renewable infrastructure, particularly following recent policy changes, is viewed as a long-term growth driver for companies with diversified portfolios.

- Despite market uncertainty, the company's execution in the North American midstream space is seen as steady and supports expectations for gradual revenue improvement.

- Bearish analysts caution that persistent commodity market uncertainty could weigh on Plains GP Holdings' growth trajectory and limit valuation rerating in the near term.

- Expectations for more moderate revenue growth reflect concerns around potential headwinds and execution risks within the sector.

- While catalysts are identified, there is skepticism regarding their durability, especially if policy adjustments or rate cuts do not materialize as anticipated.

- The downward revision in price targets suggests a more cautious stance on the firm's ability to outperform expectations amid ongoing sector dynamics.

Valuation Changes

- Consensus Analyst Price Target has declined slightly from $21.46 to $21.00, reflecting a more cautious revenue outlook.

- Discount Rate has decreased modestly from 10.31% to 10.03%, indicating slightly lower perceived risk.

- Revenue Growth expectations have fallen from 0.86% to 0.60%, pointing to more tempered growth assumptions.

- Net Profit Margin is projected to improve from 85.14% to 95.01%, suggesting better profitability forecasts.

- Future P/E ratio has dropped from 16.07x to 11.96x, signaling lower valuation multiples in the updated analysis.

Key Takeaways

- Streamlining via divestiture and redeployment enhances core crude operations, financial flexibility, and potential for higher-return investments and buybacks.

- Focus on Permian Basin growth, stable fee-based contracts, and balance sheet optimization position the company for resilient earnings and improved cash flow.

- Strategic shift to focus solely on crude oil increases exposure to demand risks, margin pressure, capital constraints, and regulatory headwinds, challenging long-term growth and profitability.

Catalysts

About Plains GP Holdings- Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

- The planned divestiture of the NGL segment and redeployment of ~$3 billion in proceeds into core crude oil operations and bolt-on acquisitions are expected to streamline operations, reduce commodity price exposure, and enhance financial flexibility-supporting growth in core revenue and improved net margins via higher-return investments and potential buybacks.

- Increased capital allocation toward Permian Basin initiatives, including new lease connects, terminal expansions, and incremental pipeline interests like BridgeTex, directly leverages Plains' dominant footprint in the fastest-growing, lowest-cost U.S. oil field, positioning it to capitalize on sustained high throughput volumes and resilient earnings as U.S. energy demand persists.

- Continued U.S. population and industrial growth, alongside robust refining and export demand trends, underpin expectations for stable or rising crude volumes, which should drive consistent utilization rates, stabilize base earnings, and lead to improved cash flows.

- The adoption of long-term, fee-based contracts and a focus on M&A synergies are improving revenue predictability and reducing volumetric risk, which supports more stable EBITDA and distributable cash flow even during periods of market volatility.

- Ongoing deleveraging through capital discipline, with proceeds earmarked for optimizing the balance sheet and opportunistic unit buybacks, is expected to further reduce interest expenses and increase net margins, supporting sustainability and growth in distributions.

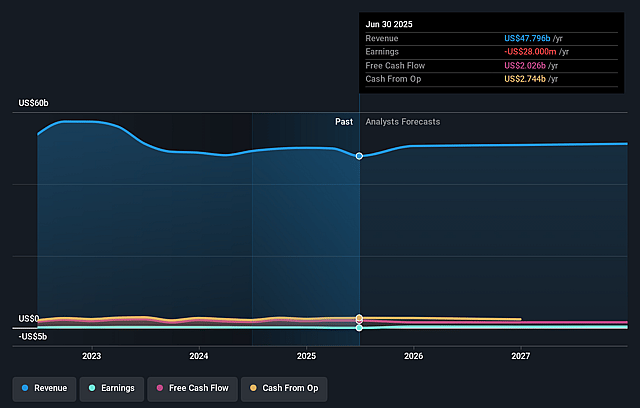

Plains GP Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Plains GP Holdings's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.1% today to 0.9% in 3 years time.

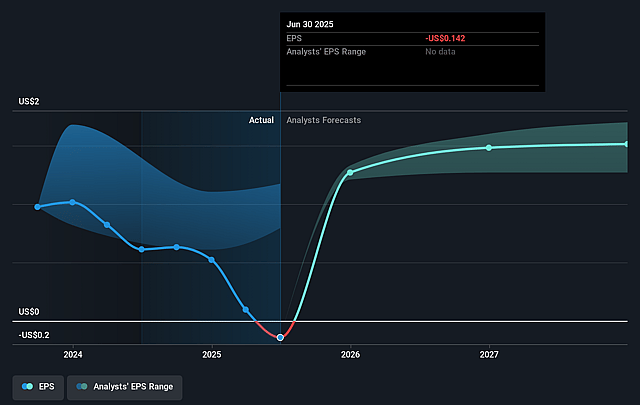

- Analysts expect earnings to reach $417.5 million (and earnings per share of $1.53) by about September 2028, up from $-28.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from -130.7x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.31%, as per the Simply Wall St company report.

Plains GP Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Plains GP Holdings' strategic pivot to being a pure-play crude oil midstream company after exiting the NGL business increases its reliance on long-term crude oil demand, which could expose it to secular risks from the accelerating global energy transition towards renewables, potentially reducing throughput volumes and impacting future revenues and earnings.

- Increased dependence on North American crude production, especially from the Permian Basin, leaves Plains vulnerable to any sustained downturns, competitive takeaway expansion, or changes in basin-level growth, risking under-utilization of assets and negatively affecting revenue and asset returns.

- The company faces potential margin compression from the renegotiation of contract rates (as seen with the roll-off of legacy contracts like Cactus I & II and Sunrise), which could offset volume gains and lead to less stable cash flows and lower net margins over time.

- Substantial capital expenditure requirements for bolt-on acquisitions, growth projects, and system expansions-alongside the redeployment of $3 billion in NGL sale proceeds-could constrain free cash flow, challenge disciplined capital allocation, and limit flexibility to return capital to shareholders, impacting earnings quality if returns on new investment underperform expectations.

- The increased operational and portfolio concentration in crude oil, combined with ongoing regulatory uncertainty and potential tightening environmental policies, heightens the risk of higher compliance costs, project delays, and reduced investor appeal for traditional oil midstream companies, which could put downward pressure on valuation multiples, operating costs, and long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.458 for Plains GP Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $17.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $49.0 billion, earnings will come to $417.5 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 10.3%.

- Given the current share price of $18.51, the analyst price target of $21.46 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.