Key Takeaways

- Strong Permian production growth, pipeline capacity constraints, and a focus on integration and fee-based contracts position Plains for margin expansion and resilient, higher-quality earnings.

- Regulatory barriers and high credit ratings enhance the value of Plains' existing network and enable strategic acquisitions or capital returns that support shareholder value.

- Heavy dependence on oil and geographic concentration, plus rising regulatory and capital pressures, threaten future revenue stability, margin sustainability, and financial flexibility.

Catalysts

About Plains GP Holdings- Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

- Whereas analyst consensus expects Permian production growth of 200,000 to 300,000 barrels per day, a strong start to 2025 and upstream producer commentary suggest this growth could exceed forecasts, pushing long-haul pipeline utilization near full capacity and creating potential for Plains GP Holdings to put through tariff increases, driving outsized revenue and EBITDA growth.

- Analyst consensus views recent bolt-on acquisitions as supportive of earnings, but Plains' expanding footprint in the Permian and Eagle Ford allows for further integration and optimization, positioning the company for margin expansion above consensus, especially as industrial activity and global energy demand rebound faster than expected.

- Plains' shift toward fee-based, long-term contracts-highlighted by recent NGL fractionation and gathering expansions with strong customer commitments-will deliver greater cash flow stability, making earnings more resilient and reducing downside risk, particularly as energy transition efforts progress more slowly than many anticipate.

- Regulatory and permitting headwinds for new pipelines are increasing the scarcity value of Plains' existing network at a time when global demand for North American energy exports is rising, which is likely to drive sustained asset utilization and premium valuations, supporting higher net margins and long-term earnings multipliers.

- With leverage at the lower end of its target range and a recent elevation to BBB credit ratings across all agencies, Plains is uniquely positioned to accelerate value-accretive acquisitions or share repurchases in response to market dislocations, which can meaningfully enhance per-share earnings and return of capital over the coming years.

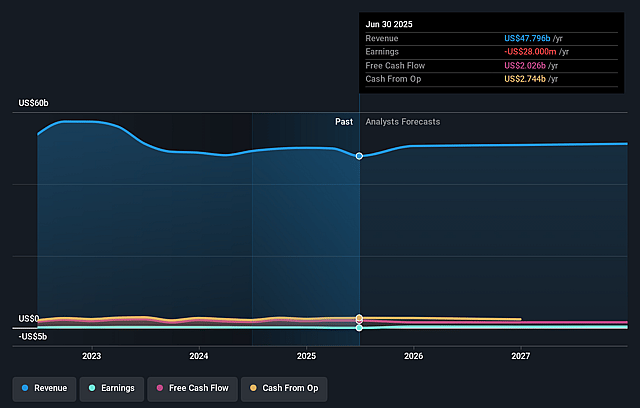

Plains GP Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Plains GP Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Plains GP Holdings's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.3% today to 0.6% in 3 years time.

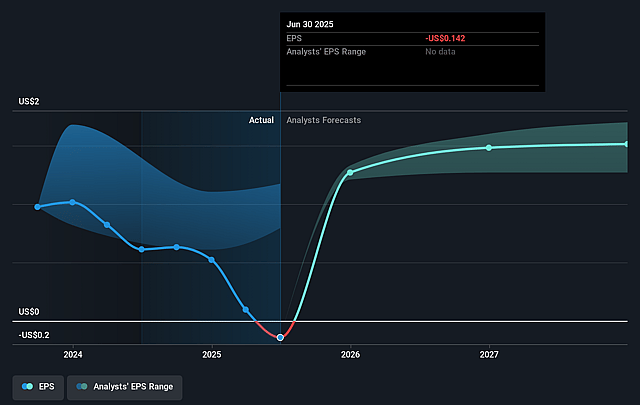

- The bullish analysts expect earnings to reach $339.9 million (and earnings per share of $1.71) by about August 2028, up from $145.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.8x on those 2028 earnings, down from 26.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 13.3x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.0%, as per the Simply Wall St company report.

Plains GP Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Plains GP Holdings remains highly exposed to long-term declines in crude oil demand due to the accelerating global transition to renewables and electrification, potentially reducing transported volumes and negatively impacting future revenues.

- The company faces increased regulatory risk as policymakers advance decarbonization goals, which may heighten compliance costs and lead to asset restrictions or shutdowns, adversely affecting operational flexibility and net margins over time.

- A significant portion of Plains' business depends on the Permian Basin, exposing it to geographic concentration risk-if Permian production growth plateaus or declines, this could lead to revenue instability and potential EBITDA compression in down cycles.

- The capital-intensive nature of pipeline maintenance and expansion, combined with ongoing bolt-on acquisitions funded by substantial outlays, could exacerbate balance sheet risk and limit future free cash flow and net earnings, especially during periods of softer growth.

- Persistent oil market volatility and emerging alternative transportation options may increase competitive pressures and reduce midstream margins, heightening earnings volatility and posing longer-term risks to sustaining high-margin revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Plains GP Holdings is $26.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Plains GP Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $17.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $57.9 billion, earnings will come to $339.9 million, and it would be trading on a PE ratio of 23.8x, assuming you use a discount rate of 10.0%.

- Given the current share price of $19.29, the bullish analyst price target of $26.0 is 25.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.