Last Update 30 Apr 25

Fair value Decreased 1.58%Key Takeaways

- Operational efficiencies, disciplined capital allocation, and strategic acquisitions position Diamondback for stable cash flow and enhanced shareholder returns despite volatile energy markets.

- Investments in infrastructure and monetization of noncore assets are set to unlock new revenue streams and improve long-term financial flexibility and profitability.

- Global renewables push, stricter ESG demands, regional concentration, rising costs, and reserve depletion collectively threaten profitability, capital access, and long-term growth stability.

Catalysts

About Diamondback Energy- An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

- Diamondback’s relentless operational efficiency improvements—evidenced by increasing capital efficiency, falling breakeven levels, and production scalability with fewer rigs—position the company to expand net margins and free cash flow, even under conservative oil price assumptions.

- With recent transformative acquisitions consolidating high-quality acreage in the Permian, Diamondback stands to benefit from persistent global energy demand growth, especially as emerging markets drive consumption, supporting long-term revenue expansion through greater reserves and higher production.

- The company’s scale and disciplined capital allocation—including an aggressive share repurchase program at attractive valuations—are set to drive per-share earnings growth and enhance total shareholder returns, with 50% or more of free cash flow targeted for shareholder distributions.

- Structural advantages as a well-capitalized U.S. producer, amid a global push for energy security and onshoring, fortify Diamondback’s market relevance and cash flow stability, providing a buffer against macroeconomic volatility and supporting future earnings.

- Strategic investments in infrastructure, including potential power generation and data center projects in the Permian, and the monetization of noncore assets are expected to unlock new revenue streams, reduce operating costs, and further improve long-term financial flexibility and profitability.

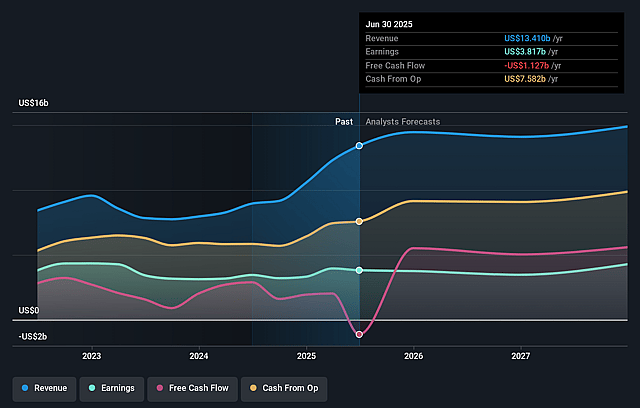

Diamondback Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Diamondback Energy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Diamondback Energy's revenue will grow by 18.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 31.4% today to 32.2% in 3 years time.

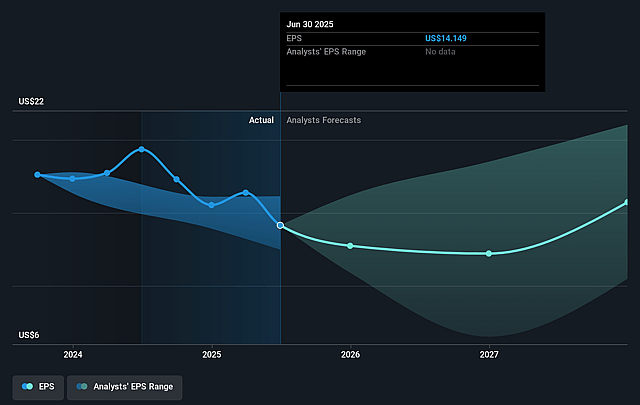

- The bullish analysts expect earnings to reach $5.6 billion (and earnings per share of $23.87) by about April 2028, up from $3.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 12.1x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Diamondback Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating transition to renewable energy and decarbonization globally poses a significant risk to long-term oil demand, which could diminish Diamondback Energy’s core revenue streams and negatively affect future earnings.

- Increasing regulatory and investor pressure for ESG compliance may raise Diamondback’s operating costs and restrict access to capital markets, impacting both net margins and the company’s ability to fund growth.

- Diamondback’s concentrated operations in the Permian Basin heighten vulnerability to region-specific risks such as local regulatory changes or declines in production, which could destabilize revenue and earnings over time.

- Sustained high capital expenditures are required to maintain and grow production, and should oil prices stagnate or decline, Diamondback may see pressured net margins and declining free cash flow, limiting shareholder returns and growth capital.

- Depletion of current reserves forces Diamondback to either invest heavily in costly new drilling or pursue expensive acquisitions, which may constrain long-term earnings and introduce greater balance sheet risk if production replacement becomes less economically viable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Diamondback Energy is $235.44, which represents two standard deviations above the consensus price target of $188.28. This valuation is based on what can be assumed as the expectations of Diamondback Energy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $242.0, and the most bearish reporting a price target of just $145.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $17.3 billion, earnings will come to $5.6 billion, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of $136.65, the bullish analyst price target of $235.44 is 42.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.