Key Takeaways

- Regulatory uncertainty, capital flight from hydrocarbons, and tightening compliance standards threaten Calumet's profit margins, earnings, and access to affordable financing.

- Ongoing decarbonization and costly modernization efforts weaken future demand, slow growth, and suppress shareholder returns from both renewable and specialty businesses.

- Regulatory incentives and cost leadership in renewables, combined with specialty product focus and financial improvements, position Calumet for enhanced profitability and shareholder value.

Catalysts

About Calumet- Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

- Despite Calumet's continued cost reductions in its Montana Renewables segment, the business remains acutely exposed to volatility in regulatory policies around renewable diesel, SAF, and related tax credits. Protracted regulatory uncertainty, such as delays or tightening of RVO mandates, could precipitate sustained low industry margins, significantly reducing earnings and EBITDA from this unit.

- The global acceleration of ESG investing and capital flight from hydrocarbon-based businesses is likely to drive up Calumet's long-term refinancing costs and impair access to capital, compounding existing balance sheet risks and eroding net margins and future cash flow required for debt reduction.

- Even as the company scales renewable fuel and specialty businesses, long-run decarbonization efforts-including more aggressive international and domestic emissions targets, carbon taxes, and further incentives for electrification-are positioned to dampen future demand and pricing power for both Calumet's specialty hydrocarbons and renewable products, ultimately slowing top-line growth.

- Calumet's significant legacy exposure to traditional specialty hydrocarbons and ongoing necessity for large-scale capital investment to comply with modernization and low-carbon pivots threaten to suppress free cash flow and delay returns, limiting shareholder value creation and putting increasing pressure on long-term earnings per share.

- Persistent tightening of regulatory compliance, narrowing crack spreads, and talent shortages as refining skills migrate toward renewable and technology sectors are poised to raise operational costs and risk across Calumet's refining and specialty businesses, structurally compressing profitability and making long-term margin improvement increasingly difficult.

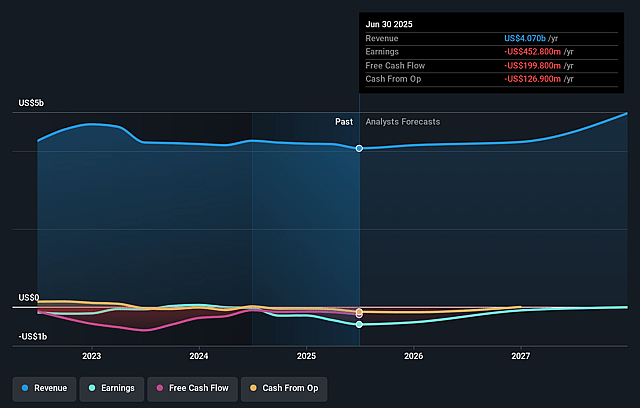

Calumet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Calumet compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Calumet's revenue will grow by 6.5% annually over the next 3 years.

- The bearish analysts are not forecasting that Calumet will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Calumet's profit margin will increase from -11.1% to the average US Oil and Gas industry of 14.9% in 3 years.

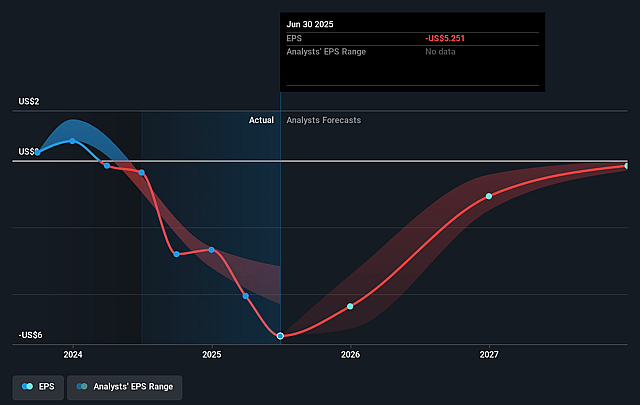

- If Calumet's profit margin were to converge on the industry average, you could expect earnings to reach $734.4 million (and earnings per share of $8.25) by about September 2028, up from $-452.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.1x on those 2028 earnings, up from -3.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.9x.

- Analysts expect the number of shares outstanding to grow by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.76%, as per the Simply Wall St company report.

Calumet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory support for renewable fuels, including the extension and transferability of the 45Z production tax credit, along with bipartisan backing and incentives through at least 2029, may continue to provide strong tailwinds for Calumet's Montana Renewables business, underpinning sustained or improved revenue and operating margins.

- The ongoing ramp-up and cost-reduction efforts at Montana Renewables, including record-low operating and SG&A costs and operational flexibility, position the company as a cost leader in the renewables space, which could lead to margin expansion and increased earnings once industry conditions normalize.

- Long-term growth in mandated demand for sustainable aviation fuel and renewable diesel, both domestically and internationally, combined with Calumet's upcoming MaxSAF 150 project and ability to serve multiple premium markets, could drive top-line growth and strengthen EBITDA in future years.

- The company's strategic shift toward higher-value, specialty products-with resilient specialty product margins and sales volumes, and limited exposure to tariffs-may support sustained profitability and mitigate exposure to commodity cycles, benefiting net income and cash flow.

- Ongoing deleveraging progress, asset monetization, and improving free cash flow outlook indicate the potential for significant interest expense reduction and earnings per share growth, creating additional upside potential for shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Calumet is $13.25, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Calumet's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $13.25.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.9 billion, earnings will come to $734.4 million, and it would be trading on a PE ratio of 2.1x, assuming you use a discount rate of 9.8%.

- Given the current share price of $17.84, the bearish analyst price target of $13.25 is 34.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Calumet?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.