Key Takeaways

- Strong demand and industry-leading cost structure position Calumet's renewables business for significant, sustained margin growth and outperformance versus consensus expectations.

- Diversified operations, strategic market access, and regulatory tailwinds are set to deliver stable earnings, cash flow, and increased equity value through growth and deleveraging.

- Transition to renewables, regulatory uncertainty, high leverage, costly infrastructure needs, and increased competition collectively threaten revenue, margin stability, and long-term earnings growth.

Catalysts

About Calumet- Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

- Analyst consensus recognizes Montana Renewables' MaxSAF expansion as a potential growth driver, but this viewpoint likely underestimates the upside: early-stage commercial negotiations have reportedly attracted more demand than Montana's new capacity can even meet, positioning Calumet to lock in long-term, premium-priced contracts across multiple geographies at higher sustained margins, which would drive disproportionate growth in renewables revenues and EBITDA well above consensus projections.

- While consensus acknowledges cost leadership at Montana Renewables, recent disclosures highlight record-setting operating costs of only 43 cents per gallon and a continuous learning curve that has eliminated expensive third-party support in advance of MaxSAF, implying Calumet could emerge as the lowest-cost SAF producer in North America and capture incremental margin expansion even in adverse market conditions, structurally boosting long-term net margins and cash flow.

- Calumet has shifted to a company-wide culture of operational excellence and continuous optimization-including niche specialty portfolio expansion, opportunistic blending strategies in segments like asphalt, and harnessing digital logistics solutions-which is driving material, sustainable cost reductions and margin increases across both core and ancillary businesses, likely leading to steady net margin uplift and improved earnings stability beyond current analyst assumptions.

- The company's location and logistics reach enable it to flexibly serve premium, deficit, and policy-advantaged markets (West Coast, Midwest, cross-border into Canada, and potentially Europe) for both SAF and specialty products, making it uniquely insulated from regional regulatory or demand shocks and supporting higher, more stable revenue streams over the next decade as global renewable fuel mandates intensify.

- With the normalization of the Production Tax Credit market and the ability to regularly monetize tax credits, coupled with imminent regulatory volume increases and the likely exclusion of imports from U.S. renewable mandates, Calumet is poised to generate substantial recurring cash windfalls and significant deleveraging, creating direct upside to equity value through reduced interest expense and releasing capital for further specialty and renewables growth investments, accelerating earnings-per-share growth above consensus for several years.

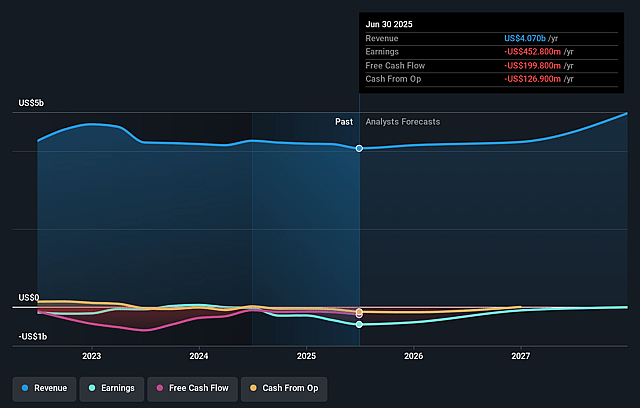

Calumet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Calumet compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Calumet's revenue will grow by 12.5% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Calumet will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Calumet's profit margin will increase from -11.1% to the average US Oil and Gas industry of 14.9% in 3 years.

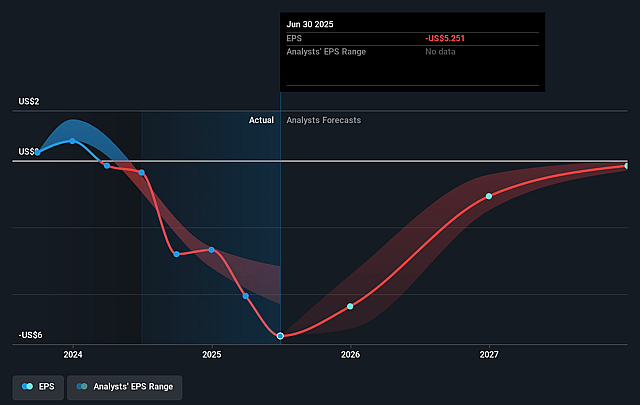

- If Calumet's profit margin were to converge on the industry average, you could expect earnings to reach $861.8 million (and earnings per share of $9.68) by about September 2028, up from $-452.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.5x on those 2028 earnings, up from -3.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.64%, as per the Simply Wall St company report.

Calumet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Calumet operates in sectors directly impacted by the global acceleration toward renewable energy and electrification, which threatens long-term demand for its fossil-fuel-derived specialty products and lubricants, likely resulting in a shrinking addressable market and downward pressure on revenue over time.

- Regulatory landscape volatility poses ongoing risks, as noted by management's repeated references to the need for regulatory clarity, particularly around renewable diesel and sustainable aviation fuel (SAF) credits, as well as unpredictable changes to RVO (Renewable Volume Obligation) mandates; this can create significant earnings volatility and impact the reliability of net margins and future cash flows.

- The company's high leverage and ongoing debt reduction efforts highlight lingering financial vulnerability; while steps are being taken to deleverage, substantial debt servicing continues to limit strategic flexibility and could constrain net margins and earnings, particularly if market or operational conditions deteriorate.

- Continual references to the need for major facility turnarounds and upgrades, together with aging infrastructure, indicate that capex requirements may remain elevated; this could hinder free cash flow and ultimately impair future earnings growth as compliance and modernization investments persist.

- Structural competition persists from both U.S. overcapacity in refining and from international specialty chemical producers and alternative sources, raising the risk of margin compression and loss of market share for Calumet's key products, which threatens both future revenue growth and gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Calumet is $33.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Calumet's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $13.25.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.8 billion, earnings will come to $861.8 million, and it would be trading on a PE ratio of 4.5x, assuming you use a discount rate of 9.6%.

- Given the current share price of $17.77, the bullish analyst price target of $33.0 is 46.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.