Last Update08 Oct 25

Analysts have maintained their price target for Calumet at $19.05. They cite only minor adjustments to discount rate and valuation assumptions that do not materially alter their outlook for the company.

What's in the News

- Calumet received notification from the U.S. Environmental Protection Agency (EPA) confirming full or partial exemptions for every small refinery petition filed between 2019 and 2024 (Key Developments).

- The EPA's decision will significantly reduce Calumet's accrued Renewable Identification Number (RIN) liability from 396 million to 89 million RINs (Key Developments).

- Of the 89 million RINs now accrued, 57 million are from 2022 and 2023 vintage, and 32 million are from 2024 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $19.05.

- Discount Rate has decreased modestly, moving from 9.54% to 9.26%.

- Revenue Growth projection is stable at approximately 8.00%.

- Net Profit Margin estimate is effectively unchanged, remaining near 0.79%.

- Future P/E ratio has declined marginally, from 55.33x to 54.91x.

Key Takeaways

- Expansion into sustainable aviation fuel and regulatory tailwinds position Calumet for significant revenue and margin growth in renewable fuels.

- Strategic shift to high-margin specialty products and efficiency initiatives enhance earnings quality and provide resilience against commodity market volatility.

- Heavy dependence on regulatory support, commodity exposure, and high leverage exposes Calumet to volatile margins, cash flow unpredictability, and constrained growth flexibility.

Catalysts

About Calumet- Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

- The MaxSAF 150 project is on track to start up in the first half of 2026, enabling Calumet to produce 120-150 million annual gallons of sustainable aviation fuel (SAF) at relatively low capital costs, capturing premiums of $1-$2/gallon over renewable diesel and tapping into surging mandated and voluntary SAF demand globally; this is likely to drive material step-up in revenues and EBITDA margin expansion once operational.

- Recent and anticipated regulatory changes-including extension and transferability of the 45Z production tax credit through 2029, higher proposed renewable volume obligations (RVO), and policies excluding imports from key credits-are strengthening domestic renewable fuels economics and creating visibility to more robust and resilient cash flows for Calumet's Montana Renewables operations, supporting both current profitability and long-term earnings growth.

- Specialty products and solutions segment continues to deliver resilient sales volumes and margin outperformance versus industry averages, supported by diversification in end-markets (e.g., lubricants, pharmaceuticals, food-grade products) and ongoing urbanization and infrastructure demand, providing stability to company-wide revenue and supporting stronger overall net margins even during commodity price downturns.

- Ongoing cost-reduction and operational reliability initiatives have decreased company-wide operating expenses and increased throughput, yielding higher production efficiency and freeing up cash which, together with monetization plans for tax attributes, provides capacity for further debt reduction and improved net income; these efficiencies are likely to structurally boost future operating margins.

- Repositioning away from commoditized products toward high-margin specialties, together with scale advantages and sustained regulatory tailwinds for renewable fuels, strategically positions Calumet to benefit from the multi-decade shift to sustainable infrastructure, transportation, and alternative energy markets-trends expected to underpin top-line growth and enhance earnings quality in coming years.

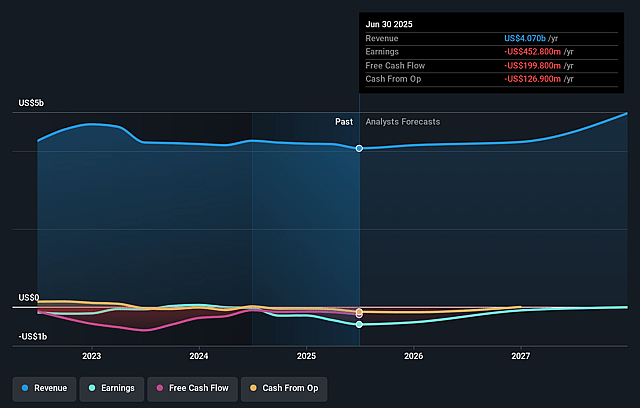

Calumet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Calumet's revenue will grow by 8.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -11.1% today to 0.8% in 3 years time.

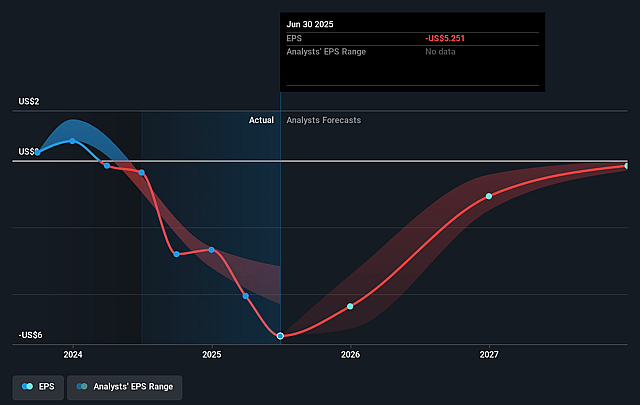

- Analysts expect earnings to reach $40.3 million (and earnings per share of $0.47) by about September 2028, up from $-452.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.6x on those 2028 earnings, up from -3.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 0.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.7%, as per the Simply Wall St company report.

Calumet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's heavy reliance on the regulatory environment to support margins-especially for renewable diesel and SAF-is a long-term risk; if regulatory support such as tax credits or favorable RVOs is reduced or fails to materialize, it could lead to significant margin compression, directly impacting long-term earnings and revenue growth.

- Persistent overhang of excess RINs, slow regulatory finalization (such as RVO and SRE uncertainty), and market volatility have led to industry-wide margin weakness, revealing Calumet's vulnerability to low mid-cycle earnings periods and unpredictable cash flows.

- The transition to more commodity-exposed segments (such as increased focus on asphalt or reliance on specialty chemical resilience) leaves Calumet exposed to cyclical downturns or industry commoditization, which may erode pricing power and compress operating margins over time.

- Although there has been progress in deleveraging, Calumet continues to carry substantial debt and remains reliant on successful asset monetizations and strategic sales; execution risk tied to this high leverage presents ongoing constraints on net margins and limits flexibility for growth investments or downturn mitigation.

- The ongoing shift toward decarbonization and potential for stricter ESG or emissions-related regulations could raise compliance costs or impose capital access challenges, particularly as Calumet's traditional hydrocarbon business segments and even renewables remain exposed to evolving policy landscapes that may negatively affect long-term revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.05 for Calumet based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $13.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.1 billion, earnings will come to $40.3 million, and it would be trading on a PE ratio of 55.6x, assuming you use a discount rate of 9.7%.

- Given the current share price of $16.76, the analyst price target of $19.05 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.