Key Takeaways

- Strong digital growth, product diversification, and geographic expansion are driving higher margins, robust fee-based revenue, and improved earnings resilience.

- Operational efficiencies and new partnerships are boosting profitability, supporting ongoing growth and recovery in underperforming regions.

- The shift to lower-margin digital services, rising competition and compliance costs, and an inflexible cost structure are eroding profitability and threatening Western Union’s long-term earnings.

Catalysts

About Western Union- Provides money movement and payment services worldwide.

- The accelerating growth of Western Union’s digital platform, with 14% transaction growth and 8% revenue growth in the most recent quarter and a strong pipeline of innovations like loyalty programs and account-to-account payouts, is expanding their customer base in fast-growing markets where smartphone and mobile banking adoption is rapidly increasing. This digital channel shift is expected to drive higher-margin revenue, increasing net margins and long-term earnings.

- Western Union’s global diversification, especially their outperformance in Europe, the Middle East, and APAC, positions the company to capture disproportionate share of international money movement as cross-border migration and global workforce mobility continues to rise. This broad geographic footprint provides resilience, helps smooth over regional downturns, and supports robust ongoing fee-based revenue growth.

- The expansion into new products and customer segments, such as the acquisition of Eurochange and growth in the Travel Money segment, provides Western Union with both cross-selling opportunities and higher-margin revenue streams. As these segments become a larger share of the business, they are expected to boost total revenue and diversify earnings sources, reducing reliance on legacy products.

- Ongoing progress in operational efficiency and cost optimization, including $140 million in savings to date and a trajectory to exceed the $150 million target two years ahead of plan, is allowing Western Union to redeploy savings to the bottom line at a faster pace. This is likely to provide an uplift to operating margins and profitability, enhancing the company’s earnings power.

- Strategic partnerships, such as those in the Middle East (e.g., with STC and du Pay), and targeted redeployment of best practices from successful markets (like Europe) to underperforming regions (such as North America) create near

- and long-term catalysts for above-average growth. These catalysts are likely to support a stronger recovery in transaction volumes, facilitate further share gains, and drive both top-line and bottom-line improvements in the years to come.

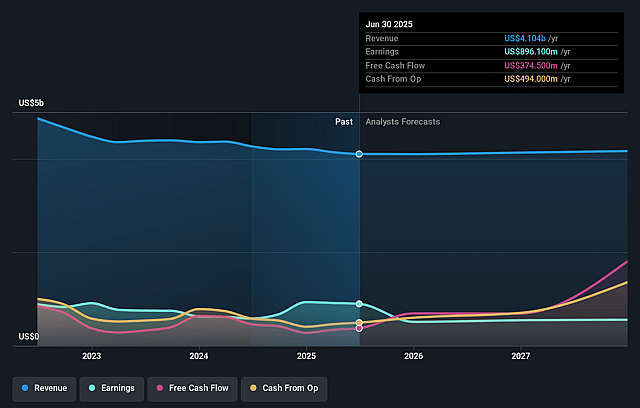

Western Union Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Western Union compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Western Union's revenue will grow by 2.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 22.1% today to 13.6% in 3 years time.

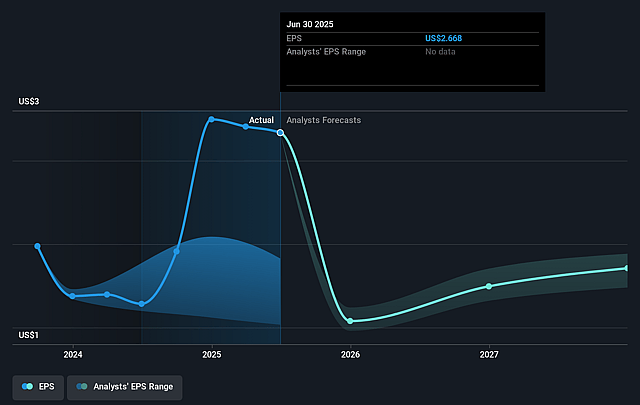

- The bullish analysts expect earnings to reach $598.6 million (and earnings per share of $1.91) by about July 2028, down from $915.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from 3.1x today. This future PE is lower than the current PE for the US Diversified Financial industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 2.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.26%, as per the Simply Wall St company report.

Western Union Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating shift from high-margin, agent-based transfers to lower-margin digital and payout-to-account transactions is compressing Western Union’s net margins and limiting future earnings growth, as their own financials and comments highlight that digital growth is not keeping overall revenue rising in line with transactions.

- Ongoing erosion of demand for traditional, retail cash-based remittance services—particularly in North America and Latin America where transaction volumes are declining—reflects both secular consumer adoption of digital payments and intensifying competition from fintechs and neobanks, driving down Western Union’s core revenues and market share.

- Persistent high cost structure from Western Union’s extensive retail network and legacy agent commissions constrains their ability to compete on pricing with digital-first providers, thereby putting sustained pressure on operating profit margins and limiting their ability to invest in innovation.

- Industry-wide fee compression due to price wars with digital native rivals and the growing threat from blockchain

- or crypto-based remittance solutions both squeeze Western Union’s transaction fees, thus threatening long-term revenue stability and margin sustainability.

- Heightened regulatory scrutiny and compliance demands—including anti-money laundering (AML) and know-your-customer (KYC) requirements—increase the company's cost base and expose it to potential fines, which further pressures profitability and weighs on future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Western Union is $16.48, which represents two standard deviations above the consensus price target of $10.87. This valuation is based on what can be assumed as the expectations of Western Union's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.4 billion, earnings will come to $598.6 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 9.3%.

- Given the current share price of $8.6, the bullish analyst price target of $16.48 is 47.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.