Key Takeaways

- Slow digital adoption and outdated pricing expose the company to faster, lower-cost fintech rivals, fueling customer loss and stagnant earnings.

- Shifting to digital wallets and rising compliance costs threaten the legacy retail model, squeezing margins and making revenue more unpredictable.

- Strong digital growth, diversification, technology adoption, and global remittance trends position the company for resilient revenue, margin expansion, and long-term earnings growth.

Catalysts

About Western Union- Provides money movement and payment services worldwide.

- The accelerating adoption of low-cost, app-based money transfer solutions is siphoning away customers from legacy platforms like Western Union, causing a sustained erosion of customer base and top-line pressure as new digital-first entrants outpace the company's ability to defend its traditional market share, leading to lower revenue growth and ongoing transaction declines.

- The inexorable decline in cash usage, coupled with increased financial inclusion and the proliferation of digital wallets, banking apps, and cryptocurrencies, rapidly undermines Western Union's core retail business. This directly threatens both transaction volume and high-margin agent-based fee income, dragging on overall revenue and compressing net margins as retail outlets become less relevant.

- The company's slow rate of digital transformation and persistent reliance on high-fee, outdated pricing structures leaves it vulnerable to aggressive fintech competitors offering faster, more convenient, and cheaper transfers. This dynamic is expected to drive accelerating customer attrition in digital channels, causing both revenues and net earnings to stagnate or decline.

- Intensifying regulatory scrutiny over anti-money laundering and know-your-customer practices, along with new legislation such as US remittance taxes, is set to meaningfully increase compliance and operational costs. For Western Union, these higher costs will weigh on operating margins at the same time as transaction growth faces heightened uncertainty.

- Ongoing entry of global technology giants and bank-led initiatives into cross-border payments is intensifying competitive pressure, eroding Western Union's pricing power and further limiting its ability to innovate at scale. As customer loyalty weakens and transaction volumes become more volatile, the company's revenues and profitability will remain highly unpredictable and at risk of further long-term decline.

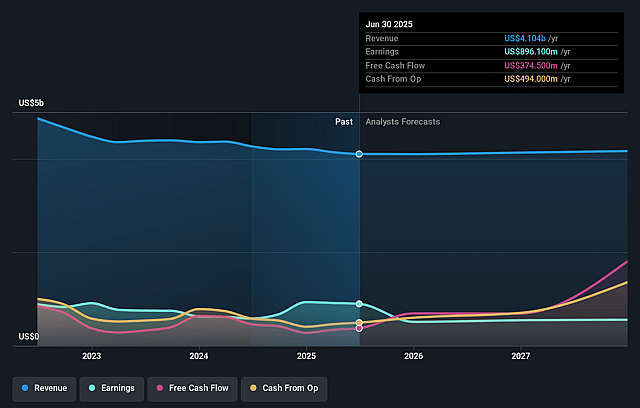

Western Union Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Western Union compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Western Union's revenue will decrease by 1.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 21.8% today to 11.9% in 3 years time.

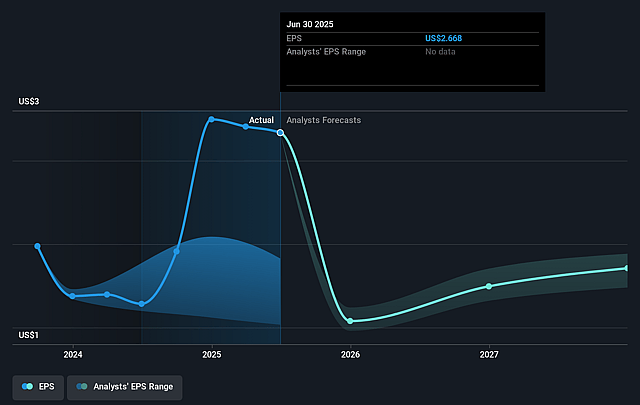

- The bearish analysts expect earnings to reach $471.1 million (and earnings per share of $1.65) by about August 2028, down from $896.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.6x on those 2028 earnings, up from 2.9x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 4.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.9%, as per the Simply Wall St company report.

Western Union Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is achieving strong growth and margin expansion in its branded digital business and consumer services, supported by continued digital transformation, which could sustain revenue and earnings even as traditional retail channels fluctuate.

- Recent strategic acquisitions (such as Eurochange) and the fast-growing Travel Money and consumer services segments are diversifying the revenue base beyond core remittances, which may support long-term top-line and margin growth.

- Investment and early success in artificial intelligence for operational efficiencies, cost reduction, and enhanced customer service are driving meaningful cost savings and improved profitability, which could strengthen net margins over time.

- Global migration and remittance flows remain a powerful, secular tailwind for Western Union, and the company's large international network positions it to benefit from ongoing demand for cross-border payments, which could provide resilience to revenue.

- Adoption of stablecoin and blockchain technologies, together with the company's focus on modernizing payments infrastructure, is likely to yield both cost savings and potential for new revenue streams in digital assets, boosting long-term earnings potential and operating efficiency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Western Union is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Western Union's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.0 billion, earnings will come to $471.1 million, and it would be trading on a PE ratio of 5.6x, assuming you use a discount rate of 9.9%.

- Given the current share price of $8.04, the bearish analyst price target of $7.0 is 14.9% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.