Key Takeaways

- Easing monetary policy could reduce MFA Financial's borrowing costs and improve net margins through lower interest expenses.

- Strategic restructuring and diversification strategies, including new securitization deals and sales, are poised to enhance revenue and operational efficiency.

- Mixed economic signals and management changes pose challenges for MFA Financial, with credit quality issues and elevated expenses potentially impacting margins and equity.

Catalysts

About MFA Financial- Operates as a real estate investment trust in the United States.

- The Federal Reserve's recent 50 basis point rate cut signals the start of an easing cycle, potentially lowering borrowing costs for MFA Financial and improving net margins through reduced interest expenses.

- Management changes and internal promotions highlight a strong executive team ready to focus on strategic growth, which could enhance operational efficiencies and boost future earnings.

- New rated securitization deals, particularly for residential transition loans, are expected to lower funding costs and improve net margins due to enhanced access to capital at better rates.

- Lima One's ongoing restructuring and focus on talent acquisition, along with its strategic shift away from multifamily originations, are set to improve origination volume and revenue by 2025.

- The programmatic sale of single-family rental loans to third parties provides a new revenue stream and diversification strategy, augmenting both revenue and net margins by broadening income sources beyond just securitization.

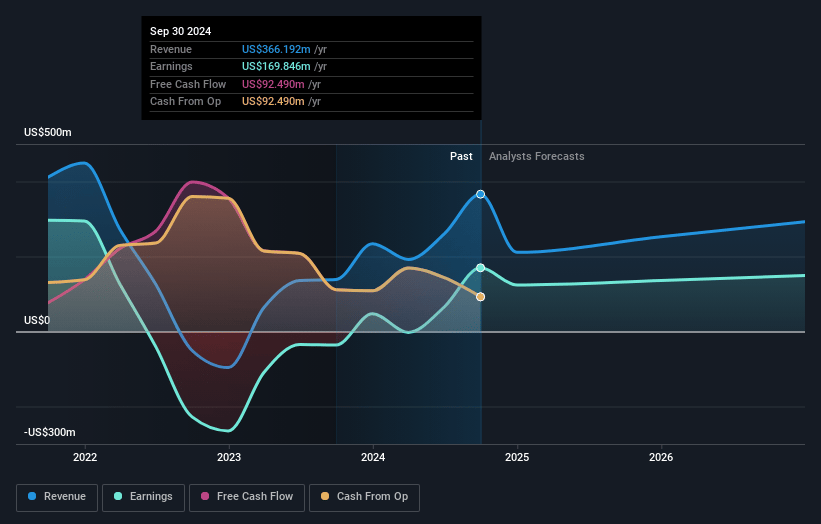

MFA Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MFA Financial's revenue will decrease by -10.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 46.4% today to 54.3% in 3 years time.

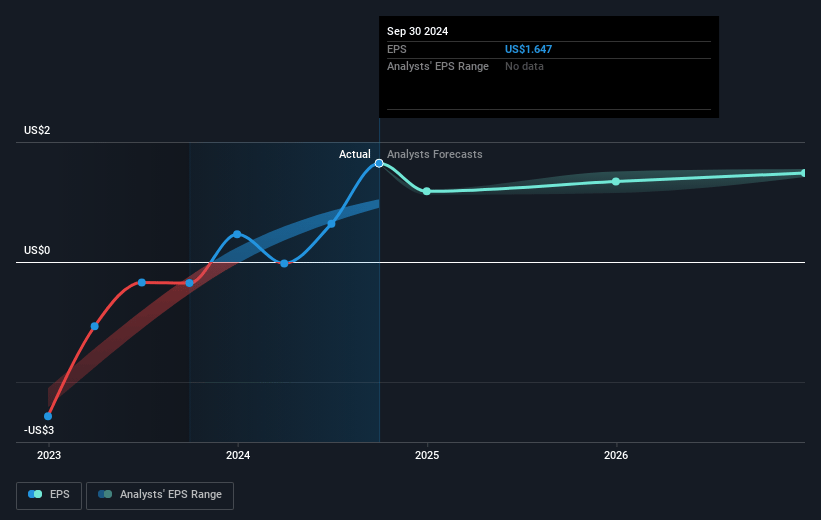

- Analysts expect earnings to reach $141.2 million (and earnings per share of $1.38) by about January 2028, down from $169.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 6.2x today. This future PE is greater than the current PE for the US Mortgage REITs industry at 11.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

MFA Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic and labor market data has been mixed, leading to uncertainty about the pace of the Federal Reserve's easing cycle, potentially impacting revenue through fluctuating interest environments.

- Management changes and refocusing efforts at Lima One have temporarily impacted origination volumes, which could affect revenue and earnings if not addressed swiftly.

- MFA’s increased credit-related unrealized losses on multifamily transitional loans highlight a risk of credit quality issues, potentially impacting net margins and earnings.

- Approximately $3.3 million in nonrecurring separation, severance, and retirement-related charges have elevated general and administrative expenses, possibly affecting net margins and earnings per share.

- A decrease in economic book value by 3% to 4% post-quarter due to higher market interest rates signals potential risks to capital value and return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.78 for MFA Financial based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $260.1 million, earnings will come to $141.2 million, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 10.9%.

- Given the current share price of $10.27, the analyst's price target of $14.78 is 30.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives