Narratives are currently in beta

- Fiserv's merger with First Data strengthens its position in the payments and financial IT software markets, likely boosting revenue growth and net margins.

- Strategic investments in technology and value-added services aim to expand markets and customer bases, enhancing earnings through service margins.

- Reliance on Argentina's economy and the shift to ASP models, along with small business health and regulatory challenges, may impact Fiserv's revenue and margins.

What are the underlying business or industry changes driving this perspective?

- Fiserv's strategy to merge First Data and Fiserv has created a diversified company with a leading position in both the high-growth payments market and the recurring revenue financial IT software and services market, which is expected to drive revenue growth and improve net margins.

- The company's focus on cross-selling and integrating merchant and financial solutions will likely enhance its ability to serve financial institutions and merchants, positively impacting revenue growth.

- Fiserv's significant investment in technology, including the launch of Clover in Brazil and expansions in other international markets, is poised to accelerate revenue growth further as new markets are tapped.

- The implementation of value-added services such as CashFlow Central and the expansion of the Payments segment with new e-commerce merchant additions can lead to increased earnings through higher service margins and expanded customer bases.

- Continued focus on operational excellence and productivity improvements across the company is expected to contribute to operating margin expansion, positively affecting net margins and earnings.

How have these above catalysts been quantified?

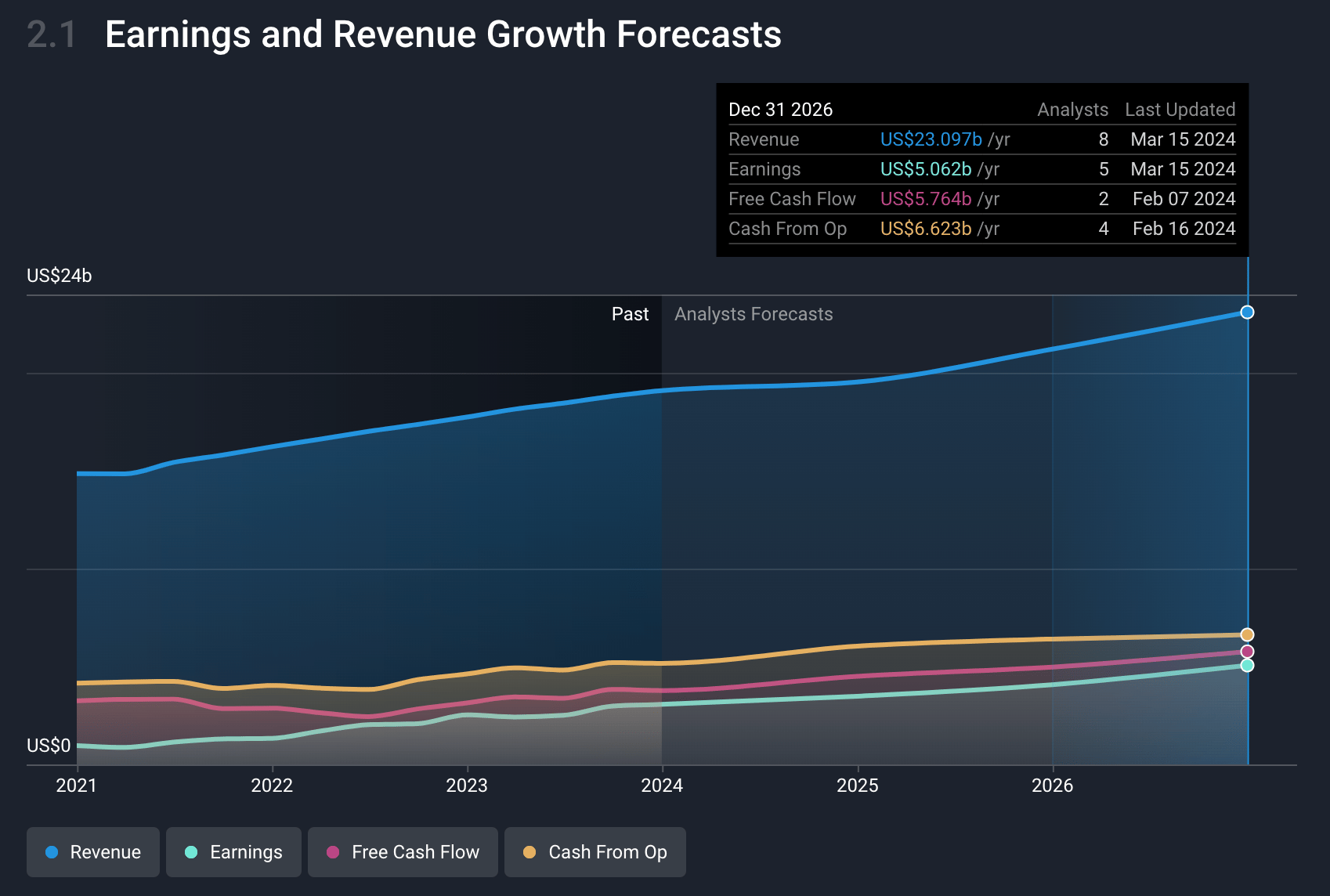

- Analysts are assuming Fiserv's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.1% today to 21.9% in 3 years time.

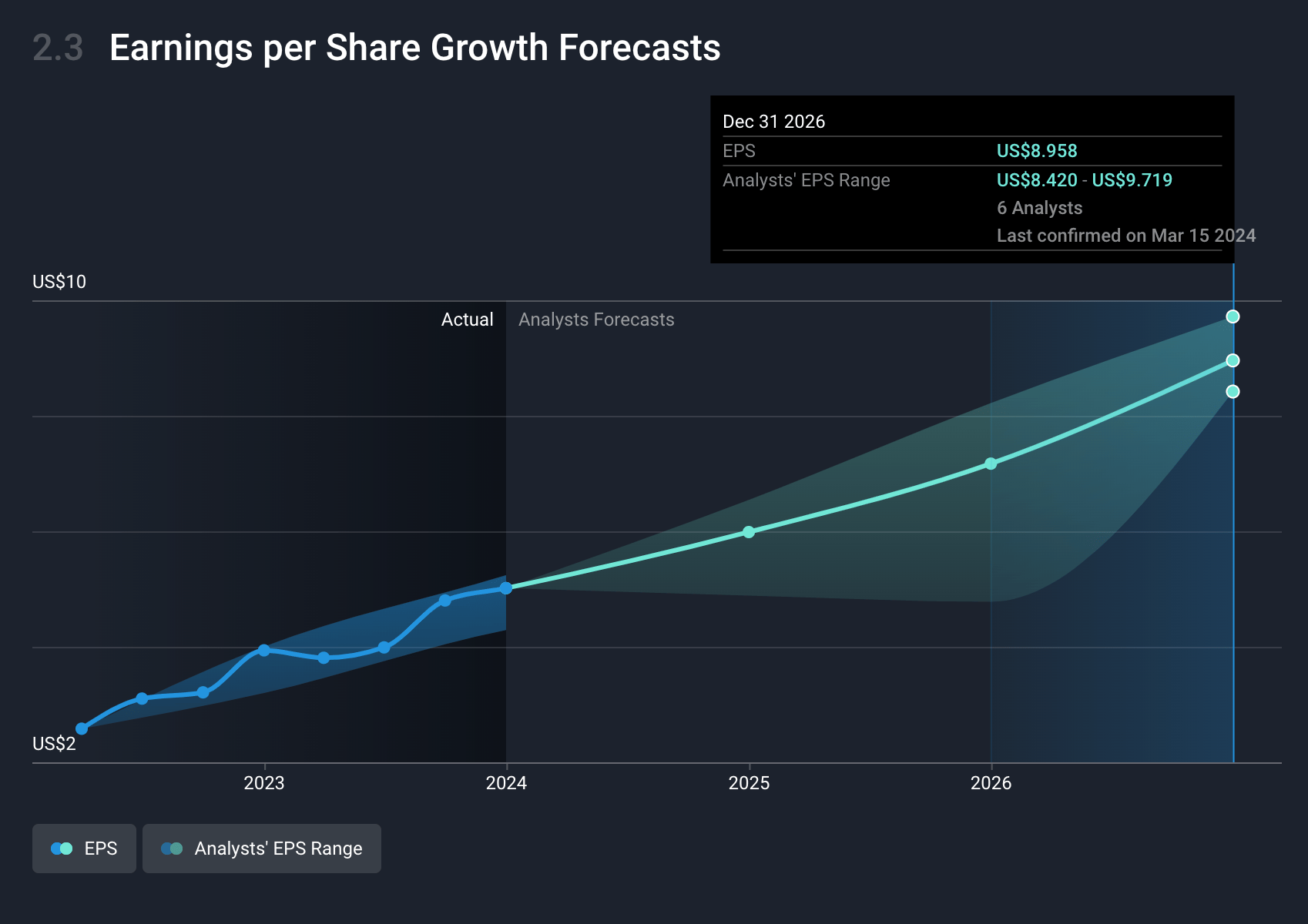

- Analysts expect earnings to reach $5.1 billion (and earnings per share of $8.96) by about March 2027, up from $3.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.4x on those 2027 earnings, down from 29.3x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

What could happen that would invalidate this narrative?

- The significant reliance on Argentina's high inflation and interest rates for part of its revenue growth might prove unsustainable, potentially affecting future revenue growth.

- Fiserv's merchant segment could experience lower growth rates in the latter half of the year if Argentina's inflation and interest rates improve, impacting revenue projections.

- The transition from licensing to ASP (Application Service Provider) models in the Fintech segment could spread revenue out across multiple years instead of recognizing it up front, possibly affecting short-term revenue recognition.

- Dependence on the health of small businesses, as indicated by the Fiserv Small Business Index, could pose a risk if economic conditions worsen, potentially impacting transaction volumes and revenue.

- The operational and regulatory challenges associated with the bank charter application in Georgia could divert resources or lead to unforeseen complications, potentially impacting net margins.

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $158.48 for Fiserv based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $23.1 billion, earnings will come to $5.1 billion, and it would be trading on a PE ratio of 20.4x, assuming you use a discount rate of 7.4%.

- Given the current share price of $152.15, the analyst's price target of $158.48 is 4.0% higher. The relatively low difference between the current share price and the analyst target indicates that they believe the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 34 Analysts

Partnerships With DoorDash And Walmart Will Expand Payment Services Internationally

Key Takeaways Partnerships and embedded finance solutions are set to boost growth by expanding financial services and increasing client base in the gig economy. International expansion and innovations in payment networks are crucial for driving revenue growth and improving transaction volume.

View narrativeUS$226.56

FV

10.0% undervalued intrinsic discount5.61%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

4users have followed this narrative

Updated narrative