Key Takeaways

- Partnerships and embedded finance solutions are set to boost growth by expanding financial services and increasing client base in the gig economy.

- International expansion and innovations in payment networks are crucial for driving revenue growth and improving transaction volume.

- Fiserv faces challenges in sustaining revenue growth due to reliance on transitory benefits in Argentina and competitive pressures in the payment solutions market.

Catalysts

About Fiserv- Provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally.

- Fiserv’s partnerships and the implementation of embedded finance solutions for large platform businesses like DoorDash and Walmart are expected to drive revenue growth by introducing new financial services offerings and expanding the merchant and gig economy client base.

- The expansion of the Clover platform, especially into international markets such as Brazil, Mexico, and Australia, is positioned to increase Fiserv's revenue through higher adoption rates of their point-of-sale systems and value-added services.

- The development and integration of CashFlow Central and XD, along with real-time payments solutions, are anticipated to enhance Fiserv’s average revenue per user for their digital banking clients, thereby boosting overall financial solutions revenues.

- Fiserv’s ongoing innovation in real-time payment networks (such as the NOW Network) and the establishment of the SMB bundle are key drivers expected to improve margins and drive long-term revenue growth through increased transaction volume and enhanced service penetration.

- Strategic initiatives such as buybacks and maintaining strong free cash flow positions allow Fiserv to effectively manage its capital, support ongoing investments, and boost adjusted earnings per share through share repurchases, likely impacting earnings growth positively.

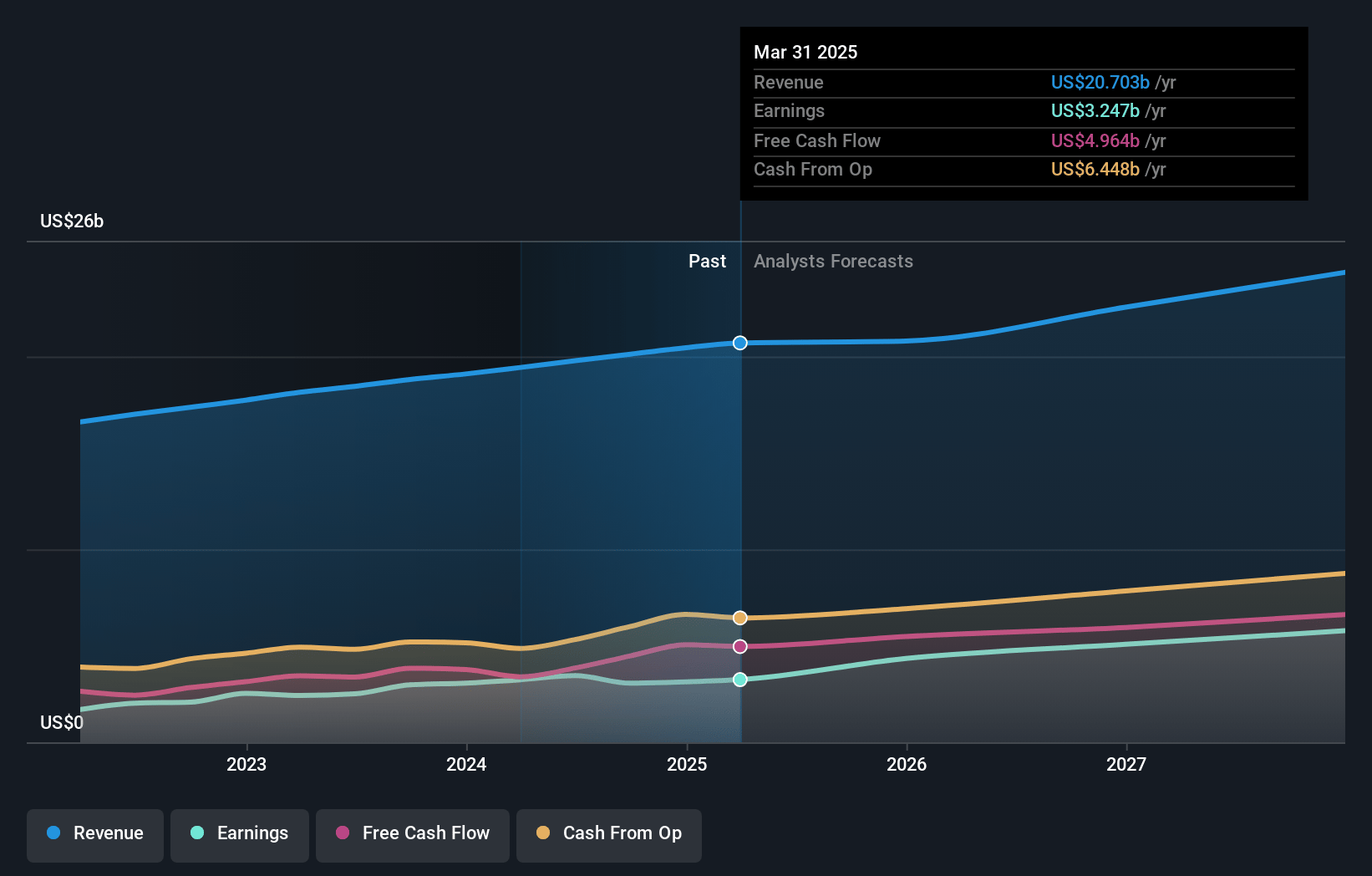

Fiserv Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fiserv's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.2% today to 23.2% in 3 years time.

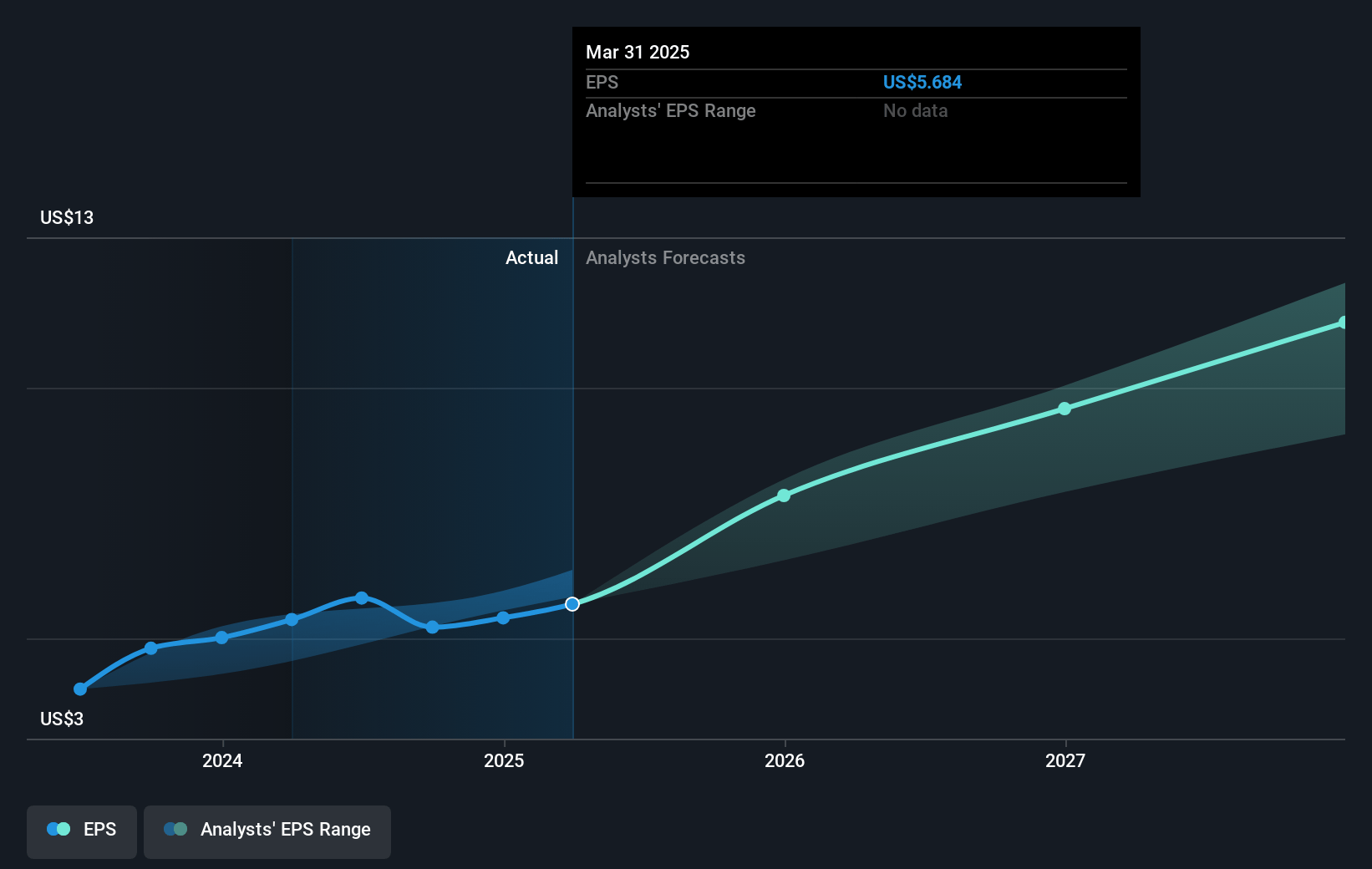

- Analysts expect earnings to reach $5.5 billion (and earnings per share of $10.72) by about January 2028, up from $3.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $4.8 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.8x on those 2028 earnings, down from 39.3x today. This future PE is greater than the current PE for the US Diversified Financial industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 3.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Fiserv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The anticipation revenue in Argentina, which has historically boosted Merchant segment revenues, is facing declining growth due to easing interest rates. This could impact future adjusted revenue growth, as seen with a 15-point currency headwind largely from the Argentine peso.

- Fiserv's reliance on transitory benefits from above-average inflation in Argentina and the Dólar turista program poses a risk. As these influences diminish, the company may face challenges in sustaining revenue growth, particularly in its Merchant segment.

- The transition of Wells Fargo Merchant Services JV to Wells Fargo ownership in 2025 might disrupt Fiserv's revenue streams. While Fiserv will continue to provide processing services, the shift in business structure could affect its long-term adjusted revenue growth outlook.

- Intense competition in the payment solutions market may pressure Fiserv's revenue and margins. The need to continuously innovate and expand internationally with products like Clover, especially in new markets like Brazil, poses execution risks that could impact earnings if not effectively managed.

- The consumer spending environment is noted as stable but with slowing growth. Given Fiserv’s exposure to consumer transactions through Clover, a downturn in consumer spending could negatively affect revenue and payment volumes, particularly in the SMB segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $233.88 for Fiserv based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $278.0, and the most bearish reporting a price target of just $168.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $23.8 billion, earnings will come to $5.5 billion, and it would be trading on a PE ratio of 26.8x, assuming you use a discount rate of 7.1%.

- Given the current share price of $211.72, the analyst's price target of $233.88 is 9.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives