Last Update 01 May 25

Fair value Decreased 2.22%Key Takeaways

- Optimism about sustained revenue and earnings growth may be misplaced due to uncertain deal flow, credit risks, and competition affecting margins.

- Elevated leverage and reliance on favorable macro trends heighten vulnerability to rising costs, deteriorating credit, and shifts in investor demand.

- Strong portfolio and disciplined risk management, supported by Barings' backing and market expertise, position the company for resilient earnings and stable dividends despite macro uncertainty.

Catalysts

About Barings BDC- A publicly traded, externally managed investment company that has elected to be treated as a business development company under the Investment Company Act of 1940.

- Investors may be overestimating the positive impact of the increased deal pipeline and M&A activity in the middle-market lending space, possibly assuming that elevated origination volumes will persist and drive outsized revenue growth, when management itself notes these indicators can be "false positives" and that deal flow remains uncertain-raising the risk that future revenue falls short of elevated expectations.

- Market participants could be overly optimistic about the durability of current credit quality and low nonaccrual rates, expecting continued benign credit environments and thus sustained high net margins and earnings, despite management cautioning on persistent macroeconomic uncertainties and the likelihood that credit performance is idiosyncratic and could deteriorate if economic conditions worsen.

- Higher leverage ratios at or above the top end of the company's target range may be seen as a way to maximize returns, with investors anticipating continued benefits to earnings; however, this increases exposure to any rise in funding costs or credit losses should interest rates remain elevated or defaults increase, potentially compressing net margins.

- There may be an assumption that Barings BDC will continue to fully capture the long-term opportunity created by banks' retreat from middle-market lending and the expansion of the private credit market, driving future portfolio and revenue growth, even though rising competition from private debt funds and other non-bank lenders may pressure yields and limit upside.

- Ongoing investor demand for alternative yield products may be supporting the valuation, under the belief that low-to-moderate interest rate environments will persist and keep BDC portfolios attractive, but if rates stay higher for longer or capital flows shift, this could erode earnings, NAV, and dividend coverage expectations tied to this secular trend.

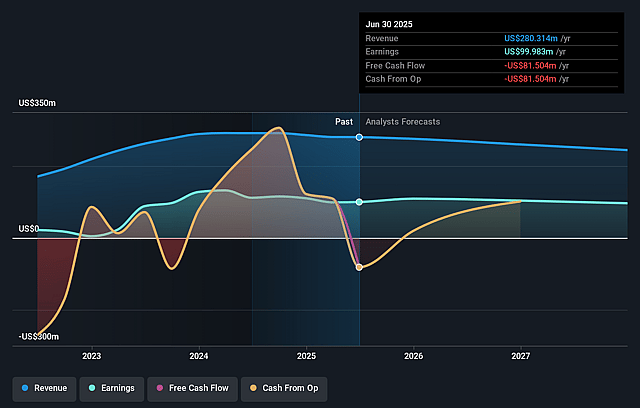

Barings BDC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Barings BDC's revenue will decrease by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 35.7% today to 41.1% in 3 years time.

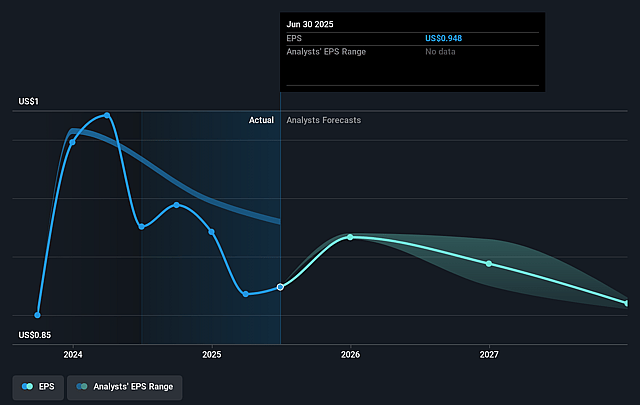

- Analysts expect earnings to reach $99.0 million (and earnings per share of $0.92) by about September 2028, down from $100.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from 9.9x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.59%, as per the Simply Wall St company report.

Barings BDC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued growth and robust pipeline in the private credit and U.S. middle market space, as highlighted by management's optimism about forward origination activity and increased M&A, could support higher revenue generation and earnings resilience over the long term.

- BBDC's strong credit performance, with industry-leading low nonaccrual rates and improving risk ratings, points to lower-than-average credit losses and greater stability in net margins and book value through potentially turbulent macro environments.

- Ongoing portfolio diversification, both in terms of sector allocation (defensive, non-cyclical sectors) and investment type (senior secured and first lien), reduces credit concentration risk and supports sustainable net investment income and stable dividend payouts.

- Backing by Barings LLC and access to a large, global origination network-combined with proven expertise in sourcing complexity premiums and durable, through-the-cycle portfolio construction-could enhance deal selection quality and boost long-term earnings power and NAV.

- Active capital management practices, including the ability to maintain leverage within a targeted range, strategic share repurchases at discounts to NAV, and a diversified, well-laddered funding structure, provide flexibility to optimize returns on equity and maintain earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.15 for Barings BDC based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $240.7 million, earnings will come to $99.0 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 9.6%.

- Given the current share price of $9.39, the analyst price target of $10.15 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Barings BDC?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.