Narratives are currently in beta

Key Takeaways

- Expanding international business and focusing on Millennials and Gen Z aim to drive long-term revenue growth and enhance earnings.

- Heavy investment in product innovation, acquisitions, and global sponsorships seeks to boost customer experience, engagement, and net margins.

- Macroeconomic factors and competitive pressures could challenge American Express's revenue growth and market share due to currency movements, interest rates, rivals, and customer acquisition risks.

Catalysts

About American Express- Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

- American Express plans to continue expanding its international business, where it is currently underpenetrated, especially in the consumer and SME segments. This is likely to drive long-term revenue growth.

- The company is focusing on adding premium customers—particularly Millennials and Gen Z—whose spending needs and small business ventures are expected to grow. This should positively impact both revenue and earnings.

- American Express is investing heavily in product innovation and refreshes across its portfolio, which is expected to drive revenue growth by attracting more fee-paying card members and stimulating card usage.

- The acquisition of Tock and Rooam as well as new sponsorships like the global partnership with Formula 1 are strategically set to enhance the customer experience, potentially boosting both consumer engagement and net margins.

- The ongoing global expansion of the merchant network aims to increase transaction volume and bolster top-line growth, potentially leading to higher revenue over time.

American Express Future Earnings and Revenue Growth

Assumptions

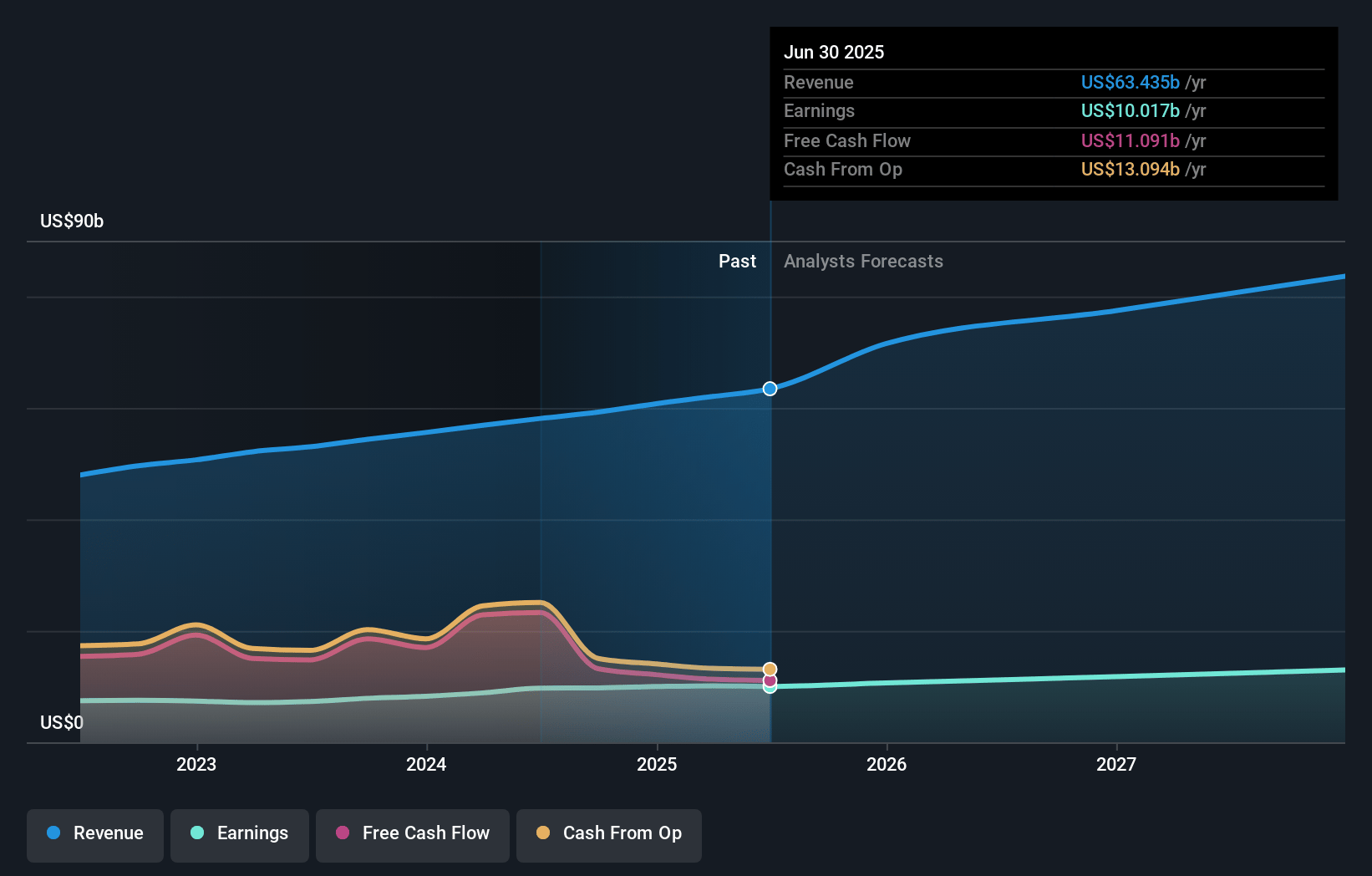

How have these above catalysts been quantified?- Analysts are assuming American Express's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.4% today to 15.9% in 3 years time.

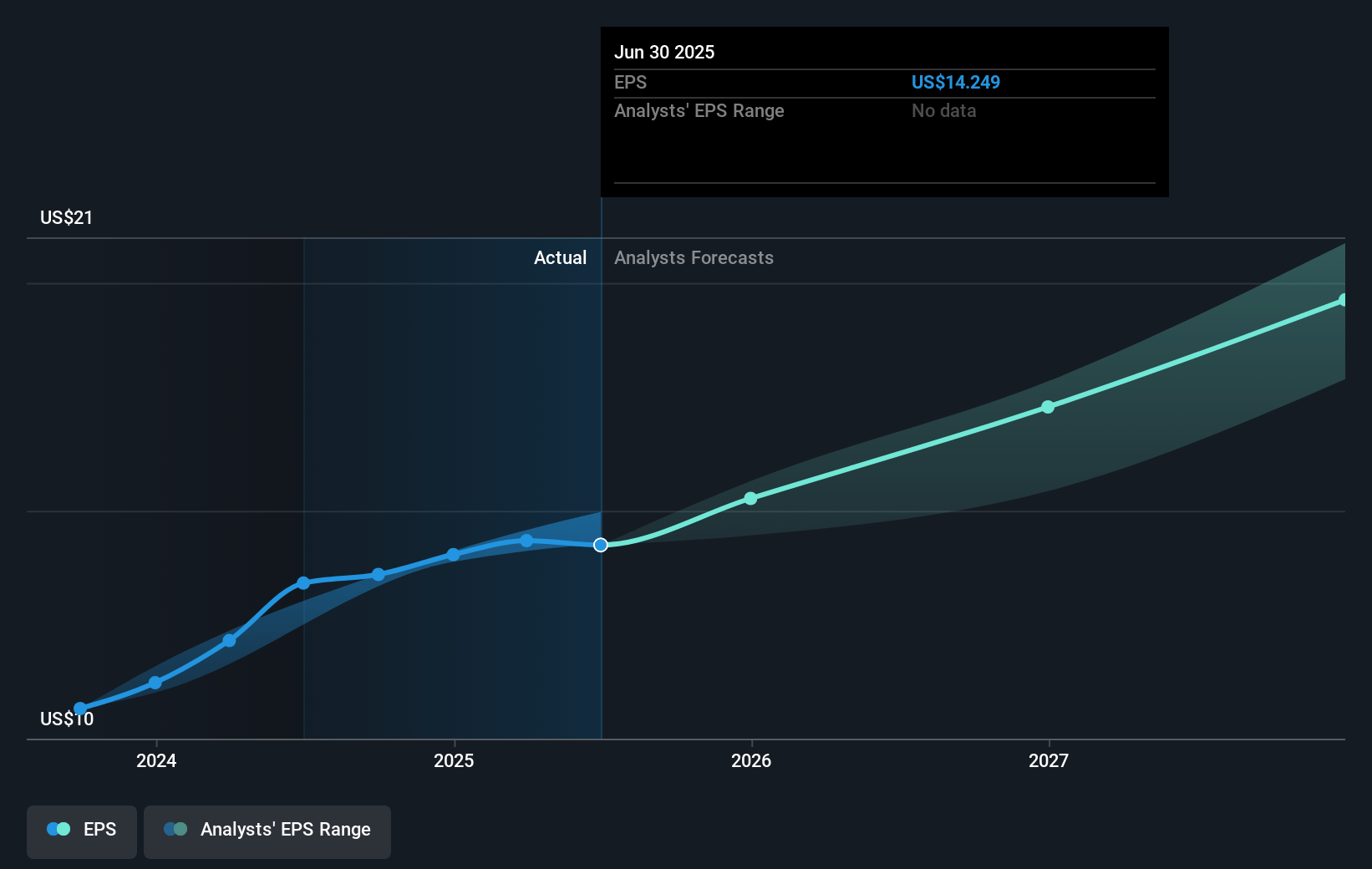

- Analysts expect earnings to reach $13.2 billion (and earnings per share of $20.17) by about January 2028, up from $10.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.1x on those 2028 earnings, down from 22.3x today. This future PE is greater than the current PE for the US Consumer Finance industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 2.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

American Express Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing strength of the U.S. dollar could be a headwind to revenue growth, impacting American Express's international revenues when converted back into dollars.

- The competitive landscape in SME (small and medium-sized enterprise) markets, with strong growth from newer companies like Ramp and Brex, may pressure American Express's growth and market share, possibly affecting future revenue and net margins.

- Potential challenges in maintaining the rate of new card acquisitions and organic spend could impact billing growth, which is a significant driver of American Express's revenues.

- Macroeconomic uncertainties, including interest rates and currency movements, as well as potential changes in tax policy, could pose risks to the revenue and earnings trajectory for American Express.

- There is a risk of modest upward pressure on write-off and reserve rates over time as American Express continues to acquire new customers and increase lending, which could impact net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $310.98 for American Express based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $371.0, and the most bearish reporting a price target of just $230.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $83.1 billion, earnings will come to $13.2 billion, and it would be trading on a PE ratio of 19.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $317.04, the analyst's price target of $310.98 is 1.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

AXP: Key Acquisitions and Enhanced Membership Models Sustains an Incredible Moat

Catalysts New Products or Services Impacting Sales or Earnings American Express has been actively enhancing its product offerings and making strategic acquisitions to drive sales and earnings growth. Here are some key points from recent earnings calls and reports: Product Innovations and Refreshes : American Express is on track to refresh approximately 40 products globally by the end of the year, including a refreshed US consumer gold card [source].

View narrativeUS$308.19

FV

3.5% overvalued intrinsic discount10.81%

Revenue growth p.a.

6users have liked this narrative

0users have commented on this narrative

6users have followed this narrative

5 months ago author updated this narrative