Key Takeaways

- Accelerating growth in high-fee alternative assets and rapid share repurchases could drive much faster earnings and margin expansion than currently expected.

- Unique positioning in global asset growth and scalable boutique partnerships enables potential outperformance versus peers amid industry consolidation and rising international wealth.

- Exposure to passive investing trends, fee compression, talent reliance, and concentration in alternatives pose significant long-term risks to growth, margin stability, and competitive positioning.

Catalysts

About Affiliated Managers Group- Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

- Analyst consensus expects growing alternative AUM to gradually drive revenue and stabilize earnings, but AMG's recent record $55 billion surge in alternative AUM-representing 20% growth in just 6 months-and the increasing dominance of high-fee, long-duration strategies indicate that both revenue and EBITDA could accelerate far faster than currently modeled, especially given alternatives now contribute more than half of EBITDA and could approach two-thirds by 2027.

- While analysts widely agree share repurchases enhance EPS, AMG is reducing its share count at an unusually rapid pace-repurchasing nearly $1 billion in the past 18 months and guiding for another $400 million in 2025-which, combined with strong cash flow and a robust balance sheet, could drive a structural step-change in per share earnings and ROE much sooner than consensus anticipates.

- AMG is uniquely positioned to capitalize on the global explosion in investable assets, particularly in underpenetrated emerging markets and through the cross-border scaling of its boutique affiliates, setting the stage for accelerating organic AUM growth and management fee income as wealth grows internationally.

- The company's strategic push into asset classes with higher performance fee potential, such as private credit, secondaries, and tax-aware liquid alternatives, creates an underappreciated avenue for substantial margin expansion and earnings upside-especially as these strategies see compounding investor demand from institutions and high-net-worth clients seeking innovative, customized solutions.

- The multi-boutique model's scalability, AMG's demonstrated ability to rapidly redeploy capital from monetized investments (e.g., Peppertree), and a record pipeline of high-performing affiliate partnerships indicate that both aggregate revenue and net margin growth could outpace the entire asset management sector, as AMG consolidates market share amidst accelerating industry outsourcing and regulatory-induced consolidation.

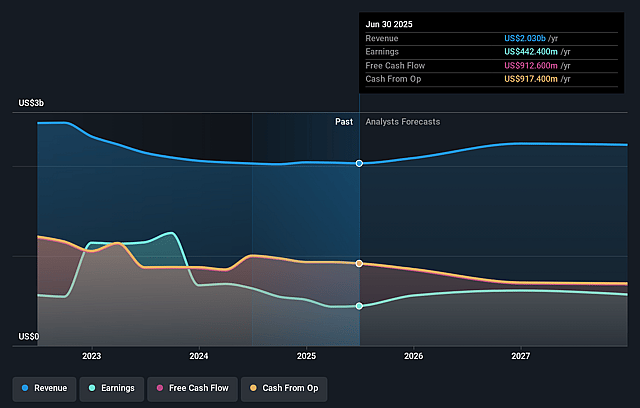

Affiliated Managers Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Affiliated Managers Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Affiliated Managers Group's revenue will grow by 6.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 21.8% today to 24.6% in 3 years time.

- The bullish analysts expect earnings to reach $594.0 million (and earnings per share of $24.47) by about September 2028, up from $442.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, up from 14.9x today. This future PE is lower than the current PE for the US Capital Markets industry at 26.7x.

- Analysts expect the number of shares outstanding to decline by 6.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.16%, as per the Simply Wall St company report.

Affiliated Managers Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently large outflows from traditional active equity strategies, as explicitly acknowledged in the call, highlight AMG's exposure to the continued rise of passive investing, which could constrain long-term AUM growth and reduce future fee revenue.

- Ongoing industry-wide fee compression, driven by investor scrutiny and regulatory pressures, threatens AMG's management fee rates across both new and existing products, putting downward pressure on revenue and net margins over time.

- AMG's reliance on its affiliates' investment talent and leadership introduces long-term risks, as succession challenges or key-person departures at boutique firms could destabilize performance and cause considerable variability in future earnings and revenue streams.

- The company's increasing focus on alternatives and concentration within specific asset classes like private markets and liquid alternatives raises risks related to limited diversification, meaning underperformance or outflows in these sectors could negatively impact top-line growth and margin expansion for AMG.

- Larger competitors' scale advantages in technology, distribution, and compliance may allow them to outcompete AMG's boutique affiliates, especially as regulatory complexities and technology-driven disintermediation in asset management increase compliance costs and could compress AMG's net margins and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Affiliated Managers Group is $331.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Affiliated Managers Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $331.0, and the most bearish reporting a price target of just $195.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $594.0 million, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 9.2%.

- Given the current share price of $231.96, the bullish analyst price target of $331.0 is 29.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.