Key Takeaways

- Unique technology-driven strategy and superior capital allocation position NewtekOne for stronger revenue growth and margin expansion compared to traditional banks.

- Expansion into integrated digital banking for small businesses and regulatory tailwinds are set to boost earnings quality and secure a larger market share.

- Rising competition, regulatory pressures, execution risks, concentrated credit exposure, and demographic shifts threaten NewtekOne's long-term profitability and growth prospects.

Catalysts

About NewtekOne- Operates as the bank holding company for Newtek Bank, National Association that provides various business and financial solutions under the Newtek and NewtekOne brands to the small- and medium-sized business market.

- Analyst consensus expects the transition from a BDC to a digital bank holding company to enhance growth, but this likely understates the transformative impact-NewtekOne's unique capital allocation, technology-driven client acquisition, and balance sheet structure position it for substantially faster revenue and net interest income growth compared to legacy banks.

- While analysts broadly agree that NewtekOne's technology will cut customer acquisition costs and boost margins, their view underappreciates the full upside-NewtekOne's proven ability to efficiently onboard 15,000 accounts remotely, integrate payments, lending, and payroll, and automate underwriting could yield industry-leading operating leverage and sustained net margin expansion.

- The accelerating digital transformation among small and mid-sized businesses is creating a rapidly expanding addressable market for NewtekOne; as SMBs increasingly demand integrated digital banking and embedded finance solutions, NewtekOne is positioned to outsized market share gains and recurring fee income, driving durable revenue growth well above peers.

- Continued regulatory tailwinds for small business lending-including potential increases in SBA loan size limits and stricter underwriting requirements that could eliminate under-resourced competitors-will enable NewtekOne, with its deep underwriting expertise and scale, to capture high-quality loan originations and improve both risk-adjusted earnings and net interest margin.

- The wind-down of legacy NSBF losses and redeployment of capital into high-return, proprietary ALP and merchant services platforms will sharply enhance earnings quality and predictability, as operating drag diminishes and faster-growing, diversified revenue streams drive sustained EPS and book value acceleration.

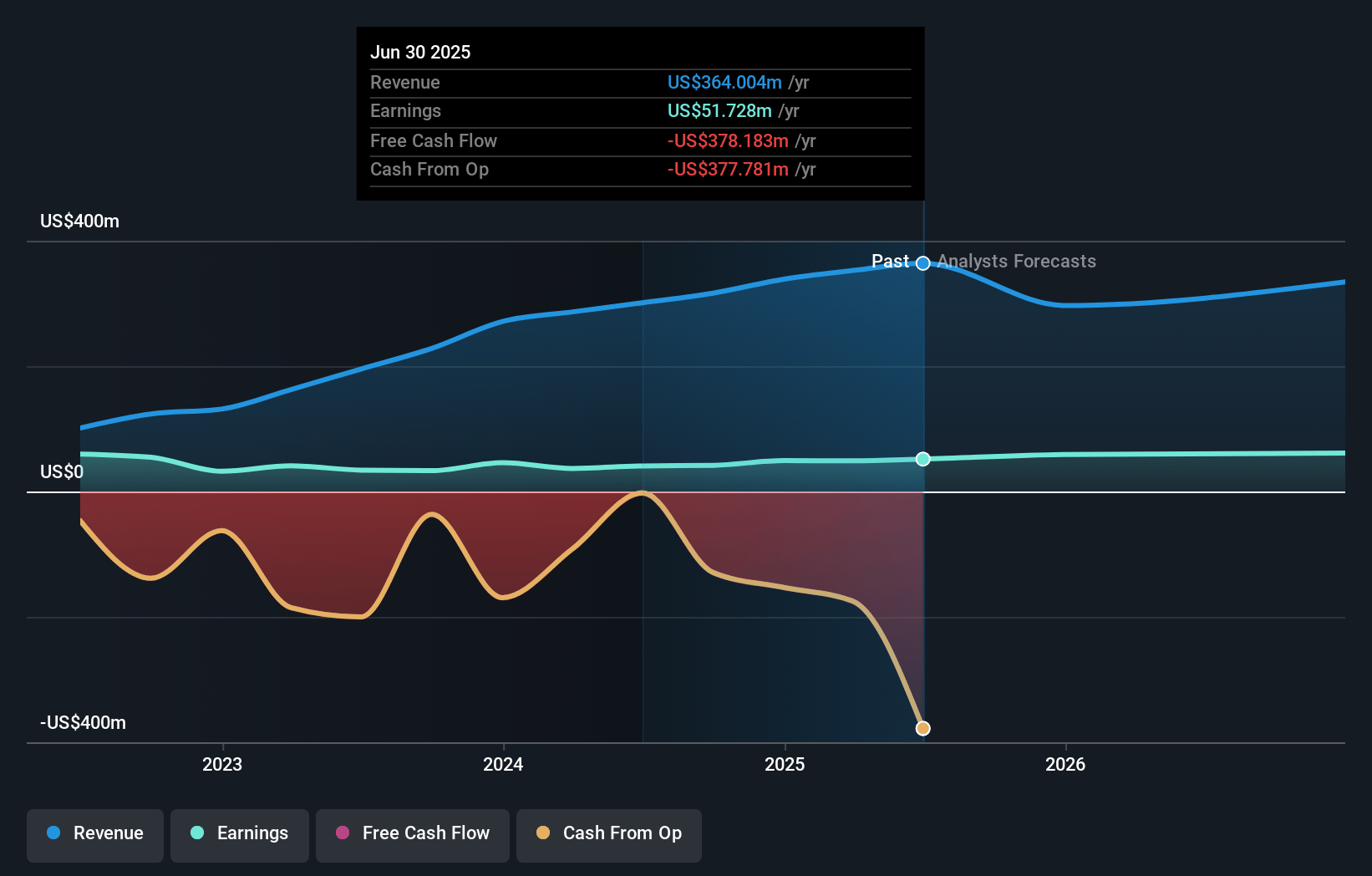

NewtekOne Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on NewtekOne compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming NewtekOne's revenue will decrease by 0.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.9% today to 21.8% in 3 years time.

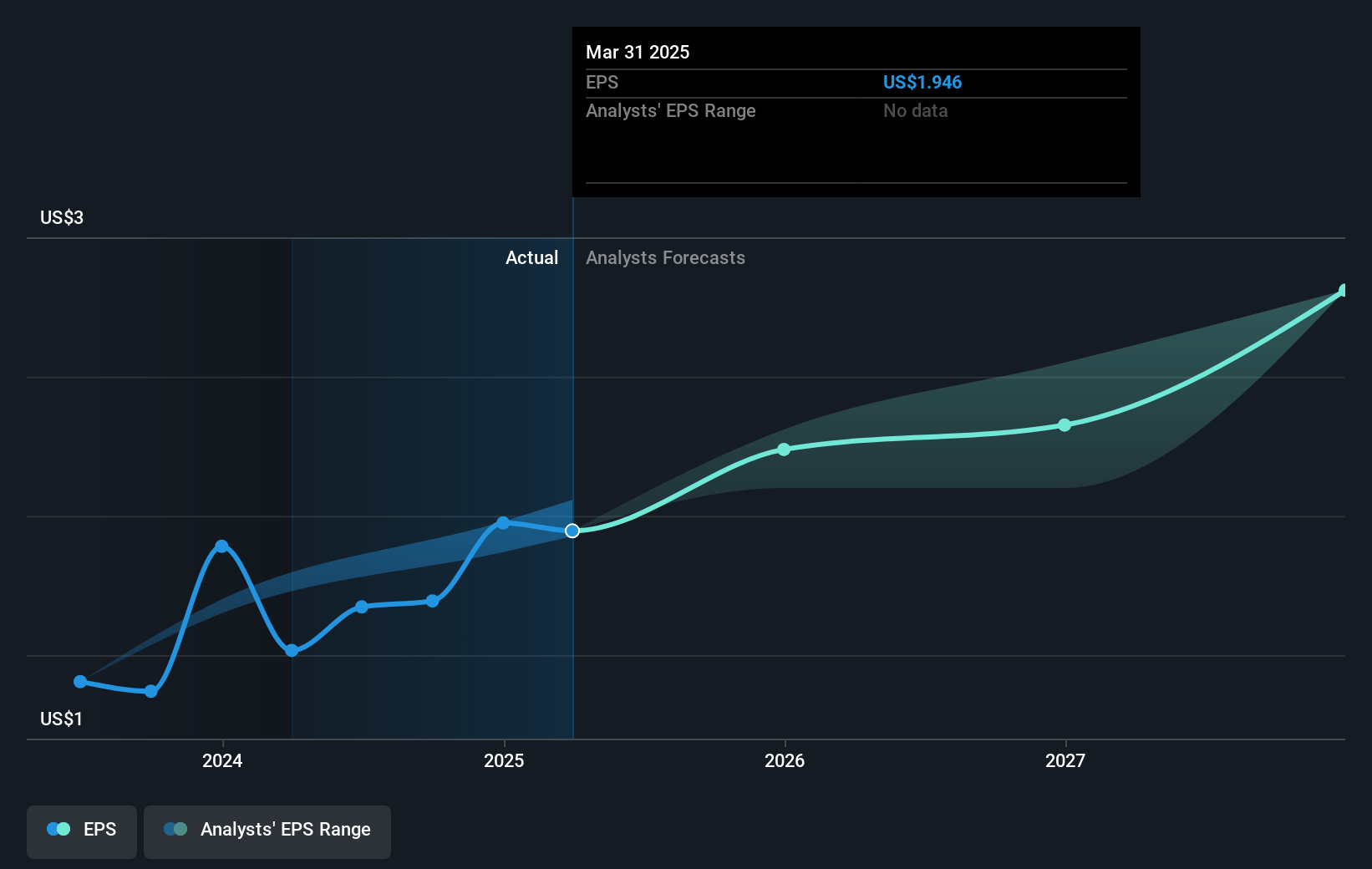

- The bullish analysts expect earnings to reach $74.8 million (and earnings per share of $2.96) by about July 2028, up from $49.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, up from 6.2x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 1.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.36%, as per the Simply Wall St company report.

NewtekOne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing disruption from fintech and alternative digital lending platforms threatens to erode NewtekOne's customer base among small and medium-sized businesses, potentially limiting long-term revenue growth as digital competitors gain share.

- Tightening regulatory scrutiny and higher compliance requirements across the financial sector could result in increased operational expenses for NewtekOne, which may put sustained downward pressure on net margins.

- The company's continued transition from a business development company framework toward a financial holding company introduces ongoing execution risk, with potential for integration challenges and elevated operating costs that could negatively affect long-term earnings.

- Heavy reliance on small business lending, especially in the SBA segment, exposes NewtekOne to material credit risk that may worsen during economic downturns, leading to heightened loan loss provisions and significantly lower net income over time.

- Demographic headwinds, such as the aging of the U.S. small business owner population, may reduce the number of new entrepreneurial businesses requiring NewtekOne's services, undermining future demand and constraining revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for NewtekOne is $18.3, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NewtekOne's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.3, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $342.8 million, earnings will come to $74.8 million, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of $11.59, the bullish analyst price target of $18.3 is 36.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.