Catalysts

About Euronet Worldwide

Euronet Worldwide operates a global financial technology platform that connects banks, retailers, digital wallets and consumers to enable payments, money transfers and digital content distribution.

What are the underlying business or industry changes driving this perspective?

- Accelerating adoption of real time, cross border digital payments, underpinned by the Dandelion network and new partnerships with global banks such as Citigroup and Commonwealth Bank of Australia, is expected to drive high margin fee growth and support sustained double digit earnings expansion.

- Structural growth in digital remittances and omnichannel money transfer, including 32 percent growth in direct to consumer digital transactions and expanding retail distribution such as Heritage Grocers, is set to lift transaction volumes and enhance revenue mix quality over time.

- The global shift toward cloud native, modern payment and credit processing platforms positions Ren and the pending CoreCard acquisition to win large bank and fintech deals, adding higher recurring software and processing revenue and widening operating margins.

- Formalization and institutional adoption of digital assets and stablecoins, supported by regulation such as the GENIUS Act and Euronet’s Fireblocks partnership, enables new use cases across treasury, remittances and ATM cash out that can increase FX and transaction based earnings while improving capital efficiency.

- Long term increase in electronic commerce, gaming and digital content consumption, combined with epay’s predominantly digital transaction base and strong brand partnerships, is expected to support steady top line growth and incremental margin expansion as higher value content and payment processing grow as a share of segment revenue.

Assumptions

This narrative explores a more optimistic perspective on Euronet Worldwide compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

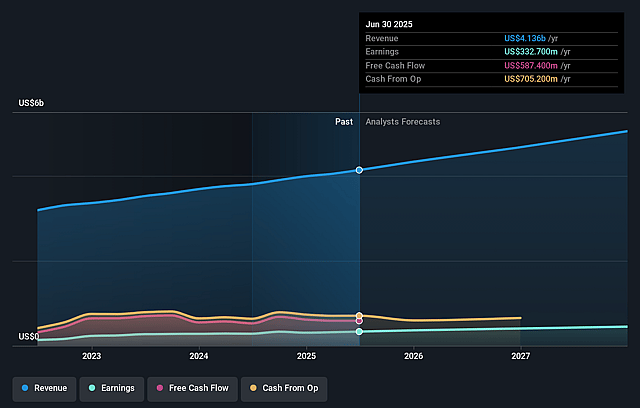

- The bullish analysts are assuming Euronet Worldwide's revenue will grow by 9.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.2% today to 9.4% in 3 years time.

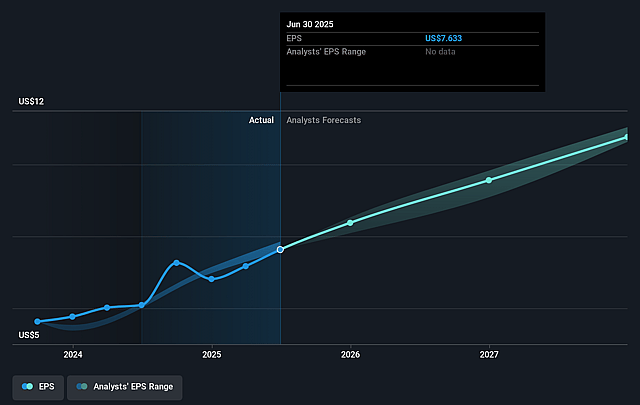

- The bullish analysts expect earnings to reach $512.5 million (and earnings per share of $11.93) by about December 2028, up from $303.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from 10.7x today. This future PE is about the same as the current PE for the US Diversified Financial industry at 13.6x.

- The bullish analysts expect the number of shares outstanding to decline by 3.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.89%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Persistent or worsening global economic weakness and high inflation could further constrain consumer discretionary spending on travel, gaming and digital content. This would pressure transaction volumes in the EFT and epay segments and slow consolidated revenue growth and earnings expansion over time.

- A prolonged tightening of immigration and remittance related policies in key sending and receiving markets such as the United States, Mexico, Europe and parts of Asia could structurally reduce migration flows and remittance frequency. This could limit long term volume growth in the Money Transfer segment and weigh on revenue and net profit.

- If competitive pricing pressure in remittance corridors and certain Middle Eastern markets broadens or intensifies, Euronet may need to discount more aggressively to defend share. This would erode gross profit per transaction and cap the envisioned improvement in consolidated operating margins and earnings.

- Execution or adoption risks around strategic initiatives such as stablecoin use cases, the Fireblocks partnership, the Dandelion network and the CoreCard integration could delay or dilute the expected shift toward higher margin, recurring digital and processing revenues. This could limit margin expansion and earnings growth versus bullish expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Euronet Worldwide is $145.0, which represents up to two standard deviations above the consensus price target of $116.0. This valuation is based on what can be assumed as the expectations of Euronet Worldwide's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $5.4 billion, earnings will come to $512.5 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 8.9%.

- Given the current share price of $77.49, the analyst price target of $145.0 is 46.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Euronet Worldwide?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.