Last Update 04 Dec 25

EEFT: Resilient Consumer Spending Will Support Undervalued Upside Despite Macro Uncertainty

Analysts have modestly trimmed their price targets on Euronet Worldwide, cutting expectations by up to $5 to reflect slightly reduced post Q3 estimates and a more cautious stance amid elevated macroeconomic uncertainty, while still acknowledging resilient consumer spending trends.

Analyst Commentary

Recent commentary around Euronet Worldwide reflects a mixed but generally constructive outlook, with analysts fine tuning their models following the latest quarterly update and sector checks.

Bullish Takeaways

- Bullish analysts highlight that consumer spending trends through September remained resilient, supporting continued transaction growth across Euronet's payments and money transfer franchises.

- Despite modest price target cuts, some still see meaningful upside from current levels, maintaining favorable ratings that imply confidence in the company’s medium term growth profile.

- Within the broader financial technology universe, Euronet is viewed as a beneficiary of sustained digital payments adoption, which supports expectations for steady revenue and earnings expansion.

- Participation in investor events and conference calls is seen as a positive for transparency and execution, helping narrow the perceived risk discount in the valuation.

Bearish Takeaways

- Bearish analysts are trimming price targets to reflect slightly lower post Q3 estimates, indicating reduced conviction in near term earnings leverage.

- Elevated macroeconomic uncertainty is prompting a tilt toward more defensive large cap payment names, which can weigh on relative valuation multiples for Euronet.

- There is caution that any softening in consumer activity, foreign exchange volatility, or regional economic pressure could slow transaction volumes and compress margins.

- The modest target reductions reflect concerns that execution will need to be very strong to achieve prior growth expectations, which may limit room for upside surprises in the short term.

What's in the News

- Completed a major share repurchase program announced in February 2022, buying back a total of 12,673,988 shares, or 27.45% of shares outstanding, for approximately $1.26 billion (company buyback update).

- During the latest reported tranche from July 1, 2025 to September 30, 2025, the company repurchased 1,343,714 shares, or 3.28% of shares outstanding, for $131.31 million, reflecting ongoing capital returns to shareholders (company buyback update).

- The scale of cumulative repurchases highlights management’s stated confidence in the company’s long term fundamentals and the potential for earnings per share accretion through a reduced share count (company buyback update).

Valuation Changes

- Fair Value: Unchanged at $117.43 per share, indicating no adjustment to intrinsic value assumptions in the latest update.

- Discount Rate: Fallen slightly from 8.95% to 8.89%, reflecting a marginally lower required rate of return in the valuation model.

- Revenue Growth: Effectively unchanged at approximately 7.11% annually, signaling consistent expectations for top line expansion.

- Net Profit Margin: Stable at about 9.53%, implying no material revision to long term profitability assumptions.

- Future P/E: Edged down slightly from 11.47x to 11.46x, pointing to a modestly lower valuation multiple applied to forward earnings.

Key Takeaways

- Expansion into digital payment processing and global money transfers leverages high-growth regions and increased demand for scalable, software-driven solutions.

- Ongoing shift from cash to digital payments fuels recurring growth, enhanced margins, and validation from strategic alliances with major financial institutions.

- Structural shifts toward digital payments, regulatory and competitive pressures, and innovation gaps threaten Euronet's legacy revenues, margins, and long-term relevance across core business segments.

Catalysts

About Euronet Worldwide- Provides payment and transaction processing and distribution solutions to financial institutions, retailers, service providers, and individual consumers worldwide.

- The acquisition of CoreCard, a scalable and proven credit card processing platform, alongside Euronet's Ren platform, positions the company to rapidly expand digital payments processing and credit issuing capabilities, particularly in large and high-growth regions like Europe and Asia; this is expected to drive substantial increases in revenue and improve operating margins due to the higher profitability of software-based, digital payment solutions.

- Strength in cross-border and international money transfer flows remains a robust engine for growth, as demonstrated by strong performance in Euronet's Money Transfer segment (33% operating income growth year-over-year) and expansion into fast-growing remittance markets, notably with the Kyodai Remittance acquisition in Japan; this leverages increasing globalization and economic migration trends, supporting future transaction and revenue growth.

- The rapid shift from cash to digital and electronic payments worldwide, including the transformation of epay to a primarily digital transaction business (now 70% fully digital), as well as the increasing share of digital and real-time transactions in Money Transfer (digital transactions now comprise 55% of volume in that segment), provides recurring growth opportunities and incremental net margin enhancement as digital products scale and overtake legacy cash-based revenues.

- Strategic wins such as the Ren platform deal with a top 3 U.S. bank and ongoing partnerships with large global financial institutions further validate Euronet's technology and create a strong reference base for additional large-scale contracts, supporting higher future software revenue and increased operating leverage from scalable digital solutions.

- Euronet's ability to cross-sell new high-margin digital offerings, such as CoreCard's revolving credit solutions, through its global payments network and deep relationships with banks, fintechs, and digital wallets-especially in underbanked and emerging markets-offers a path for outsized earnings growth and margin expansion as financial inclusion accelerates adoption of modern payment and credit products.

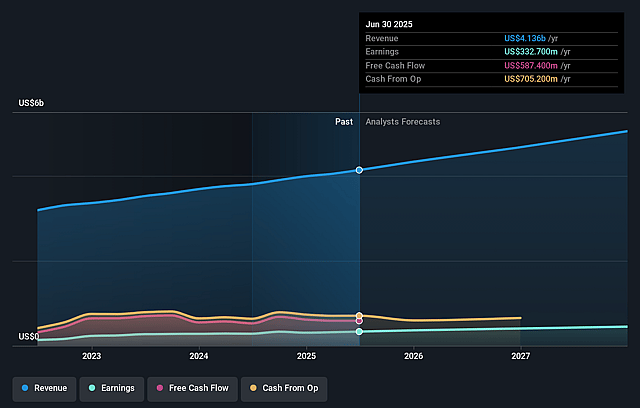

Euronet Worldwide Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Euronet Worldwide's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 9.1% in 3 years time.

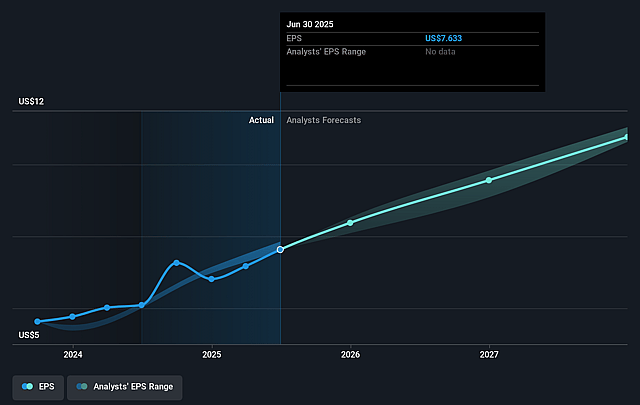

- Analysts expect earnings to reach $476.3 million (and earnings per share of $10.76) by about September 2028, up from $332.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from 10.9x today. This future PE is lower than the current PE for the US Diversified Financial industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 6.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.0%, as per the Simply Wall St company report.

Euronet Worldwide Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift toward cashless societies and digital/mobile payments poses a long-term threat to Euronet's legacy ATM and cash-based segments, which are still a significant contributor to revenue and profit; as these revenue streams decline, the company may face headwinds in maintaining overall top-line growth and high-margin legacy businesses.

- Euronet's Money Transfer business remains exposed to regulatory risks, such as new remittance taxes (e.g., the recent 1% remittance tax affecting 27% of the segment's revenue), anti-money laundering (AML), and KYC compliance requirements-these can compress net margins and introduce earnings volatility, especially as geopolitical and regulatory changes increase in key corridors.

- The proliferation of large tech players and superapps (Apple, Google, PayPal, etc.) in digital payments and cross-border money transfer intensifies competition, risking long-term market share erosion for Euronet and potentially driving price compression, which would directly impact revenue growth and net margins across segments.

- Industry-wide adoption of real-time payment rails and central bank digital currencies (CBDCs) could disintermediate traditional payments and money transfer services, threatening Euronet's transaction-based fee income model with sustained pressure on both revenue and margins.

- Euronet's CoreCard acquisition brings concentration risk from major customers (notably Apple/Goldman Sachs), and the loss or reduction of business from these clients would slow growth in the credit card processing segment; additionally, persistent underinvestment or lag in cutting-edge fintech innovation (versus agile start-ups or incumbents) could further threaten long-term earnings and market relevance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $127.714 for Euronet Worldwide based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $476.3 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 9.0%.

- Given the current share price of $91.34, the analyst price target of $127.71 is 28.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Euronet Worldwide?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.