Narratives are currently in beta

Key Takeaways

- Launch of Celebrity River Cruises aims to drive high-margin growth, increase revenue, and capture market share in river cruising.

- Expansion in the Caribbean market with new ships and destination investments is expected to boost yields, profitability, and revenue.

- High capital requirements for expansion and new projects pose substantial risk to profitability, cash flow, and shareholder returns if demand projections are unmet.

Catalysts

About Royal Caribbean Cruises- Operates as a cruise company worldwide.

- The launch of Celebrity River Cruises in 2027 is expected to create a new high-margin, high ROIC business for Royal Caribbean, providing additional revenue streams and capturing substantial market share in the growing river cruising market. This expansion is anticipated to drive future revenue growth and improve net margins.

- Expected growth in the Caribbean market with the introduction of new ships like Star of the Seas and Celebrity Xcel, as well as private destination investments, is forecasted to increase yields by 2.5% to 4.5% in 2025. This strategic deployment is likely to enhance overall profitability and revenue.

- The development of industry-leading digital and AI capabilities to enhance customer experience is expected to optimize pricing and yield growth, ultimately improving net margins and earnings by leveraging guest data for more personalized service.

- The expansion of private destinations such as the Beach Club in Nassau and future Perfect Day locations is projected to drive higher guest satisfaction and loyalty, which in turn benefits revenue and earnings by increasing customer retention and spend.

- Strong cost control measures and moderate capacity growth maintaining earnings expectations despite external headwinds, are likely to enhance net margins and EPS growth, demonstrating the company’s ability to achieve superior financial performance.

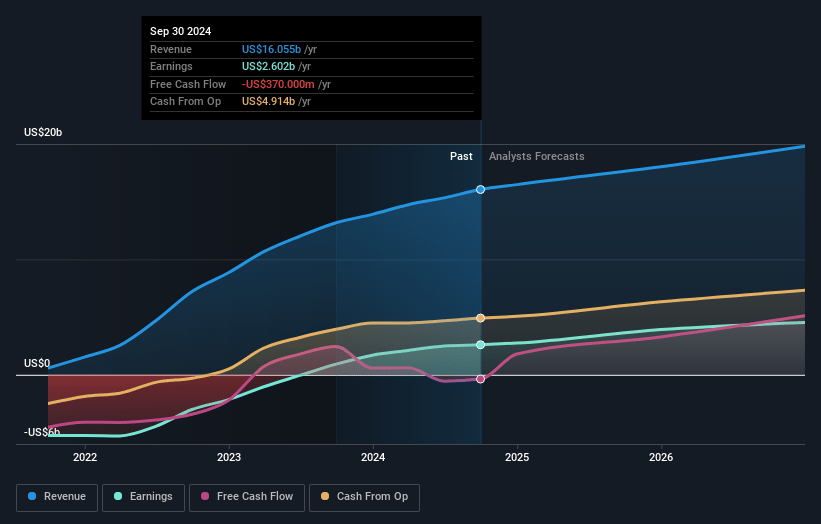

Royal Caribbean Cruises Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Royal Caribbean Cruises's revenue will grow by 9.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.5% today to 24.9% in 3 years time.

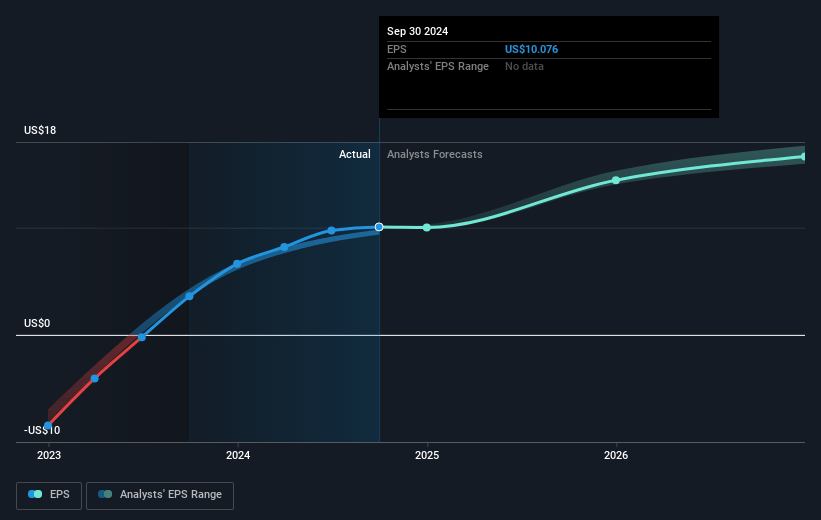

- Analysts expect earnings to reach $5.3 billion (and earnings per share of $19.49) by about January 2028, up from $2.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, down from 24.8x today. This future PE is lower than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.15%, as per the Simply Wall St company report.

Royal Caribbean Cruises Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The expansion into Celebrity River Cruises involves launching an initial fleet that requires significant upfront capital investment, which could impact net margins if initial demand does not meet expectations.

- The river cruise market is fragmented and presents execution risks, particularly regarding competition from established players like Viking, potentially affecting future revenues.

- The focus on globally sourcing passengers for river cruises, despite the current heavy concentration of customers in North America, presents a risk if international demand doesn't materialize at projected levels, impacting yield growth and profitability.

- Although there is a favorable macroeconomic environment currently, changes in consumer sentiment or economic conditions could impact the prioritization of travel spending, negatively affecting booking volumes and future revenues.

- The rapid expansion of private destinations and acquisition of Costa Maya highlight a strategy heavily dependent on high capital expenditure, which may strain operating cash flow and affect the ability to return capital to shareholders if projected returns do not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $254.31 for Royal Caribbean Cruises based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $310.0, and the most bearish reporting a price target of just $155.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $21.5 billion, earnings will come to $5.3 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 8.1%.

- Given the current share price of $265.25, the analyst's price target of $254.31 is 4.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives