Key Takeaways

- Accelerated digital adoption and proprietary platforms position Brightstar for outsized revenue growth, margin expansion, and dominance in evolving global iLottery markets.

- Strategic balance sheet improvements and industry trends empower Brightstar to pursue M&A, invest for growth, and sustain higher margins against less agile competitors.

- Over-reliance on legacy retail, regulatory pressures, demographic shifts, jackpot volatility, and lagging digital innovation threaten Brightstar Lottery's revenue growth and market position.

Catalysts

About Brightstar Lottery- Provides lottery solutions in the United States, Italy, rest of Europe, and internationally.

- Analysts broadly agree that digital adoption and smartphone penetration are driving strong iLottery growth; however, Brightstar's digital initiatives-like the MYLOTTERIES app in Italy, which is gaining share at double the market rate and aims to become an all-in-one hub for lottery, iGaming, and sports betting-could enable revenue growth and net margin expansion at a pace and scale meaningfully above consensus expectations as digital penetration remains in early stages in key markets.

- While analyst consensus believes contract renewals and regulatory liberalization will secure long-term revenue streams, the recent pure-play lottery focus, early renewal wins, and global contract pipeline (including opportunities like the Greek State Lottery) suggest even greater revenue durability and free cash flow visibility over the next decade as Brightstar solidifies its market dominance and expands its addressable market ahead of expectations.

- The company's transformational balance sheet reset, following the sale of its gaming and digital operations and aggressive debt paydown, dramatically enhances its capacity for future M&A, strategic investment, and shareholder returns, which can accelerate earnings per share growth through both operational leverage and significant capital allocation flexibility.

- Industry consolidation and Brightstar's deep technology stack/integration position it to be a key beneficiary as smaller competitors struggle with increasing regulatory, security, and digital experience requirements, supporting structurally higher operating margins and long-term market share gains.

- The strong shift towards gamification, instant-play, and advanced ticket technologies-coupled with Brightstar's now rapidly scaling instant ticket printing capacity and deep proprietary game library-creates potential for sustained double-digit revenue growth and higher recurring revenue streams as the company is uniquely positioned to capture new digital-native and younger demographics globally.

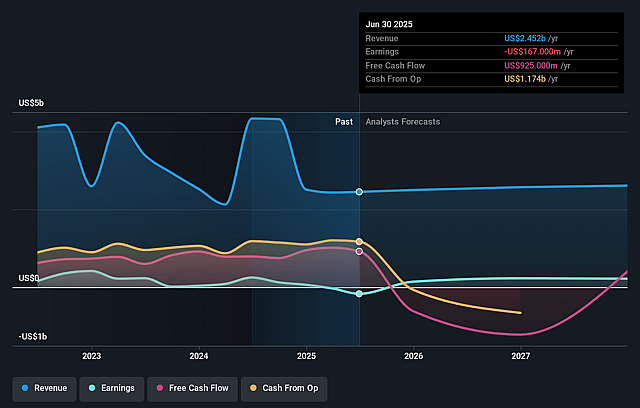

Brightstar Lottery Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Brightstar Lottery compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Brightstar Lottery's revenue will grow by 4.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -6.8% today to 6.8% in 3 years time.

- The bullish analysts expect earnings to reach $190.6 million (and earnings per share of $1.15) by about September 2028, up from $-167.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.5x on those 2028 earnings, up from -19.1x today. This future PE is greater than the current PE for the US Hospitality industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.28%, as per the Simply Wall St company report.

Brightstar Lottery Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Brightstar Lottery's heavy reliance on legacy physical retail networks exposes it to long-term declines in in-person lottery participation as more consumers migrate to digital entertainment alternatives, potentially reducing future revenue and threatening sustained earnings growth.

- Growing regulatory scrutiny and anti-gambling sentiment pose a risk of stricter regulations, higher compliance costs, and restricted product offerings for Brightstar Lottery, which could compress margins and limit top-line revenue growth.

- A lack of material jackpot activity in recent periods, combined with jackpot revenue's inherent unpredictability, introduces structural volatility to Brightstar's earnings and revenue model, making it difficult to achieve consistent growth.

- The lottery industry faces long-term demographic challenges, with aging player bases and difficulties in attracting younger generations, which could shrink Brightstar's addressable market and exert downward pressure on long-term revenues.

- While digital and product innovation are emphasized, slower adoption rates relative to competitors or insufficient innovation in online and mobile platforms could lead to erosion of market share, adversely impacting both future revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Brightstar Lottery is $27.68, which represents two standard deviations above the consensus price target of $18.22. This valuation is based on what can be assumed as the expectations of Brightstar Lottery's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $12.52.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $190.6 million, and it would be trading on a PE ratio of 40.5x, assuming you use a discount rate of 13.3%.

- Given the current share price of $16.82, the bullish analyst price target of $27.68 is 39.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives