Key Takeaways

- Investment in digital innovation and proprietary platforms is driving higher sales, improved margins, and stronger customer retention while boosting operational efficiencies.

- An asset-light, franchised model and global expansion, supported by menu innovation and new kitchen technology, are set to accelerate revenue growth and market reach.

- Health and regulatory headwinds, menu dependence, rising labor costs, and saturation risks could limit Wingstop’s growth, margin stability, and revenue diversification over time.

Catalysts

About Wingstop- Wingstop Inc., together with its subsidiaries, franchises and operates restaurants under the Wingstop brand.

- Continued investments in digital innovation, proprietary ordering platforms, and the forthcoming loyalty program are expanding Wingstop’s digital sales—which already reached 72% of total sales—enabling higher average ticket sizes, greater customer retention, and improved net margins by driving labor and marketing efficiencies.

- The asset-light, 100% franchised model combined with record-breaking new unit development—over 400 net new restaurants in the past year and global growth guidance raised to 16–17%—positions Wingstop to significantly scale revenues and accelerate both domestic and international market expansion, supporting robust free cash flow generation.

- Ongoing rollout of the Wingstop Smart Kitchen, which reduces order times by more than 50% and enhances both guest experience and restaurant throughput, is expected to unlock previously unmet demand, drive higher average unit volumes, and improve operating margins across the system.

- International expansion into new, higher-growth markets such as Australia, the GCC, and India is broadening Wingstop’s total addressable market, capitalizing on urbanization and rising middle-class consumer bases who increasingly favor chicken and protein-centric fast food, which should meaningfully augment future revenue streams.

- Rapid menu innovation—including the successful relaunch of tenders and continued product R&D—targets the growing consumer preference for higher-quality, protein-based quick meals, attracting new guests, increasing visit frequency, and capturing a larger share of off-premises and meal occasion spend, ultimately driving top line growth.

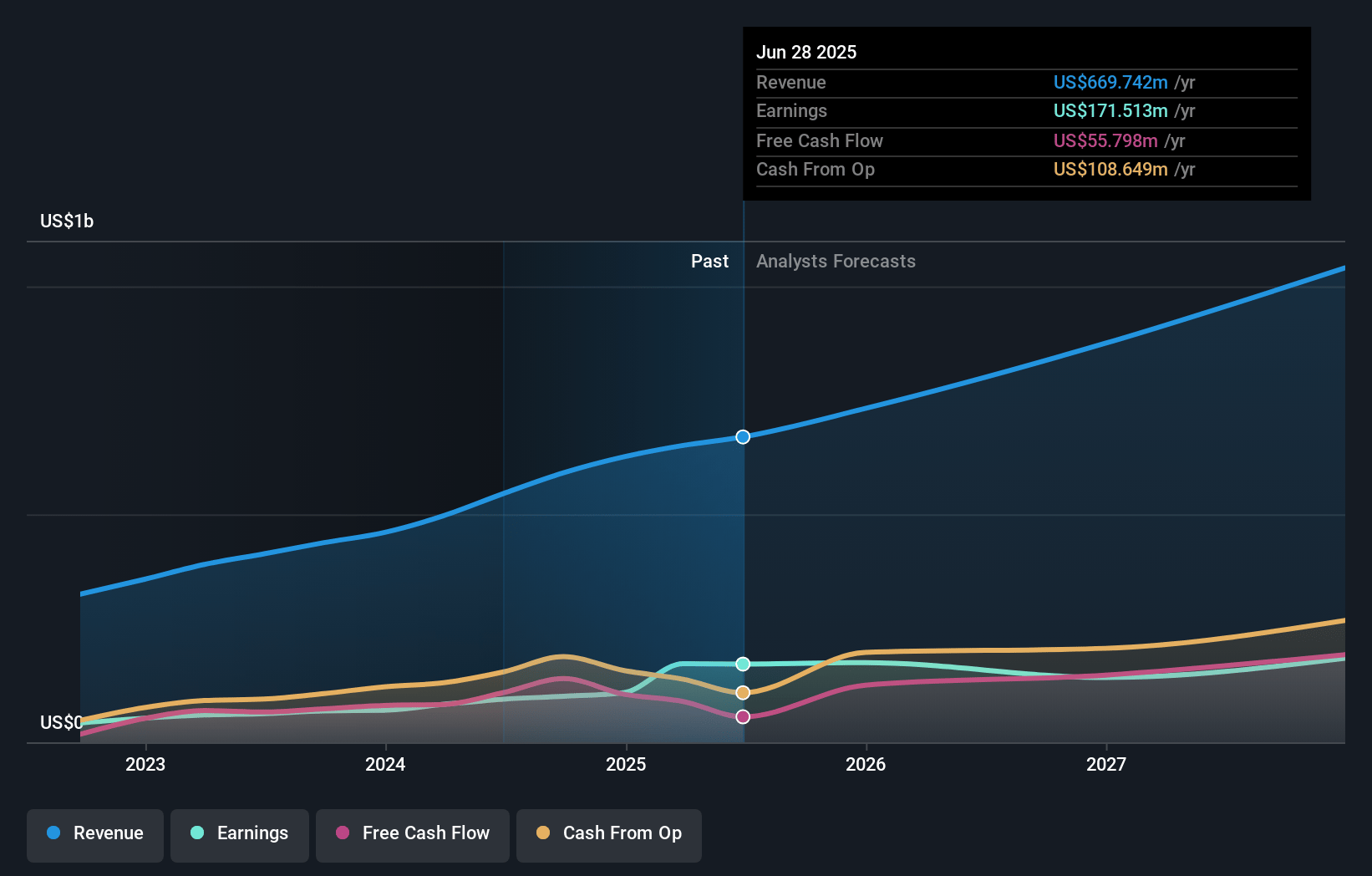

Wingstop Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wingstop compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wingstop's revenue will grow by 20.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 26.5% today to 16.7% in 3 years time.

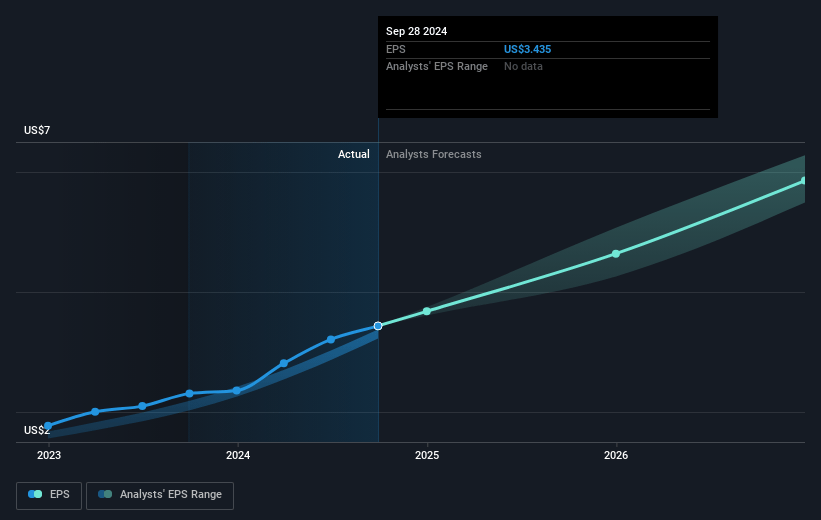

- The bullish analysts expect earnings to reach $192.1 million (and earnings per share of $6.95) by about July 2028, up from $172.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 69.7x on those 2028 earnings, up from 52.0x today. This future PE is greater than the current PE for the US Hospitality industry at 24.5x.

- Analysts expect the number of shares outstanding to decline by 4.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.23%, as per the Simply Wall St company report.

Wingstop Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating consumer shift toward health and wellness trends, indicated by dropping sales among certain demographics and heightened value sensitivity, poses a major long-term threat to demand for Wingstop's indulgent, high-calorie menu, which could limit growth in same-store sales and future revenue.

- Regulatory risks around food ingredients, such as possible new taxes or limits on sodium, fat, and additives, combined with calls for more transparency and controls over the quick-service restaurant industry, may lead to rising compliance costs and margin pressure for Wingstop over time.

- The company’s heavy reliance on chicken wings, with limited menu diversification, creates vulnerability to both changing consumer tastes and input disruptions; this exposes Wingstop to revenue volatility and possible top-line growth stagnation if demand for wings softens or chicken prices spike due to supply chain shocks, as seen with commodity inflation risks and references to unpredictable food costs.

- Labor market tightening, evidenced by franchisee conversations around headcount expenses and operating cost increases, could compress net margins as higher wages and a competitive labor environment make restaurant operations more expensive for Wingstop and its franchise partners going forward.

- Aggressive domestic and international expansion raises saturation risk, with diminishing returns likely as markets mature—particularly as new store openings increasingly draw sales from existing locations and brand awareness becomes harder to grow organically, which could slow systemwide revenue growth and impact earnings in future periods.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wingstop is $440.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wingstop's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $440.0, and the most bearish reporting a price target of just $178.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $192.1 million, and it would be trading on a PE ratio of 69.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of $320.81, the bullish analyst price target of $440.0 is 27.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.