Narratives are currently in beta

Key Takeaways

- Resilient domestic and cross-border travel, combined with personalized experiences, will enhance Trip.com's revenue growth and potentially improve margins.

- AI integration and expansion in international markets, especially in APAC, highlight Trip.com's potential for increased earnings and operational efficiency.

- The company's reliance on China's travel market and international expansion faces risks from economic challenges, competition, geopolitical tensions, and technological implementation issues.

Catalysts

About Trip.com Group- Through its subsidiaries, operates as a travel service provider for accommodation reservation, transportation ticketing, packaged tours and in-destination, corporate travel management, and other travel-related services in China and internationally.

- The China travel market's demonstrated resilience, particularly in domestic and cross-border travel, along with growing consumer confidence and enthusiasm for travel, is expected to boost Trip.com Group's future revenue growth.

- The increasing demand for diversified and personalized travel experiences, especially among young people seeking events like concerts and sporting events, is anticipated to positively impact Trip.com Group's revenue growth and potentially improve net margins through higher-margin offerings.

- The integration of AI to enhance the travel experience, streamline planning, and provide personalized solutions can lead to improved operational efficiency and customer satisfaction, supporting better earnings and net margins.

- Strong growth in international markets, with APAC regions showing over 70% growth in bookings, suggests a significant potential impact on future revenue growth as Trip.com continues expanding its market presence globally.

- The growing travel demand from the senior population, who exhibit higher spending habits and preferences for customized trips, presents an opportunity for Trip.com Group to capture additional revenue and improve earnings through targeted products and services.

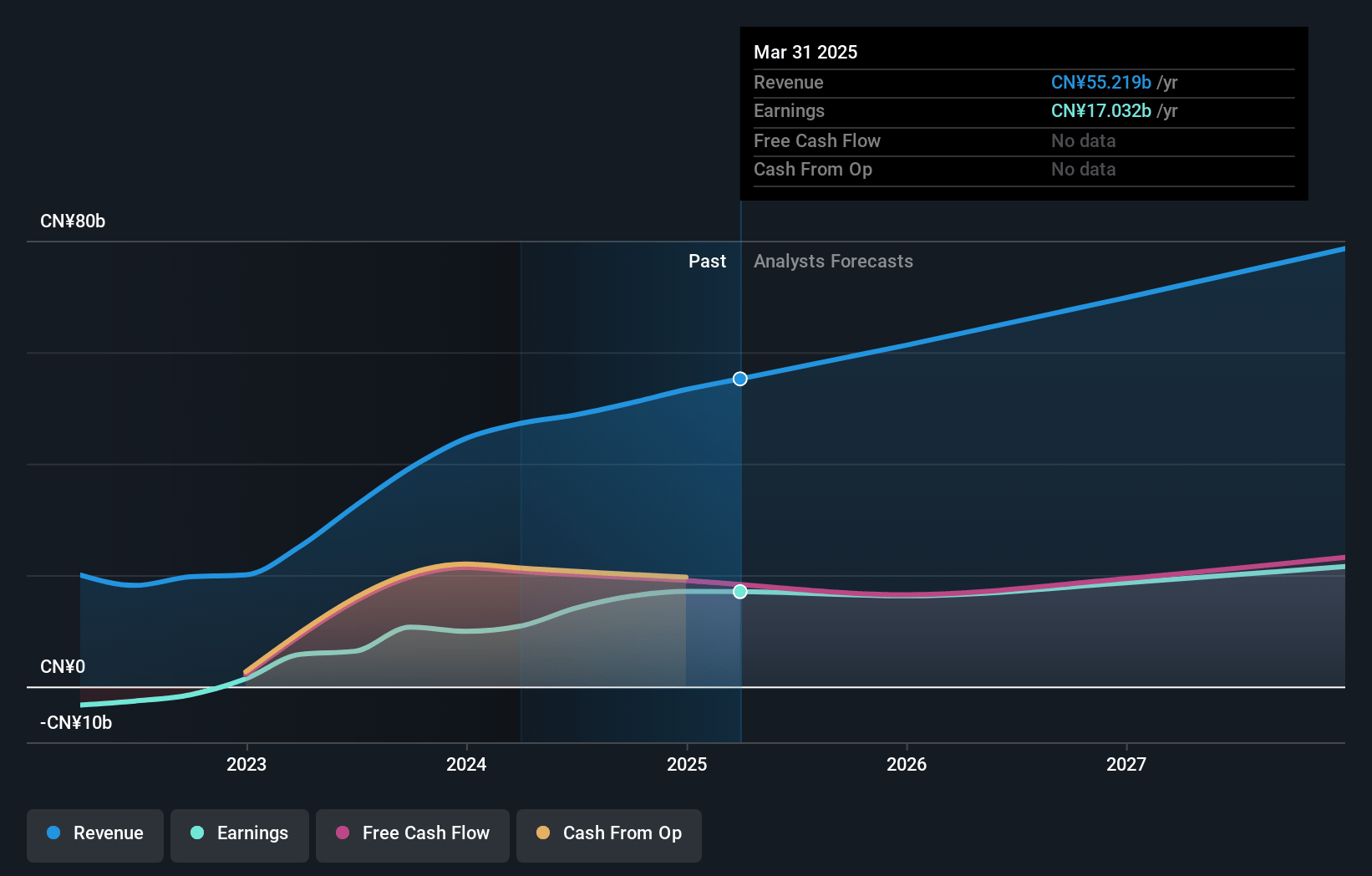

Trip.com Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Trip.com Group's revenue will grow by 15.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 31.9% today to 29.5% in 3 years time.

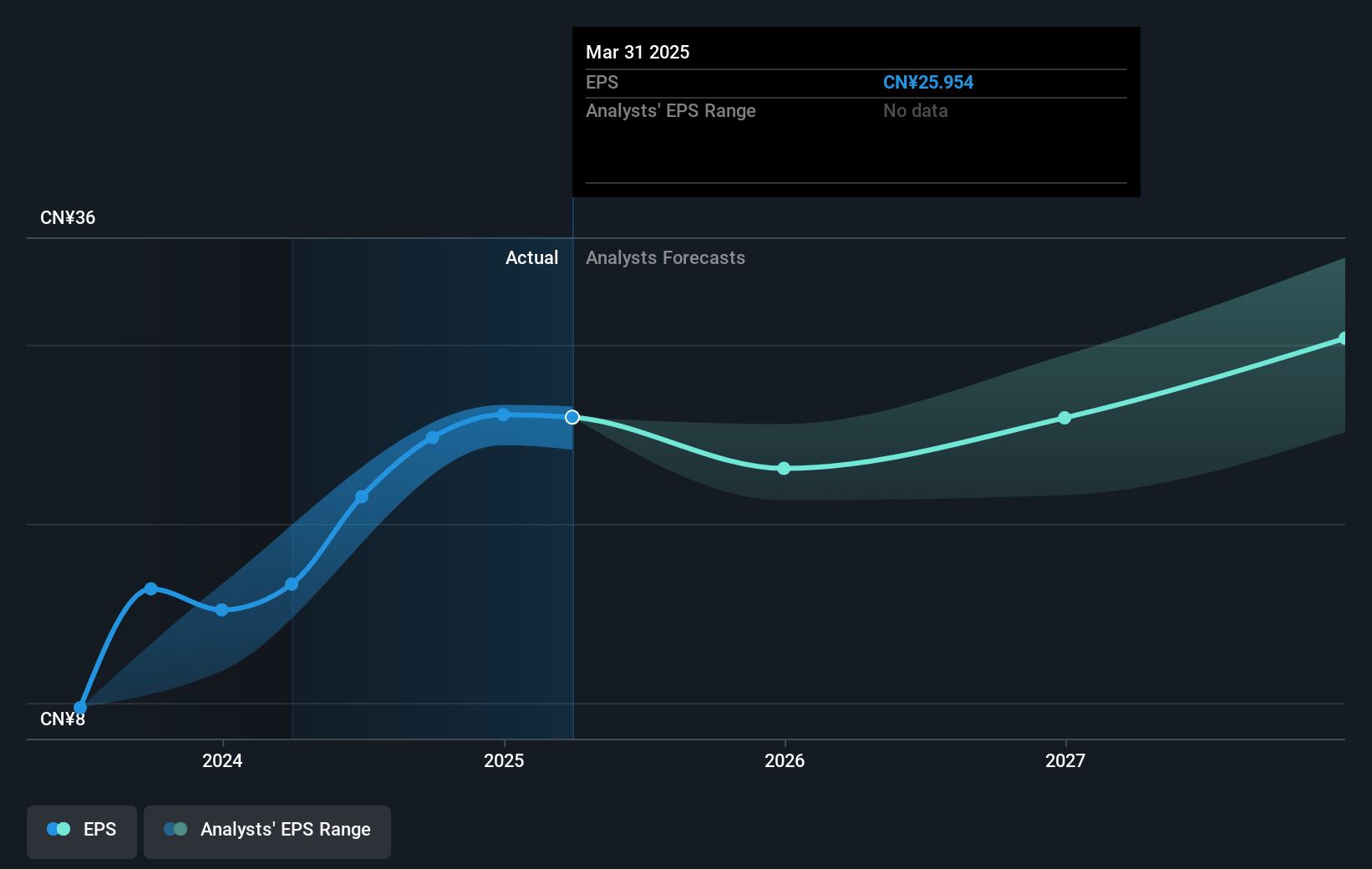

- Analysts expect earnings to reach CN¥22.8 billion (and earnings per share of CN¥33.65) by about January 2028, up from CN¥16.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥15.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, up from 20.8x today. This future PE is lower than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 1.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.68%, as per the Simply Wall St company report.

Trip.com Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on the Chinese travel market's resilience and domestic travel momentum might pose a risk, as any economic slowdown or decline in consumer confidence could impact revenue and net margins negatively.

- The focus on international expansion, particularly in the APAC region, introduces execution risks such as increased competition and geopolitical tensions, which could impact earnings and market share growth.

- The dependence on AI and technological advancements for enhancing customer experiences and operational efficiencies brings inherent risks such as implementation challenges or cybersecurity issues, potentially affecting cost structures and profitability.

- While investments in ESG initiatives are commendable, they require allocation of resources that could potentially divert funds from direct revenue-generating activities, impacting net margins and financial returns.

- The fluctuations in hotel prices and airline capacity, along with the impact of global economic policies and travel regulations, could influence booking trends and pricing strategies, thus affecting revenue stability and growth projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $77.66 for Trip.com Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $101.13, and the most bearish reporting a price target of just $51.59.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥77.3 billion, earnings will come to CN¥22.8 billion, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 7.7%.

- Given the current share price of $71.44, the analyst's price target of $77.66 is 8.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives