Key Takeaways

- Maintaining growth and margin expansion is challenged by fierce competition, evolving auto industry dynamics, and ongoing investments in digital platform innovation.

- Regulatory scrutiny, changing vehicle ownership patterns, and automaker-controlled digital insurance models could limit the company's long-term relevance and margin improvements.

- Mounting costs, disruptive industry shifts, regulatory pressures, and intensifying competition threaten SunCar's margins, earnings growth, and ability to capitalize on future revenue opportunities.

Catalysts

About SunCar Technology Group- Through its subsidiaries, provides cloud and mobile app-based auto eInsurance, technology, and auto services in the People’s Republic of China.

- While SunCar is capitalizing on the rapid digitalization of insurance and auto services in China-with more automakers and dealerships turning to tech-driven, online platforms for revenue streams-the company faces the operational challenge of integrating with a highly fragmented and competitive landscape that could erode its early-mover advantage, placing pressure on both future revenue growth and the sustainability of its net margins.

- Although there is a significant expansion opportunity stemming from the rising middle class and higher vehicle ownership in China, SunCar's extensive reliance on partnerships with both emerging EV makers and legacy gas vehicle dealers exposes it to the risk that faster-than-expected electrification or changes in auto ownership patterns could make parts of its platform or product suite less relevant, constraining long-term earnings upside.

- Despite strong growth in its AI-powered cloud infrastructure and proprietary digital products, SunCar must now continually invest in platform innovation not only to keep pace with customer expectations for seamless, omnichannel app experiences but also to defend its offerings against larger, better-capitalized competitors, which could compress gross margins.

- While SunCar's shift toward deeper enterprise software integration and SaaS models theoretically enhances switching costs and recurring revenue, the persistent advancement of direct-to-consumer, automaker-controlled digital insurance models risks disintermediating the company, potentially limiting transaction volumes over time and capping topline revenue expansion.

- Although the increasing demand for personalized, usage-based insurance solutions-enabled by connected vehicles-positions SunCar to benefit from secular technology changes, tightening regulatory scrutiny around data privacy and insurance practices in China may increase ongoing compliance costs, thus offsetting some of the operational leverage expected to drive margin and earnings improvements.

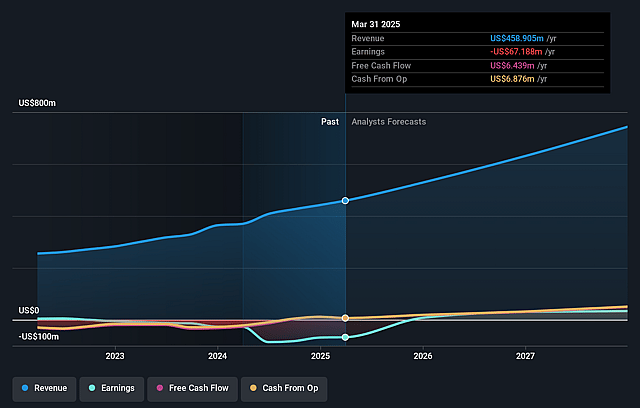

SunCar Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SunCar Technology Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SunCar Technology Group's revenue will grow by 21.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -14.6% today to 6.6% in 3 years time.

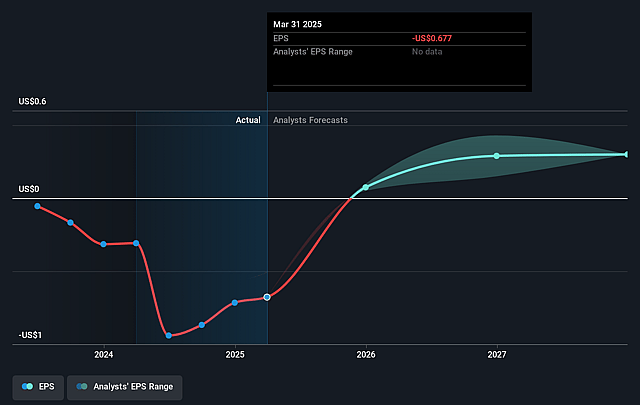

- The bearish analysts expect earnings to reach $54.4 million (and earnings per share of $0.49) by about September 2028, up from $-67.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, up from -4.0x today. This future PE is lower than the current PE for the US Consumer Services industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 4.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.06%, as per the Simply Wall St company report.

SunCar Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SunCar's significant increase in operating costs and expenses, rising to $500.3 million compared to $379.2 million the previous year, far outpaced its revenue growth and resulted in a net loss, which, if sustained, could negatively affect future earnings and margins.

- The rapid acceleration of EV adoption and a potential shift toward autonomous driving may decrease demand for traditional auto-related services that SunCar relies on, ultimately shrinking the addressable market and impacting revenue growth over the long term.

- The company's deep integration with automaker and insurance partners leaves it vulnerable to industry consolidation, digital disintermediation, and increased competition from larger tech-savvy rivals, which could erode market share and suppress both revenue and net margins.

- Growing customer expectations and the need for ongoing, costly AI and technology upgrades may put persistent pressure on SunCar's operating expenses, challenging its ability to deliver sustained margin improvement and strong earnings growth.

- Heightened regulatory risks and evolving data privacy laws in China could increase compliance costs and limit SunCar's ability to leverage user data for monetization, which would impact ancillary revenue streams and compress net profit.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SunCar Technology Group is $3.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SunCar Technology Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $824.8 million, earnings will come to $54.4 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 8.1%.

- Given the current share price of $2.64, the bearish analyst price target of $3.5 is 24.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.