Key Takeaways

- Rapid digital adoption and deep integration with major online platforms position SunCar for dominant growth in auto insurance and broader automotive services.

- AI-driven personalization and efficiency gains from automation are set to boost recurring revenues, improve profitability, and lock in long-term customer engagement.

- Rising industry shifts, reliance on key partners, escalating competition, and increasing costs threaten SunCar's profitability and long-term market position.

Catalysts

About SunCar Technology Group- Through its subsidiaries, provides cloud and mobile app-based auto eInsurance, technology, and auto services in the People’s Republic of China.

- Analysts broadly agree that online auto insurance adoption in China will drive growth, but they may be underestimating SunCar's first-mover advantage and rapid scaling with top automakers, which positions the company to dominate the digital channel and capture a disproportionate share of the market as over 330 million drivers transition online; this will accelerate both revenue and operating leverage more quickly than consensus expects.

- Analyst consensus highlights the gas vehicle market as a growth area, but this significantly understates the urgency and scale of digital transformation among gas vehicle dealers, where structural economic pressures are forcing a wholesale shift to digital solutions, enabling SunCar to penetrate a market far larger than the current EV channel and substantially lift insurance-related revenues and renewal streams.

- SunCar's deep integration with major internet platforms and retail leaders-such as Douyin, Didi, Meituan, Alipay, and Sam's Club-not only diversifies revenue but is likely to drive exponential user growth and engagement through embedded service offerings, creating sticky, recurring revenue streams and reducing customer acquisition costs over time.

- Rising demand for AI-driven personalization in automotive insurance and after-sales services gives SunCar a unique competitive advantage, as its Anji AI Technology Center and proprietary data assets allow rapid deployment of new features and upsell of value-added products, boosting recurring technology service revenue and expanding net margins.

- The normalization of operating and R&D expenses following last year's one-time equity compensation will result in step-function improvements in reported earnings and profitability, while ongoing efficiency gains from automation and scale are poised to structurally raise adjusted EBITDA and cash flow conversion going forward.

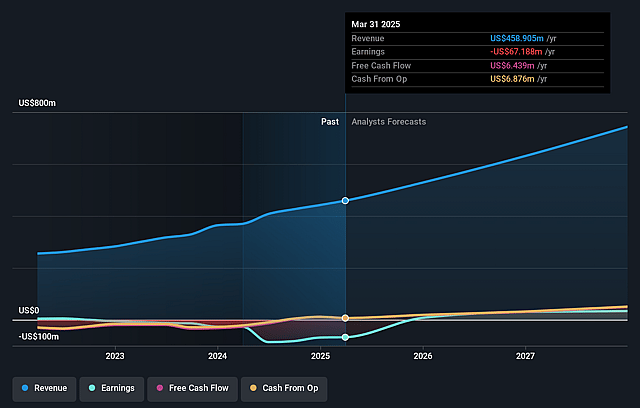

SunCar Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SunCar Technology Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SunCar Technology Group's revenue will grow by 21.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -14.6% today to 6.6% in 3 years time.

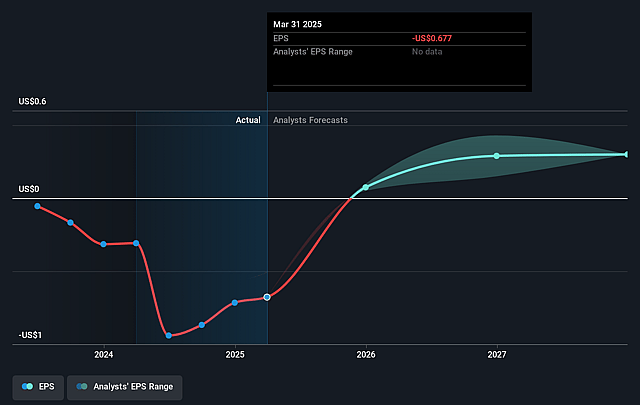

- The bullish analysts expect earnings to reach $54.8 million (and earnings per share of $0.49) by about September 2028, up from $-67.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.0x on those 2028 earnings, up from -4.1x today. This future PE is greater than the current PE for the US Consumer Services industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 4.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.04%, as per the Simply Wall St company report.

SunCar Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of autonomous vehicles and shared mobility could reduce private vehicle ownership over time, leading to a shrinking addressable market for SunCar's core insurance and auto services products and negatively impacting long-term revenue growth.

- SunCar's reliance on a concentrated group of major automotive and insurance partners heightens the risk of customer churn or renegotiations, as a loss or reduction in business from one or more key clients-such as Tesla, Xiaomi, or national bank partners-could significantly undermine revenue stability.

- Intensifying competition from both established insurance firms and emerging digital platforms may pressure SunCar's pricing power and force margin concessions, resulting in compressed net margins even if transaction volume continues to grow.

- Significant and rapid increases in general and administrative expenses, including a surge from $22.5 million to $47 million in one year and increased R&D spending, signal rising cost pressures that could weigh on future profitability and earnings, especially if topline growth slows.

- The trend of automotive manufacturers and insurers shifting toward direct-to-consumer and embedded insurance models may disintermediate SunCar's platform, reducing the volume of transactions routed through SunCar and thereby depressing both revenue and market share over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SunCar Technology Group is $12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SunCar Technology Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $828.4 million, earnings will come to $54.8 million, and it would be trading on a PE ratio of 32.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of $2.68, the bullish analyst price target of $12.0 is 77.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on SunCar Technology Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.