Narratives are currently in beta

Key Takeaways

- Marriott's expansion into the mid-scale segment and efficient cost reductions are set to enhance market share and profitability.

- Strengthening the Marriott Bonvoy loyalty program is expected to drive higher revenue through increased customer loyalty and spending.

- Macroeconomic pressures and restructuring costs could constrain Marriott's revenue growth and profitability, with challenges in China and North America affecting earnings.

Catalysts

About Marriott International- Engages in operating, franchising, and licensing hotel, residential, timeshare, and other lodging properties worldwide.

- Marriott's strong pipeline growth, with global signing activity of over 95,000 organic rooms year-to-date in 2024 and a pipeline that grew to a record 585,000 rooms, indicates future potential revenue growth from increased inventory and market presence.

- The focus on efficiency, including a planned $80 million to $90 million of annual pretax cost reductions starting in 2025, suggests an expected improvement in net margins through reduced general and administrative expenses.

- Marriott's expansion into the mid-scale segment with City Express by Marriott, along with their recent multiunit conversion deals, is poised to capture market share in this high-growth segment and enhance future earnings.

- Strengthening of the Marriott Bonvoy loyalty program, which grew to over 219 million members and includes co-branded credit cards in 11 countries, is likely to drive higher revenue from increased customer loyalty and spend.

- The ongoing enterprise-wide process to enhance effectiveness and efficiency, expected to yield cost savings, is anticipated to improve operating efficiency and profitability, impacting future earnings positively.

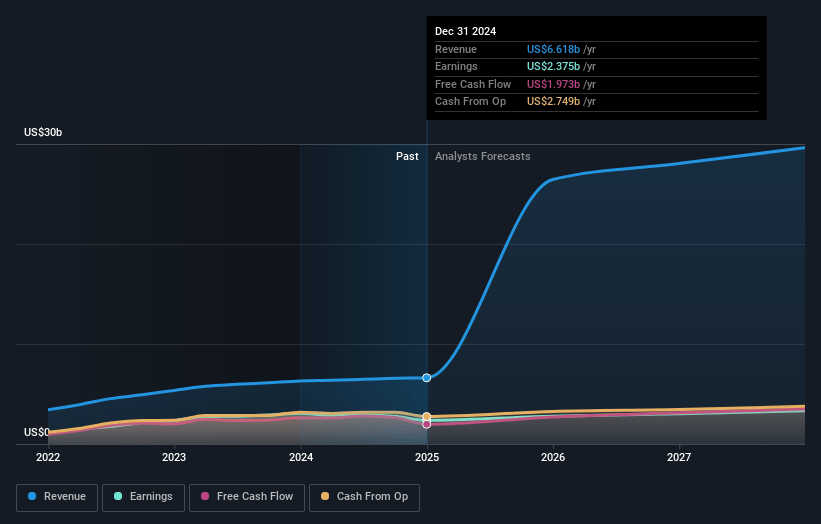

Marriott International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Marriott International's revenue will grow by 64.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 42.1% today to 11.6% in 3 years time.

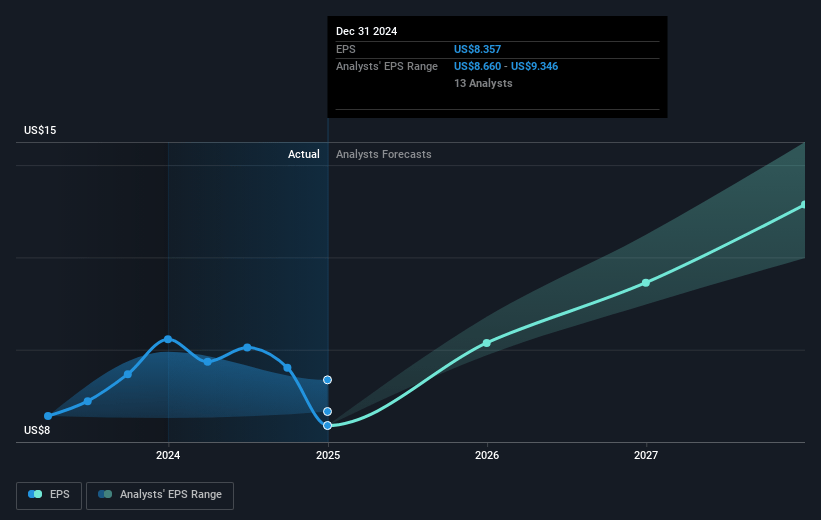

- Analysts expect earnings to reach $3.4 billion (and earnings per share of $12.95) by about November 2027, up from $2.8 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.4x on those 2027 earnings, down from 28.0x today. This future PE is greater than the current PE for the US Hospitality industry at 24.4x.

- Analysts expect the number of shares outstanding to decline by 1.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

Marriott International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Greater China RevPAR declined 8% in the third quarter due to macroeconomic pressures, weak domestic leisure demand, and restricted pricing power, which could impact overall revenue and profitability in the region.

- The election impact is forecasted to be around negative 300 basis points in November and negative 100 basis points for the quarter in U.S. and Canada RevPAR, which might affect earnings and revenue.

- Anticipated restructuring and merger-related charges of $100 million in the fourth quarter of 2024 could impact short-term net margins and profitability.

- Global RevPAR growth is expected to slow to 2% to 3% in the fourth quarter, which potentially constrains revenue growth.

- There are uncertainties around future interest rate movements, which might affect development activities and net unit growth, impacting long-term revenue potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $264.52 for Marriott International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $328.0, and the most bearish reporting a price target of just $200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $29.1 billion, earnings will come to $3.4 billion, and it would be trading on a PE ratio of 25.4x, assuming you use a discount rate of 7.7%.

- Given the current share price of $279.27, the analyst's price target of $264.52 is 5.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives