Key Takeaways

- Shifting consumer preferences and rising costs threaten long-term revenue growth and profitability, with limited ability to mitigate pressures through price increases or innovation.

- Heavy regional concentration and slow digital adaptation expose the company to economic, regulatory, and competitive risks, limiting resilience and potential for sustainable expansion.

- Menu innovation, expanded geographic growth, operational efficiencies, restaurant modernization, and digital upgrades support increased customer acquisition, profitability, and broader market potential.

Catalysts

About El Pollo Loco Holdings- Through its subsidiary, El Pollo Loco, Inc., develops, franchises, licenses, and operates quick-service restaurants under the El Pollo Loco name.

- Despite management's optimism regarding menu innovation and brand relaunch, El Pollo Loco's long-term growth is significantly threatened by a secular shift toward plant-based diets and flexitarian eating habits, which is likely to shrink the core addressable market for chicken-centric concepts and suppress same-store sales and total revenue growth over time.

- Persistent and rising labor costs-amplified by regulatory pressures such as California's minimum wage hikes-are set to drive ongoing and severe restaurant-level margin compression, as witnessed by the 12 percent wage inflation already experienced in Q1 and projected 4 to 5 percent for the year, ultimately eroding net profitability with little ability to offset through incremental pricing.

- El Pollo Loco's geographic concentration, with more than 85 percent of units clustered in California and the Southwest, will continue to expose the company to outsized economic downturn risk and region-specific regulatory headwinds, creating heightened revenue volatility and limited resilience against localized sales declines.

- Commodity cost volatility, especially for chicken, along with escalating occupancy and delivery aggregator expenses, will keep operating expenses structurally high and unpredictable, resulting in further gross margin pressure and restricting the recovery or expansion of net earnings.

- The company's digital and operational innovation lags behind larger fast-casual and quick-service peers; this sluggish pace, exacerbated by competitive intensity and evolving consumer preferences for seamless digital ordering and off-premise consumption, is expected to cap traffic growth, decrease customer retention, and hold back both revenue and profitability on a long-term basis.

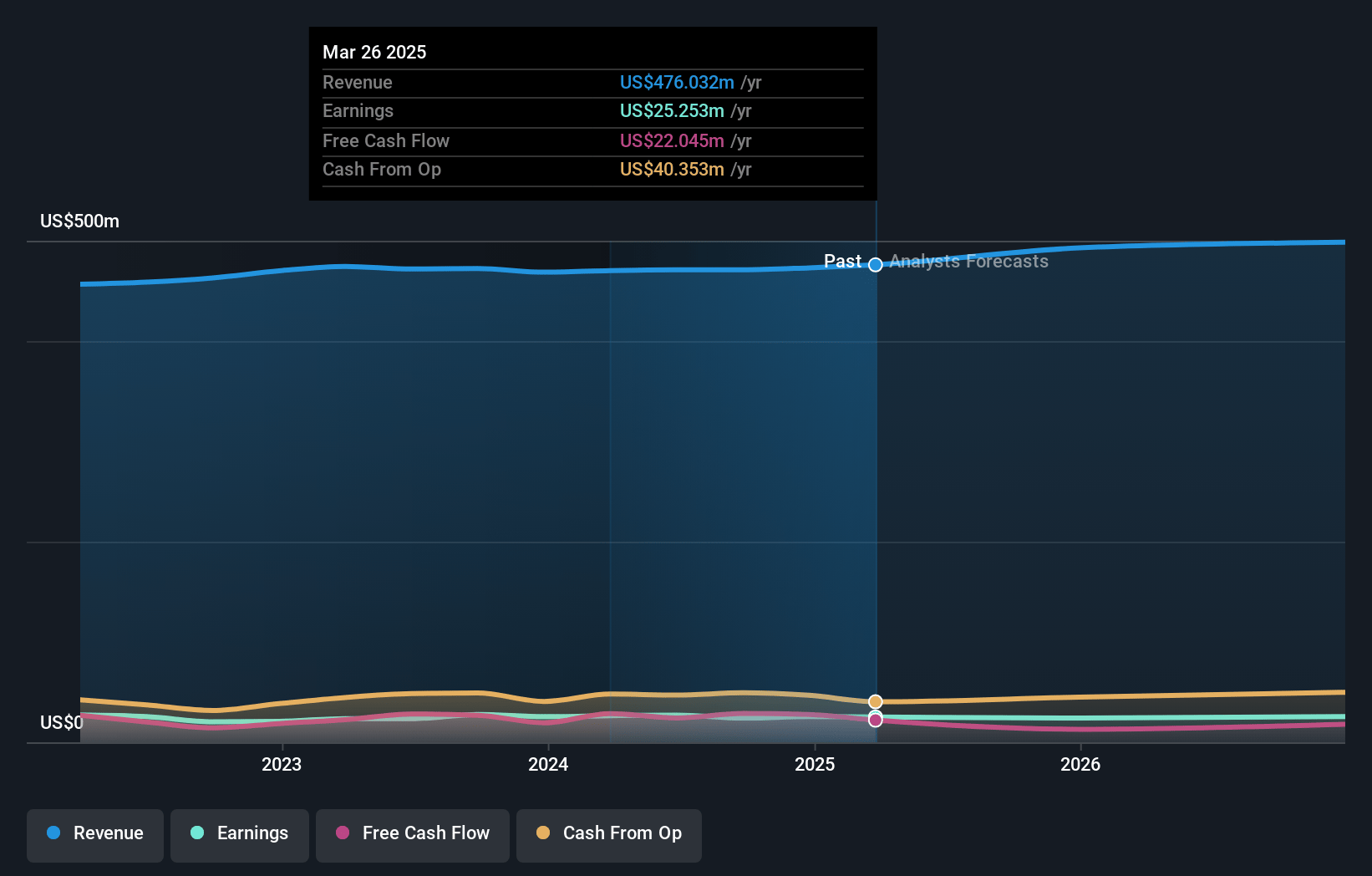

El Pollo Loco Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on El Pollo Loco Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming El Pollo Loco Holdings's revenue will grow by 2.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 5.3% today to 4.9% in 3 years time.

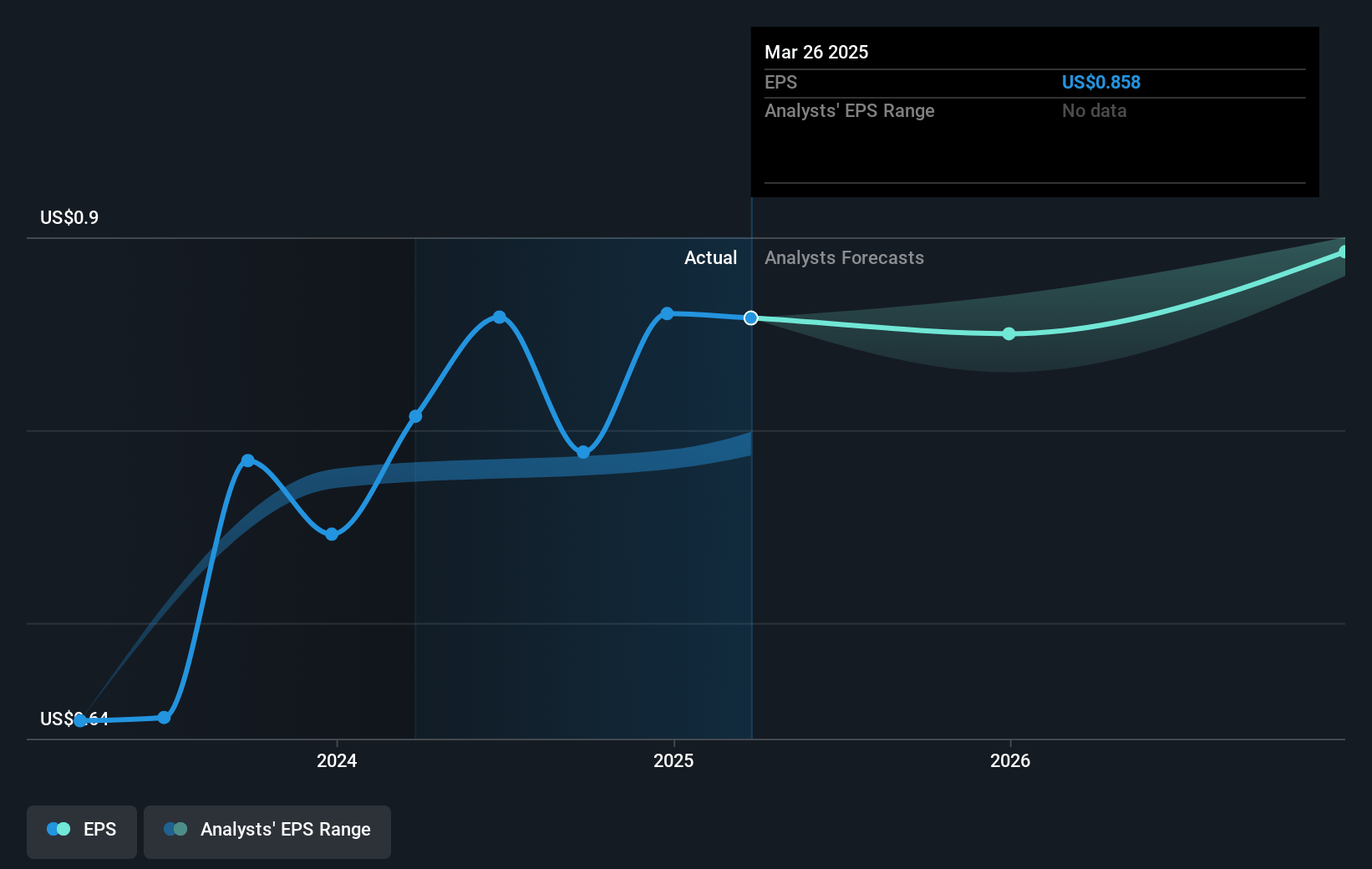

- The bearish analysts expect earnings to reach $24.7 million (and earnings per share of $0.91) by about June 2028, down from $25.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.6x on those 2028 earnings, up from 13.3x today. This future PE is lower than the current PE for the US Hospitality industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.75%, as per the Simply Wall St company report.

El Pollo Loco Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued menu innovation and brand relaunches, such as Mango Habanero Fire Grilled Chicken, Fresca wraps, and new quesadillas, have demonstrated early success in attracting new and lapsed customers, suggesting that sustained product innovation could drive higher comparable store sales and revenue growth.

- The company's strategic focus on expanding outside its historically concentrated California base, coupled with a robust pipeline for new restaurant openings in multiple states, indicates the potential for meaningful topline and unit growth, reducing reliance on any single region and broadening the overall addressable market.

- Investments in kitchen technology, process improvements, and supply chain optimization (exemplified by projects like Project Fire and the transition to PFG distribution) are expected to deliver ongoing margin improvements and operational efficiencies, which would enhance restaurant-level profitability and support positive earnings trajectory over the long term.

- Accelerated remodel and modernization efforts, including a two-tiered approach for both low-cost and more extensive refurbishments, aim to revitalize a significant portion of the restaurant base; early results have shown positive sales and economic returns, which could bolster average unit volumes and cash flow as these initiatives roll out system-wide.

- Strengthening of digital capabilities, such as expanding kiosk deployment and leveraging technology for merchandising and operational enhancements, positions the company to capitalize on consumer shifts toward convenience and digital ordering, potentially increasing transaction counts and sustained revenue improvements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for El Pollo Loco Holdings is $11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of El Pollo Loco Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $510.2 million, earnings will come to $24.7 million, and it would be trading on a PE ratio of 17.6x, assuming you use a discount rate of 9.7%.

- Given the current share price of $11.2, the bearish analyst price target of $11.0 is 1.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.