Narratives are currently in beta

Key Takeaways

- Data-driven strategies and tech investments boost customer engagement, operational performance, and net margins, driving future revenue growth.

- Strong pipeline for new restaurant openings and focus on employee satisfaction enhance operational execution and support market share gains.

- Persistent inflation and delayed new openings due to Hurricane Milton may challenge earnings stability and revenue growth in a pressured breakfast and brunch market.

Catalysts

About First Watch Restaurant Group- Through its subsidiaries, operates and franchises restaurants under the First Watch trade name in the United States.

- First Watch is leveraging data-driven demand generation strategies to effectively attract new customers and increase frequency of visits, which can positively impact future revenue growth.

- The company is making significant investments in technology, both in back-of-house operations and front-of-house efficiencies, to enhance operational performance and improve net margins.

- Improved restaurant-level operating efficiencies, including significant reductions in ticket times, are supporting market share gains, which could lead to enhanced earnings as the company outperforms the broader casual dining segment.

- First Watch's strong pipeline for new restaurant openings, including high-performing freestanding locations, suggests robust revenue potential, expected to accelerate unit growth toward a long-term target of 2,200 domestic units.

- The focus on employee satisfaction, recognized through their award for being the #1 Most Loved Workplace, is likely to bolster operational execution and reduce costs associated with high employee turnover, positively impacting net margins.

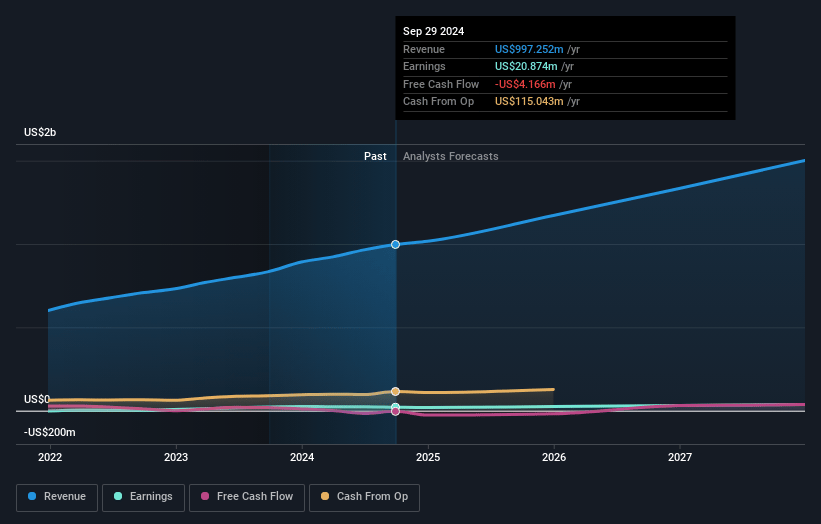

First Watch Restaurant Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Watch Restaurant Group's revenue will grow by 13.8% annually over the next 3 years.

- Analysts are assuming First Watch Restaurant Group's profit margins will remain the same at 2.1% over the next 3 years.

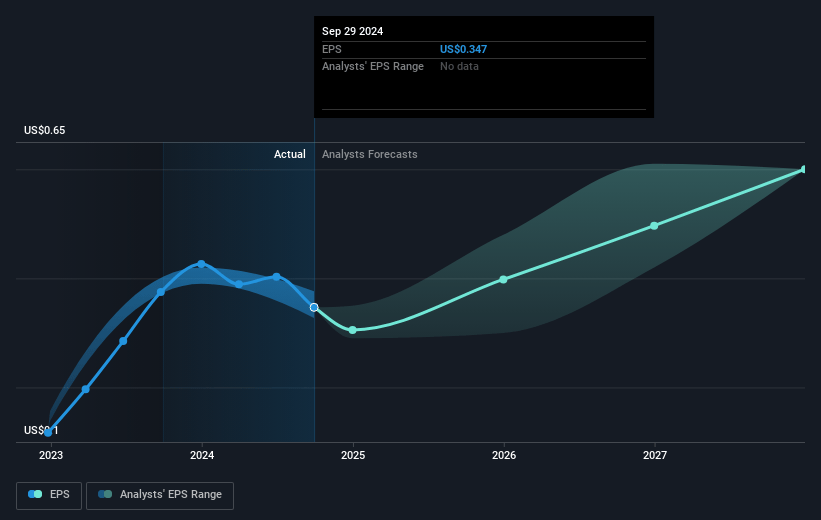

- Analysts expect earnings to reach $31.3 million (and earnings per share of $0.5) by about January 2028, up from $20.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $39.2 million in earnings, and the most bearish expecting $25.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 61.7x on those 2028 earnings, up from 61.6x today. This future PE is greater than the current PE for the US Hospitality industry at 24.3x.

- Analysts expect the number of shares outstanding to grow by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.92%, as per the Simply Wall St company report.

First Watch Restaurant Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Negative same-restaurant sales of 1.9% and a decline in same-restaurant traffic by 4.4% indicate a challenge in driving consistent guest visits, potentially impacting future revenue growth.

- Third-party delivery traffic trends are described as more negative, which could pose a risk to overall traffic figures and off-premise revenue, concealing improvements in other channels.

- Persistent inflationary pressures on food and labor costs, with a reported 3.4% for commodities and 3.8% for labor in the third quarter, might squeeze net margins if not managed effectively.

- The company's delayed new restaurant openings due to construction-related disruptions from Hurricane Milton highlight potential risks in achieving revenue targets and expected growth timelines.

- High dependency on improving dining room traffic amidst macroeconomic pressure on the breakfast and brunch segment introduces uncertainties that may prolong the challenges in stabilizing and growing earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.09 for First Watch Restaurant Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $31.3 million, and it would be trading on a PE ratio of 61.7x, assuming you use a discount rate of 8.9%.

- Given the current share price of $21.23, the analyst's price target of $24.09 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives