Last Update07 May 25Fair value Decreased 14%

Key Takeaways

- Generative AI integration boosts Duolingo’s content creation efficiency, enabling rapid expansion into new subjects and supporting higher engagement, operating leverage, and margin improvement.

- International and subject-matter expansion, combined with innovative premium offerings, positions Duolingo for sustained revenue growth and enhanced long-term monetization.

- Core language learning market saturation, regulatory pressures, and tough AI competition threaten Duolingo’s revenue growth, while new verticals and weaker economies heighten risk and limit expansion.

Catalysts

About Duolingo- Operates as a mobile learning platform in the United States, the United Kingdom, and internationally.

- Duolingo is uniquely positioned to capitalize on the growing worldwide demand for language skills—evidenced by their rapid DAU growth and high engagement across both mature and emerging markets—as internet and smartphone adoption continues to rise, which significantly expands their total addressable market and will propel sustained user and revenue growth for many years.

- The further adoption and integration of generative AI is rapidly increasing the efficiency and speed of Duolingo’s content creation and personalization, allowing for the accelerated rollout of new language modules, verticals (like chess, math, and music), and advanced user features—a shift that will support substantial operating leverage, enhance user engagement, and drive margin expansion as content creation costs decline and product velocity increases.

- Duolingo’s expansion into adjacent learning subjects through the same gamified, subscription-based model is already demonstrating early monetization, features low incremental cost due to scalable AI production, and offers sizable new revenue streams over the long term as subjects like math and chess ramp from millions to tens of millions of active users, supporting future ARPU and earnings acceleration.

- The move towards international expansion, especially targeting English learners where Duolingo remains underpenetrated, is a major forward catalyst. As Duolingo releases more advanced and localized content—now possible via AI—for intermediate and advanced English learners, there is potential to reach the 80 percent share of global language learners that focus on English, which will substantially grow revenue and improve ARPU over time.

- Duolingo’s ongoing innovation in premium product tiers, pricing optimization (including geographic and feature-based price tests), and family/subscription plans are driving conversion mix-shift to higher LTV products such as Max, which together with improvements in retention and platform engagement, set the stage for sustained gains in net margins and recurring earnings as monetization efficiency improves.

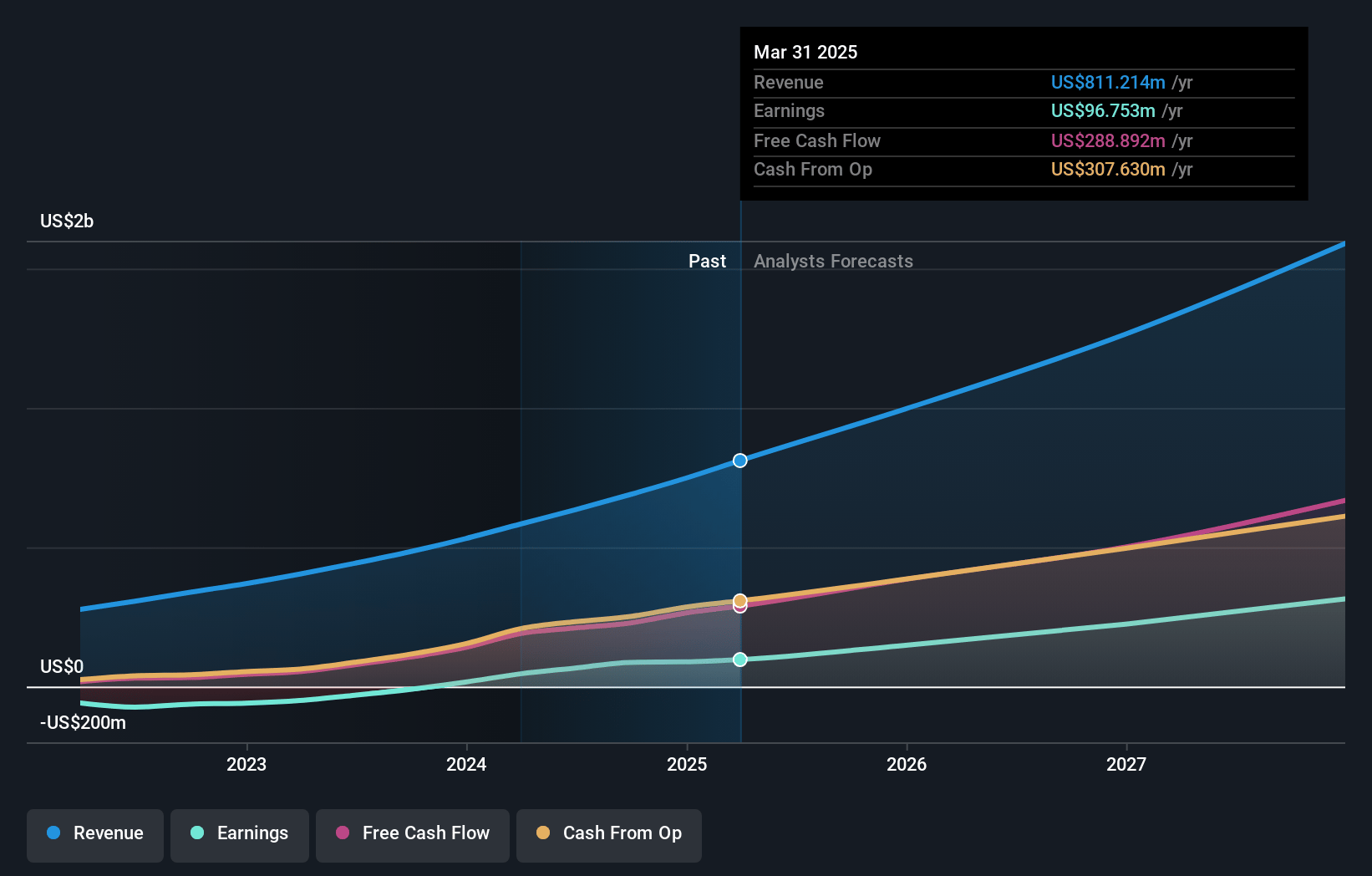

Duolingo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Duolingo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Duolingo's revenue will grow by 28.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.9% today to 20.0% in 3 years time.

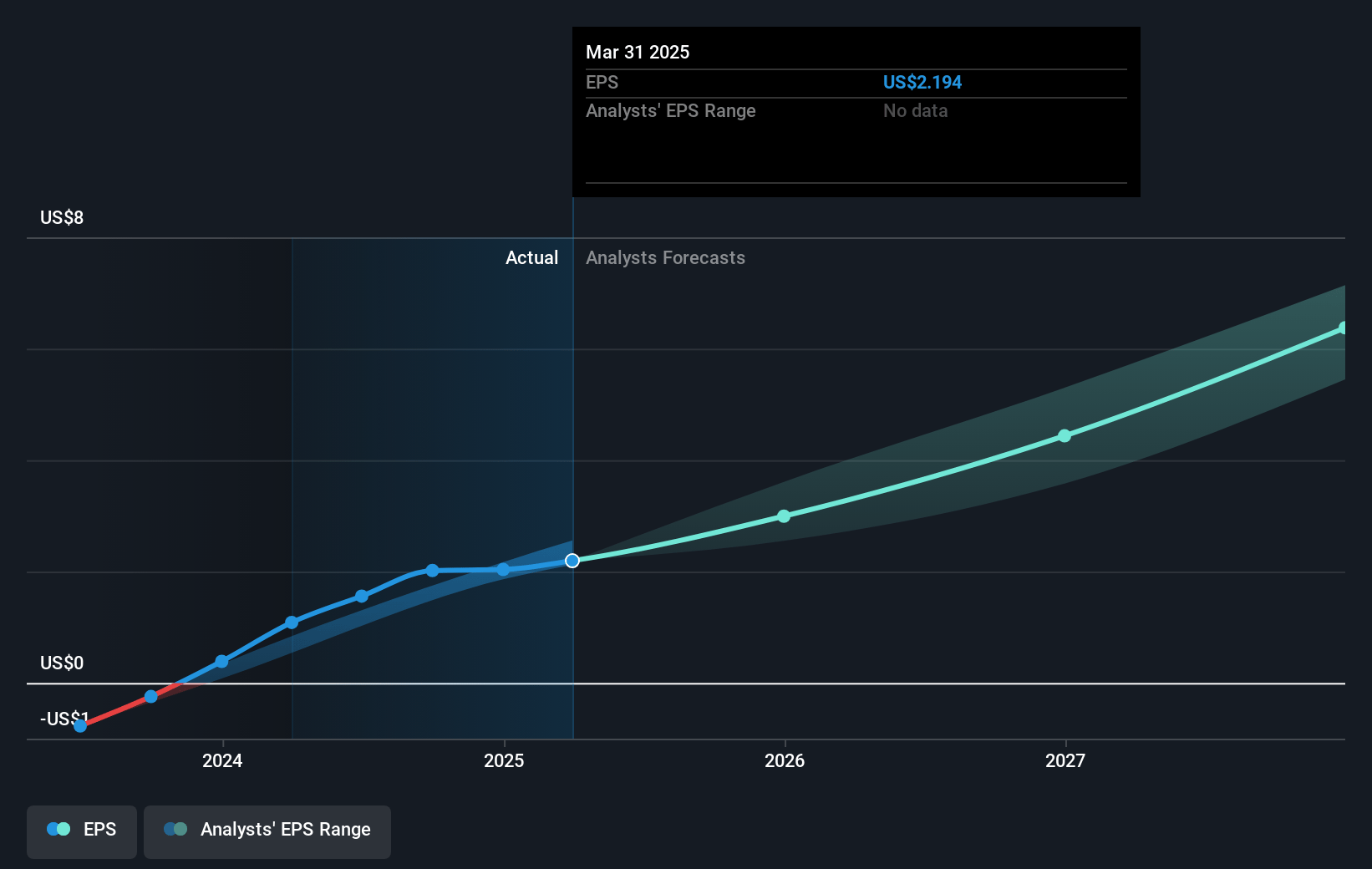

- The bullish analysts expect earnings to reach $344.1 million (and earnings per share of $7.14) by about May 2028, up from $96.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 95.6x on those 2028 earnings, down from 230.5x today. This future PE is greater than the current PE for the US Consumer Services industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 5.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.42%, as per the Simply Wall St company report.

Duolingo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s heavy reliance on a freemium model and advertising-funded free users could be undermined by intensifying global data privacy regulations, which may constrain both user data collection and targeted monetization efforts, thereby directly limiting future advertising revenue growth and the company’s pricing flexibility.

- The new math, music, and chess verticals are significantly smaller in user base and monetization compared to language learning and are expected to take years to scale meaningfully, so failure to grow these segments as rapidly as hoped could lead to an over-reliance on mature language learning markets and cap long-term revenue and earnings growth.

- Management acknowledges diminishing returns from adding additional language courses, as most major languages and large geographic gaps have already been addressed, which may lead to saturation in Duolingo’s core segment and a slowdown in organic user growth, potentially pressuring top-line revenue expansion.

- Duolingo’s focus on rapid AI-driven feature and content development is mirrored by rising competition from larger tech companies (such as Google and Apple) and specialized edtech startups leveraging generative AI, a dynamic that could erode Duolingo’s user base, compress market share, and limit revenue and gross profit margin growth.

- As global economic uncertainty persists, with particular exposure in lower GDP per capita regions where user conversion rates are weak, any prolonged downturn or inflationary environment could reduce both consumer discretionary spend and institutional education budgets, directly elevating churn rates and flattening subscription and bookings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Duolingo is $515.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Duolingo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $515.0, and the most bearish reporting a price target of just $315.12.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $344.1 million, and it would be trading on a PE ratio of 95.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $490.55, the bullish analyst price target of $515.0 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives