Key Takeaways

- Reliance on traditional dine-in concepts and slow health-focused innovation risk alienating consumers and driving long-term sales declines amid changing food preferences and convenience expectations.

- Persistent cost pressures, sluggish international growth, and operational inflexibility limit margin expansion and increase vulnerability to macroeconomic and competitive challenges.

- Operational improvements, tech adoption, menu simplification, and financial discipline are strengthening margins, guest satisfaction, and setting up Bloomin’ Brands for long-term growth.

Catalysts

About Bloomin' Brands- Through its subsidiaries, owns and operates casual, polished casual, and fine dining restaurants in the United States and internationally.

- The growing consumer shift towards healthier, fresher, and less processed foods threatens to reduce demand for Bloomin' Brands' core casual dining concepts, which are still closely associated with higher-calorie, larger-portion menus and have only made incremental progress on health-focused innovation; this will likely further pressure same-store sales and erode long-term revenue growth.

- As fast-casual and delivery-focused competitors continue to gain market share, Bloomin' Brands’ reliance on traditional dine-in experiences leaves its brands increasingly out of step with evolving consumer expectations for convenience and speed, which could drive sustained declines in guest traffic, particularly among younger demographics, and result in a protracted negative comp sales trend.

- Persistent labor market tightness and ongoing wage inflation are driving up restaurant operating costs, while the company’s relatively low mix of franchised (asset-light) units results in heightened fixed costs and operational inflexibility, leading to continued compression in net margins and higher sensitivity to macroeconomic shocks.

- Sluggish progress on international expansion compared to industry peers limits Bloomin’ Brands’ access to faster-growing markets, increasing its dependence on the oversaturated and highly competitive U.S. casual dining space — a dynamic that is likely to restrict top-line growth and leave earnings vulnerable to U.S.-centric cyclical downturns.

- Rising commodity costs and further volatility in tariffs or supply chains disproportionately challenge premium-leaning menus like Outback’s, but ongoing menu simplification and value promos are unlikely to fully offset these structural headwinds; as a result, restaurant-level margins are set to remain pressured and any earnings improvement is likely to be slow and costly.

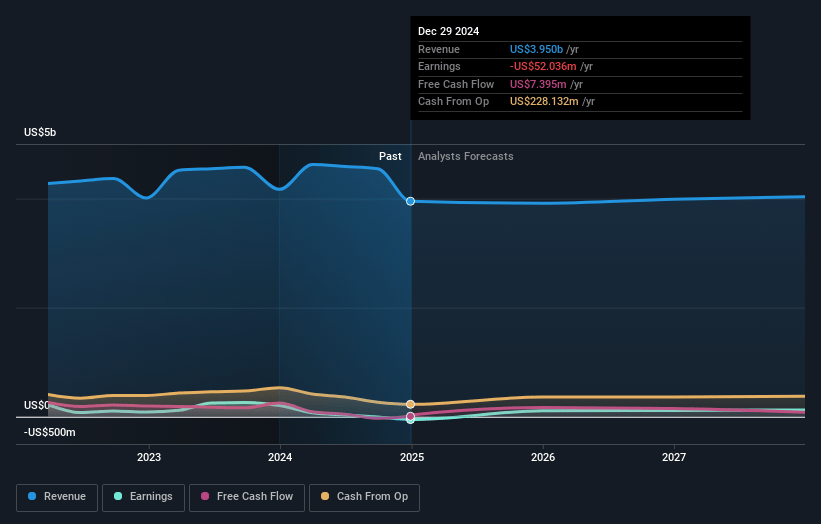

Bloomin' Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bloomin' Brands compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bloomin' Brands's revenue will decrease by 0.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.0% today to 3.4% in 3 years time.

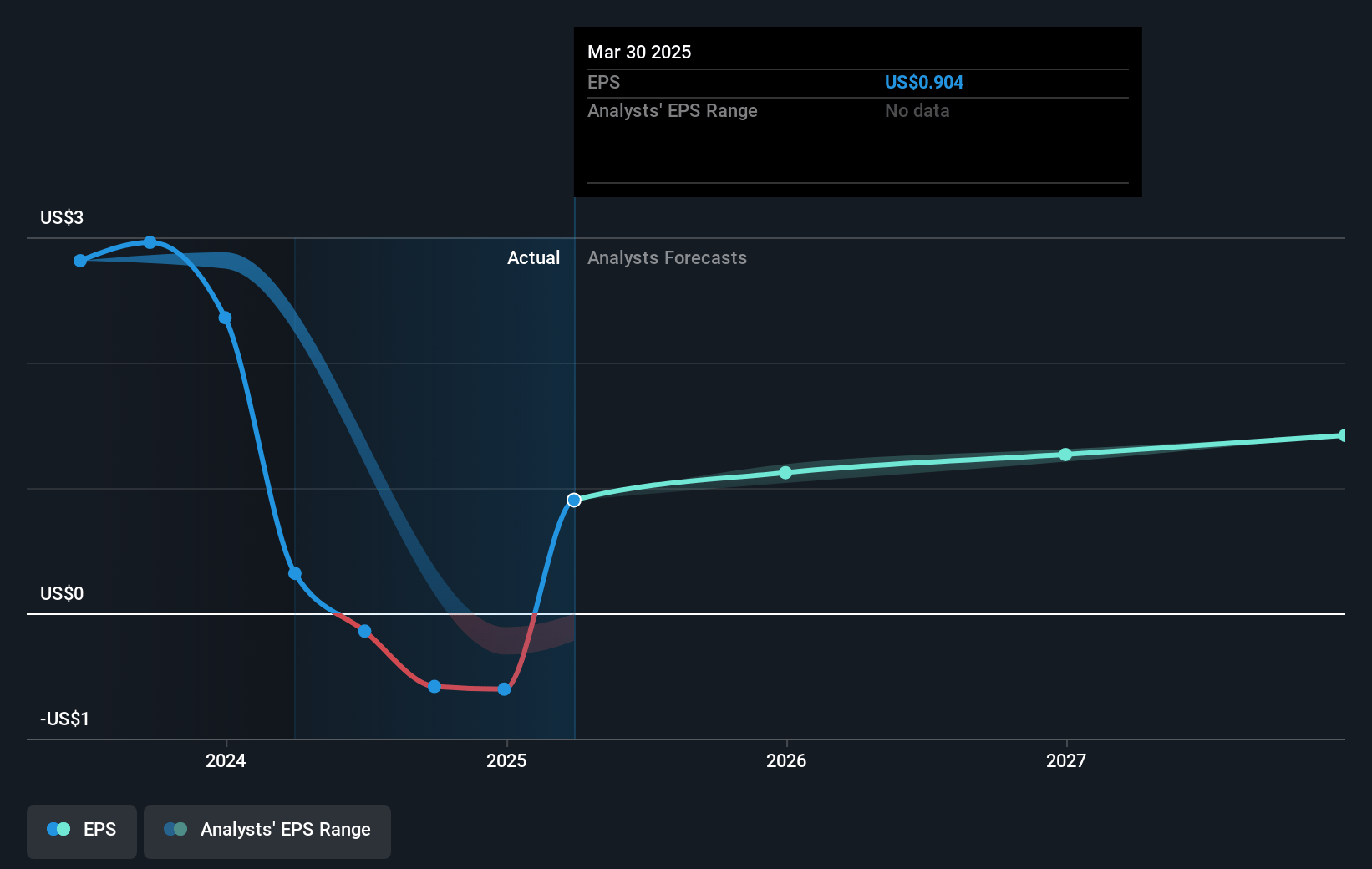

- The bearish analysts expect earnings to reach $132.5 million (and earnings per share of $1.53) by about July 2028, up from $77.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, down from 10.3x today. This future PE is lower than the current PE for the US Hospitality industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Bloomin' Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bloomin' Brands is demonstrating operational discipline and cost control, having realized more G&A expense savings than forecasted with an ongoing organizational redesign, which can improve net margins and long-term earnings as the company further streamlines its operations.

- The company is seeing success with digital technology investments, such as the rollout of Ziosk tablets, which are improving table turns and enabling immediate customer feedback, enhancing operational efficiency and potentially supporting higher revenue and margins through better guest experience and service optimization.

- Menu simplification across brands is being received positively by both employees and guests, reducing complexity and potentially increasing consistency and quality, which could drive higher guest satisfaction, repeat visits, and improved restaurant-level margins.

- The company’s strong liquidity, active debt paydown plan, and healthy cash flow provide resilience and financial flexibility, enabling continued reinvestment in core brands and shareholder capital returns, supporting earnings stability and potentially higher shareholder returns over time.

- Test stores for the Outback turnaround are showing early positive results in guest experience, food quality, and value, with feedback loops from technology enabling agile strategy execution; if this scales successfully, it could drive a sustainable traffic and comp sales recovery, reversing recent declines and bolstering long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bloomin' Brands is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bloomin' Brands's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.9 billion, earnings will come to $132.5 million, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 11.6%.

- Given the current share price of $9.36, the bearish analyst price target of $7.0 is 33.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.