Key Takeaways

- Strategic acquisitions and expansion in medical practice solutions are expected to enhance revenue, profitability, and operational efficiency.

- Strong cash flow and disciplined M&A strategy position Afya for sustained earnings and growth opportunities.

- Dependence on acquisitions and seat expansions could risk integration, while competitive pressures may affect revenue growth and profit margins in education segments.

Catalysts

About Afya- Operates as a medical education group in Brazil.

- The acquisition of Unidom, which brings additional medical seats and strengthens the company's presence in key metropolitan areas like Salvador, is expected to enhance Afya's revenue growth and profitability through increased enrollments and higher tuition rates. This expansion is likely to impact revenue and earnings positively.

- A strategic focus on expanding Medical Practice Solutions through increased B2B and B2P engagements is set to drive higher revenue in this segment, supported by a 28% increase in new contracts, particularly with the pharma industry. This expansion is projected to enhance net margins by leveraging operational efficiencies.

- The company's commitment to maintaining cash conversion efficiency and stable net debt levels, even after significant acquisitions, positions it to sustain strong cash flows and potentially higher earnings, facilitating further strategic investments and potential dividend distributions.

- Afya's operational restructuring in Continuing Education and Medical Practice Solutions is expected to support margin expansion due to improved efficiencies, potentially leading to better EBITDA margins and overall earnings growth.

- A favorable M&A environment with potential lower acquisition multiples and a disciplined focus on acquiring highly concentrated medical institutions anticipates future growth opportunities in revenue and net income, as Afya continues to expand its strategic footprint.

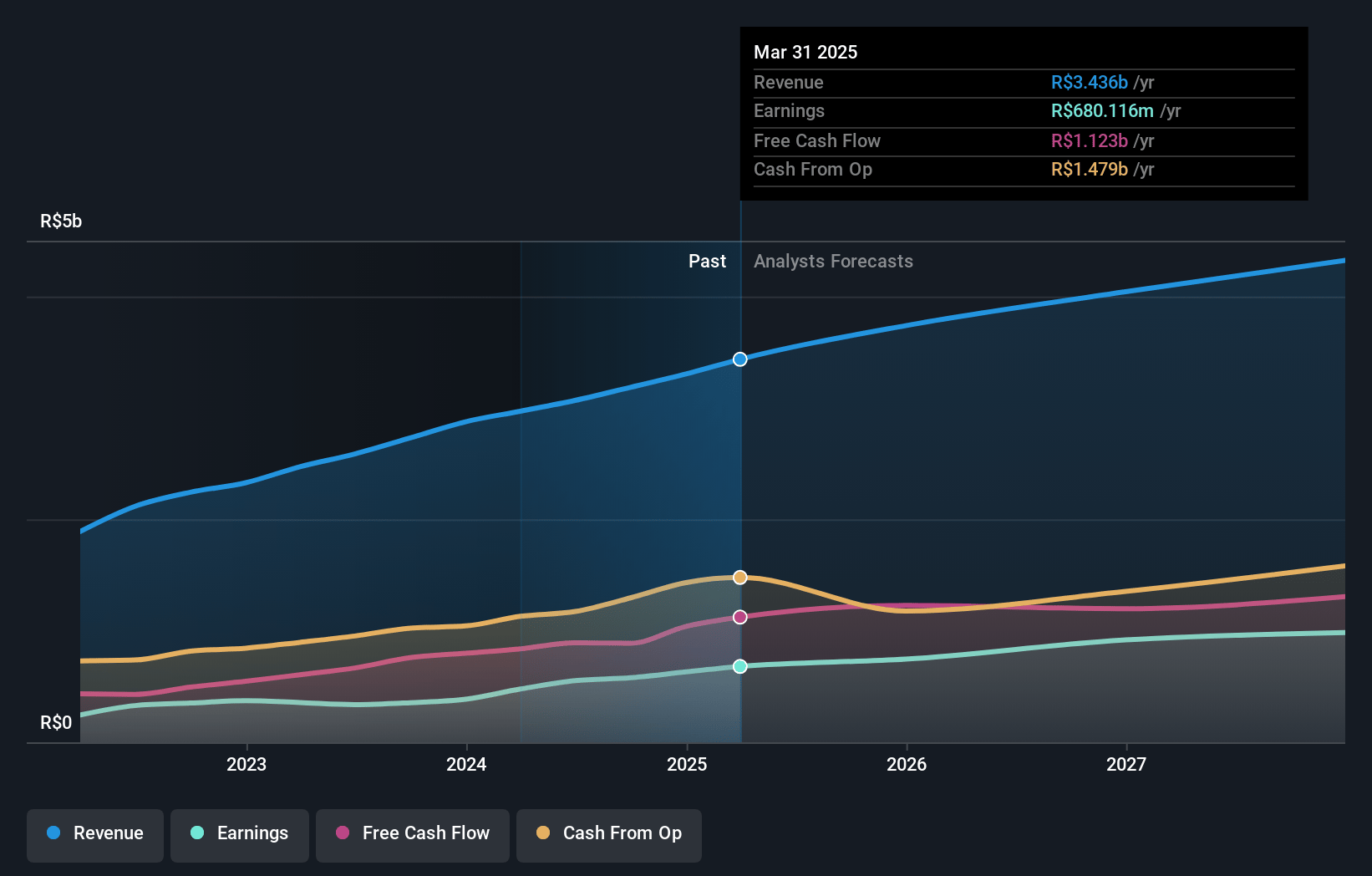

Afya Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Afya's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.2% today to 27.6% in 3 years time.

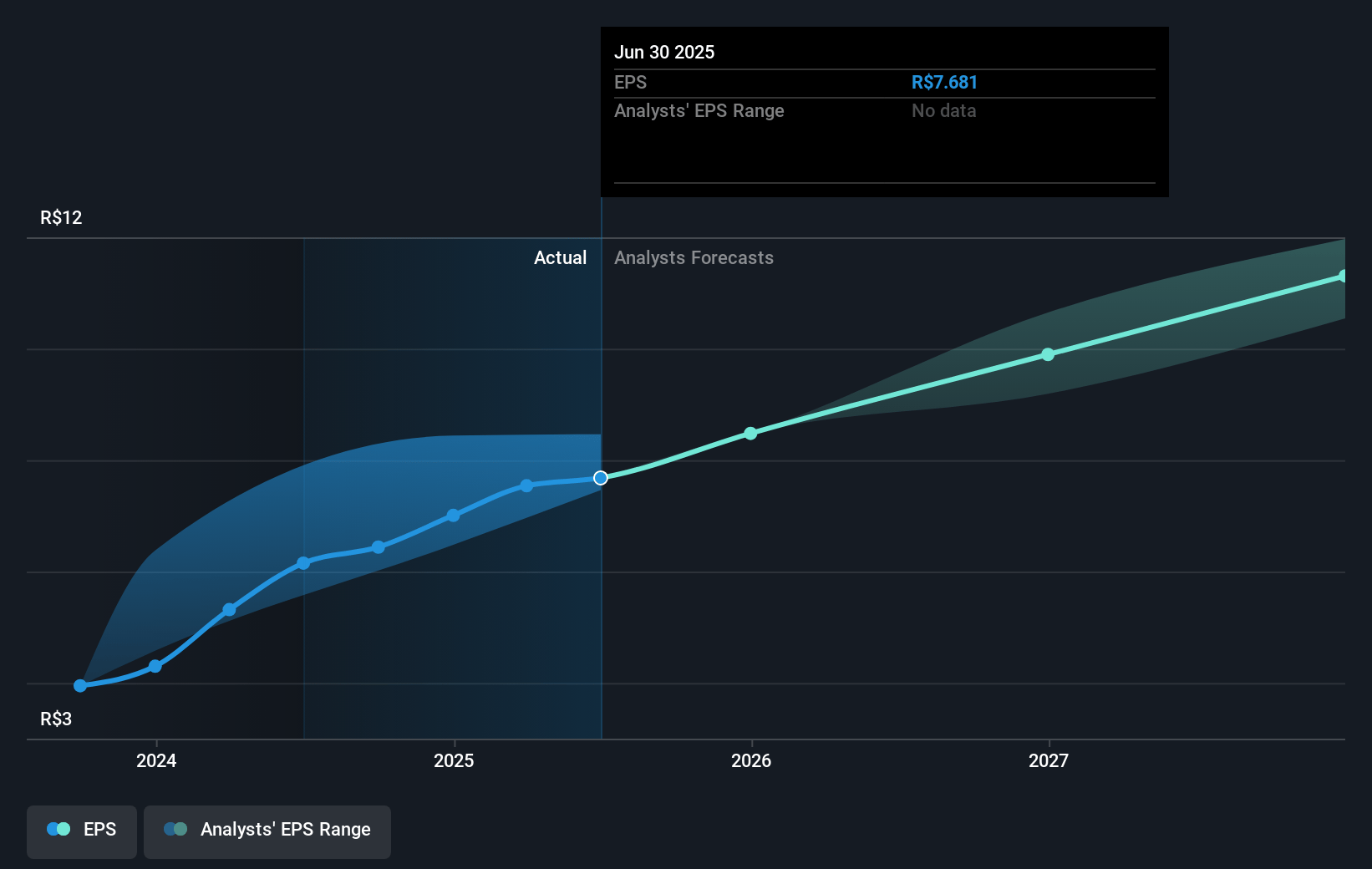

- Analysts expect earnings to reach R$1.2 billion (and earnings per share of R$14.86) by about January 2028, up from R$579.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$824 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, down from 15.1x today. This future PE is lower than the current PE for the US Consumer Services industry at 20.7x.

- Analysts expect the number of shares outstanding to decline by 4.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.61%, as per the Simply Wall St company report.

Afya Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's reliance on new acquisitions and seat expansions for growth could pose integration risks, affecting revenue stability and operational efficiency.

- Declining monthly active users on digital services platforms could signal challenges in user engagement, potentially impacting ongoing revenue from digital solutions.

- The completion of operational restructuring suggests limited room for further efficiency gains, which could constrain future improvements in net margins and EBITDA growth.

- Speculation around refinancing or redemption of soft loans, such as the SoftBank debt, introduces financial uncertainty that may impact future capital allocation priorities and net earnings.

- The potential increase in competitive pressure on tuition rates and candidate intake could affect revenue growth and profit margins in the core education segments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.75 for Afya based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.34, and the most bearish reporting a price target of just $16.44.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$4.3 billion, earnings will come to R$1.2 billion, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 10.6%.

- Given the current share price of $16.46, the analyst's price target of $19.75 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

NA

NateF

Community Contributor

AFYA Market Outlook

Afya Limited (NASDAQ: AFYA) is a Brazilian company specializing in medical education and digital health services. Sector: Education Industry: Medical Education Market Capitalization: $1.4b (small cap) Major Competitors: Afya Limited (NASDAQ: AFYA) is a prominent player in Brazil's medical education sector.

View narrativeUS$14.86

FV

16.8% overvalued intrinsic discount9.72%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

4users have followed this narrative

about 1 month ago author updated this narrative