Key Takeaways

- Rapid consumer shift to digital healthcare and e-commerce is eroding the relevance and profitability of Walgreens' brick-and-mortar retail model.

- Persistent underinvestment in technology and mounting regulatory pressures are constraining margins, competitiveness, and long-term sales growth.

- Improving contract negotiations, store optimization, automation, digital investments, and international growth are driving operational efficiency, revenue gains, and greater long-term earnings stability.

Catalysts

About Walgreens Boots Alliance- Operates as a healthcare, pharmacy, and retail company in the United States, Germany, the United Kingdom, and internationally.

- The rapid acceleration in consumer preference towards digital healthcare and e-commerce channels is undermining Walgreens' core brick-and-mortar retail model, with management explicitly acknowledging persistent weakness in front-end retail and ongoing channel shifting; this secular shift is likely to result in long-term declines in store traffic and continued erosion of retail revenue.

- Increasing dominance and vertical integration of pharmacy benefit managers and large healthcare entities such as Amazon and CVS is compressing reimbursement rates for standalone chains like Walgreens, even as recent contract renegotiations offer only limited near-term relief; this sustained pricing pressure will likely drive further margin contraction in the pharmacy segment and weigh on net earnings in future years.

- Despite significant store closures under the Footprint Optimization Program, Walgreens continues to face structural headwinds from an aging customer base that is increasingly demanding online delivery and home healthcare services, thereby diminishing the relevance and profitability of its remaining physical locations and constraining long-term same-store sales growth.

- Chronic underinvestment in technology and digital customer experience relative to industry peers leaves Walgreens slow to adapt to evolving consumer expectations, risking ongoing revenue stagnation and share loss as the pharmacy and health retail landscape becomes more omni-channel and digitally driven.

- Escalating regulatory pressures-including changes on generic drug pricing and pharmacy reimbursement-combined with intensified industry-wide price transparency and consumer price sensitivity, threaten to further compress gross margins and reduce the company's ability to grow operating income over the long run.

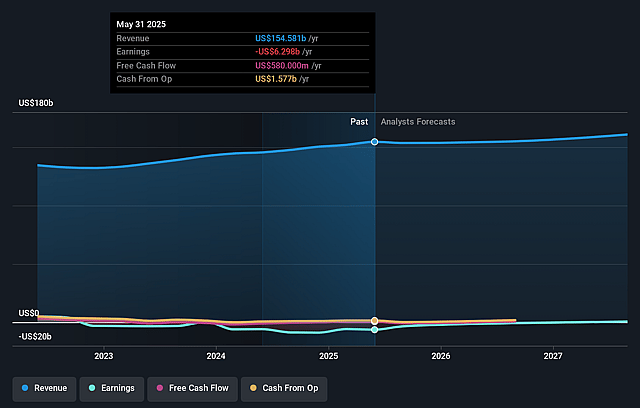

Walgreens Boots Alliance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Walgreens Boots Alliance compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Walgreens Boots Alliance's revenue will decrease by 0.0% annually over the next 3 years.

- The bearish analysts are not forecasting that Walgreens Boots Alliance will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Walgreens Boots Alliance's profit margin will increase from -3.8% to the average US Consumer Retailing industry of 2.7% in 3 years.

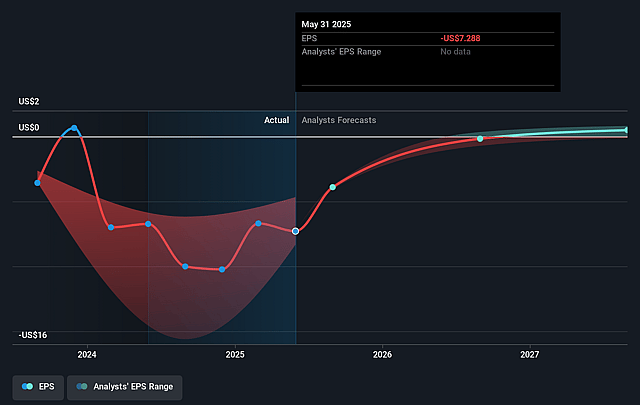

- If Walgreens Boots Alliance's profit margin were to converge on the industry average, you could expect earnings to reach $4.1 billion (and earnings per share of $4.75) by about June 2028, up from $-5.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 2.9x on those 2028 earnings, up from -1.7x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 21.9x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Walgreens Boots Alliance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's success in renegotiating reimbursement contracts with pharmacy benefit managers for 2025 has resulted in reduced margin pressure and increased stability, setting the stage for improved net margins and earnings growth in future years.

- The store footprint optimization-closing underperforming locations and retaining a higher-performing store base-has led to outperforming sales growth and script retention in the remaining fleet, supporting potential increases in consolidated revenue and operating income over the long term.

- Significant advancements in automation and micro fulfillment centers are lowering pharmacy fulfillment costs and freeing up pharmacists to focus on higher-value clinical services, enabling operational efficiency gains that can enhance net margins and profitability.

- Accelerating digital and omnichannel investments, including same-day delivery, virtual care, and a modernized loyalty program, position Walgreens to tap into changing consumer preferences and capture greater share of healthcare and retail spending, which could drive top-line revenue growth.

- The turnaround and strong growth in Boots UK and international operations, as evidenced by robust retail sales and expanding e-commerce contributions, provide a diversified earnings base that mitigates U.S. retail headwinds and may contribute to long-term consolidated earnings and free cash flow stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Walgreens Boots Alliance is $10.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Walgreens Boots Alliance's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.21, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $151.8 billion, earnings will come to $4.1 billion, and it would be trading on a PE ratio of 2.9x, assuming you use a discount rate of 11.6%.

- Given the current share price of $11.31, the bearish analyst price target of $10.0 is 13.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.