Key Takeaways

- Store optimization, automation, and digital health investments are driving stronger margins, higher operating leverage, and long-term earnings growth through increased prescription volumes and cost efficiencies.

- Expansion into health services, own brands, and integrated care uniquely positions the company to boost customer loyalty, revenue diversity, and structural margin improvement.

- Slow digital adoption, declining in-store sales, shrinking margins, and disruptive industry shifts threaten revenue, profitability, and long-term competitive position.

Catalysts

About Walgreens Boots Alliance- Operates as a healthcare, pharmacy, and retail company in the United States, Germany, the United Kingdom, and internationally.

- Analyst consensus expects store closures to improve profitability, but the company's store retention and script transfer rates are significantly outperforming historical averages, indicating a potential for a much stronger uplift in net margins and EBITDA as high-performing locations capture additional volume and deliver greater operating leverage than previously modeled.

- Analysts broadly agree that pharmacy micro fulfillment centers will support cost reduction, but current year-over-year results-a 23% increase in shipped volume and 13% lower fill cost-suggest rollout could accelerate, enabling faster gross margin improvement and allowing pharmacists to focus more on reimbursable clinical services, enhancing earnings power.

- Walgreens' investments in digital health capabilities and omnichannel experience-including home delivery, virtual care, and integrated pharmacy management-uniquely position the company to capture outsized prescription volume growth and customer loyalty as consumers demand convenience in an era of rising digital health adoption, creating substantial long-term revenue upside.

- The company's strategic focus on expanding health and wellness and launching high-margin own brand products addresses the growing need for preventive care and self-care among an aging population, which is likely to drive sustained comps growth, increase basket size, and structurally improve gross margins over time.

- Walgreens is positioning itself as a key last-mile healthcare provider amid expanding insurance coverage and value-based care ecosystems, and stands to benefit from long-term growth in specialty and chronic disease prescriptions as well as partnerships with providers and payers, supporting robust top-line growth and higher-margin ancillary service revenues.

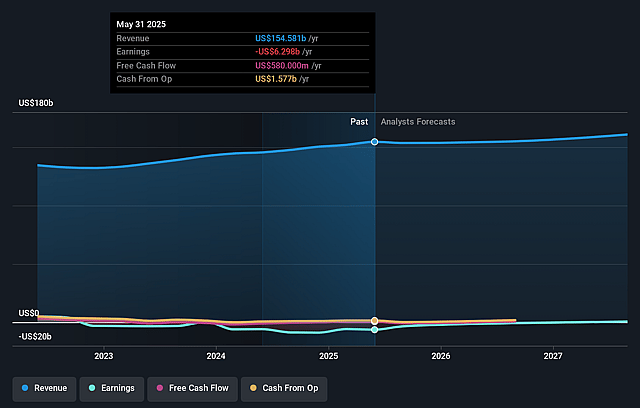

Walgreens Boots Alliance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Walgreens Boots Alliance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Walgreens Boots Alliance's revenue will grow by 4.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -4.1% today to 0.7% in 3 years time.

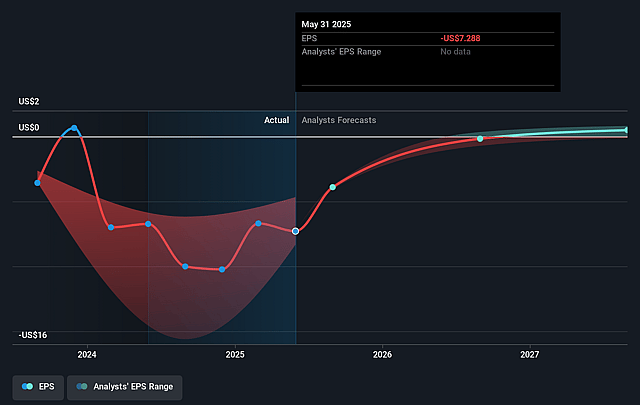

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $1.59) by about August 2028, up from $-6.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from -1.6x today. This future PE is lower than the current PE for the US Consumer Retailing industry at 21.5x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.55%, as per the Simply Wall St company report.

Walgreens Boots Alliance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift toward e-commerce and online health services is contributing to persistent declines in in-store retail sales, as indicated by comparable retail sales dropping 4.6 percent in the quarter, which pressures revenue growth and undermines the viability of the physical store network over time.

- Walgreens Boots Alliance continues to face significant profit margin pressure from shrinking reimbursement rates, as well as the growing bargaining power of government payers, with management highlighting that contract renegotiations are only partly offsetting years of margin decline, suggesting continued risk to net margins and long-term earnings stability.

- Underinvestment in digital transformation and reliance on legacy store-based models leave Walgreens Boots Alliance at a strategic disadvantage versus tech-enabled competitors, making it more difficult to capture growth from shifting consumer behaviors, which is likely to erode both revenue and market share in future years.

- Accelerated store closures, while intended to optimize the company's footprint, risk triggering one-off asset write-downs, reduced economies of scale, and ongoing declines in operating leverage, which could weigh on bottom-line profitability and depress future earnings.

- The proliferation of telehealth providers, mail-order pharmacies, and industry consolidation via vertical integration by insurers and PBMs is diverting prescription volume away from Walgreens' stores and reducing the company's prescription reimbursement rates, which directly threatens both revenue and gross profit in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Walgreens Boots Alliance is $14.1, which represents two standard deviations above the consensus price target of $11.93. This valuation is based on what can be assumed as the expectations of Walgreens Boots Alliance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $175.6 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 11.6%.

- Given the current share price of $11.92, the bullish analyst price target of $14.1 is 15.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.