Key Takeaways

- Focus on affluent, less interest rate-sensitive buyers and diversification into new markets positions the company for resilient margins and stable growth despite economic cycles.

- Investment in technology and digital sales platforms drives higher efficiency, supporting increased home sales, improved margins, and reduced sensitivity to market fluctuations.

- Shifting demographics, rising rates, evolving housing preferences, and high land costs threaten Toll Brothers’ luxury home model, risking revenue, margins, and stability.

Catalysts

About Toll Brothers- Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

- The persistent undersupply of U.S. housing stock and lack of existing home inventory, particularly in affluent markets, is expected to enable Toll Brothers to sustain robust demand and maintain premium pricing, supporting both top-line revenue growth and strong gross margins in the years ahead.

- Favorable demographic trends, with Millennials and Gen Z increasingly forming new, higher-income households and seeking suburban luxury homes, will continue to expand Toll Brothers’ buyer pool and underpin longer-term absorption rates, positively impacting delivery volumes and overall home sales revenue.

- The company’s focus on luxury and move-up buyers—wealthier clientele less sensitive to interest rates, with over a quarter paying all cash and low loan-to-value ratios—positions Toll Brothers to capture outsized share of the demand driven by rising U.S. affluence and wealth concentration, underpinning margin resilience and revenue durability even through economic cycles.

- Ongoing expansion into new geographic markets and product lines (including active adult, first-time luxury buyers, and multi-family communities) diversifies revenue streams, reduces cyclicality, and supports the company’s forecasted 8–10% growth in community count, laying a foundation for top-line and earnings growth well beyond current analyst expectations.

- Advanced investments in technology, design studio customization, and digital sales platforms are expected to increase conversion rates while reducing selling and general expenses, enhancing net margins and operating leverage as scale and digital adoption grow across the enterprise.

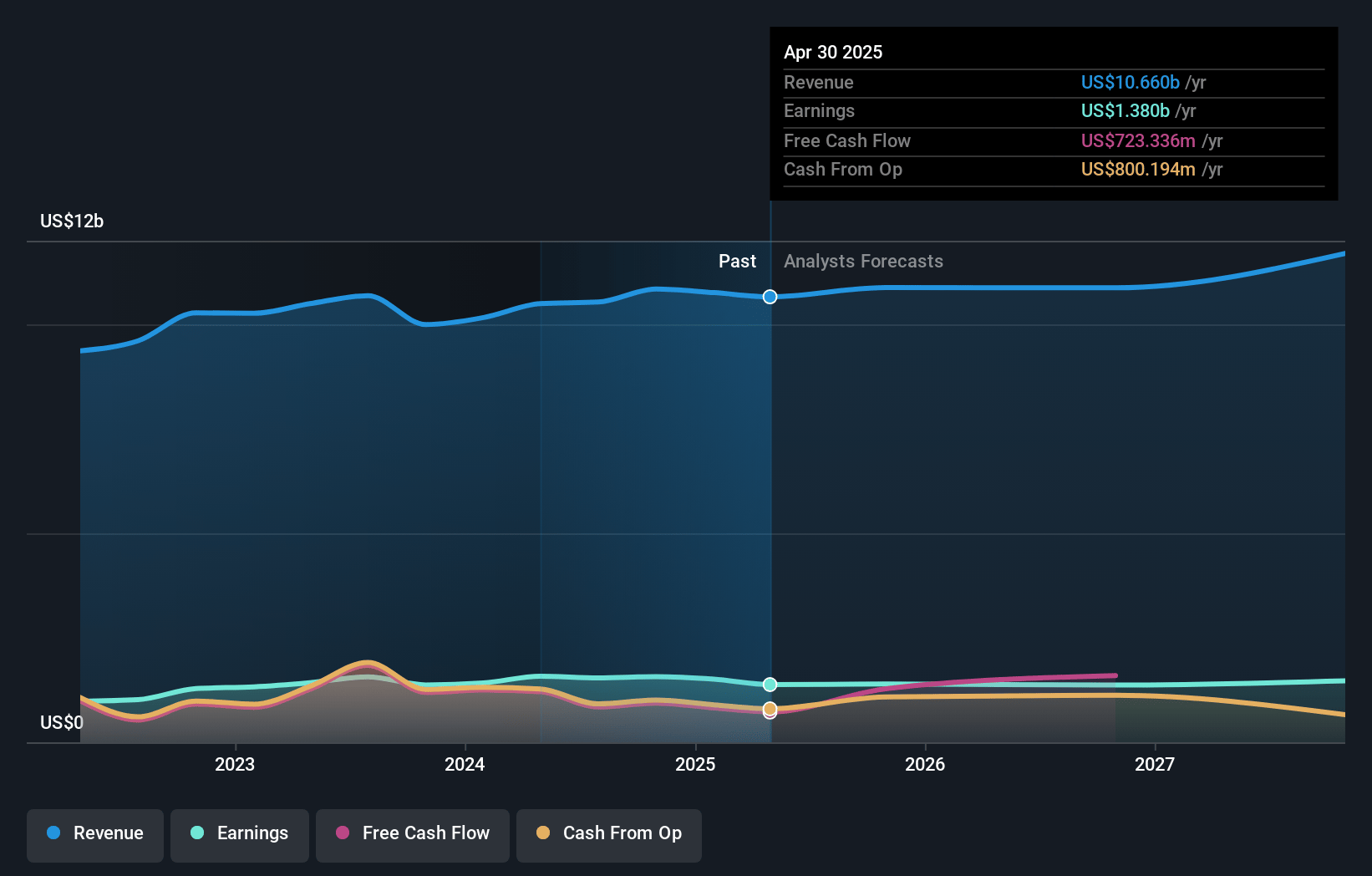

Toll Brothers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Toll Brothers compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Toll Brothers's revenue will grow by 6.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 12.9% today to 12.2% in 3 years time.

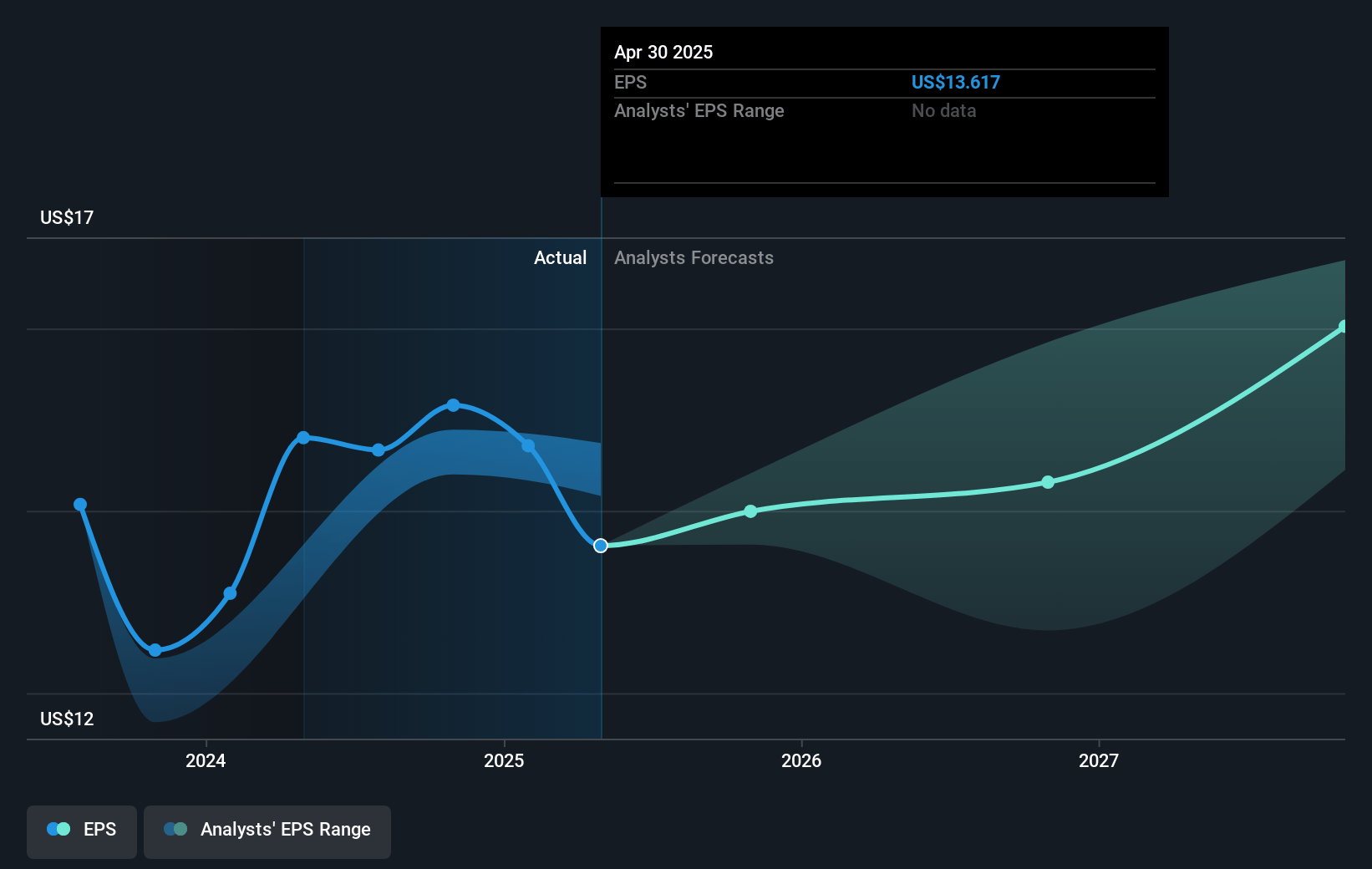

- The bullish analysts expect earnings to reach $1.6 billion (and earnings per share of $17.59) by about July 2028, up from $1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 9.0x today. This future PE is greater than the current PE for the US Consumer Durables industry at 10.4x.

- Analysts expect the number of shares outstanding to decline by 2.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

Toll Brothers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The aging U.S. population may reduce the long-term demand for large, luxury homes—Toll Brothers’ core market—which could lead to lower revenues as their primary customer base shrinks over the next decade.

- Structural increases in interest rates could significantly depress affordability for high-end homes even among affluent buyers, which would likely constrain sales volumes, erode pricing power, and pressure future revenues and margins.

- Toll Brothers’ strong emphasis on suburban luxury and move-up markets exposes it to potential revenue contraction if urbanization trends, preferences for smaller or urban homes, and changing work-from-home dynamics lessen demand for its traditional suburban and large-home products.

- Continued escalation in land acquisition and development costs, which the company cites as being only modest now, could accelerate over the long term and compress gross and net margins, especially if headline land deals and pre-COVID lots run out and the company is forced to rely on higher-priced land.

- The company remains highly concentrated in the luxury and affluent market segment, making it vulnerable to cyclical downturns in specific geographic regions or demographic groups, which could result in more volatile earnings and unpredictable revenue streams over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Toll Brothers is $182.73, which represents two standard deviations above the consensus price target of $139.94. This valuation is based on what can be assumed as the expectations of Toll Brothers's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $183.0, and the most bearish reporting a price target of just $92.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $13.0 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 8.2%.

- Given the current share price of $126.59, the bullish analyst price target of $182.73 is 30.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives