Narratives are currently in beta

Key Takeaways

- Expansion in geographic presence and product lines aims to drive revenue growth by catering to diverse buyer preferences and market conditions.

- Strategic shift to spec homes and operational efficiency is expected to boost return on equity and improve operating margins.

- High mortgage rates, economic uncertainties, and regional challenges may compress margins and affect revenue if market conditions and supply chain issues persist.

Catalysts

About Toll Brothers- Designs, builds, markets, sells, and arranges finance for a range of detached and attached homes in luxury residential communities in the United States.

- Toll Brothers is expanding its geographic presence, product lines, and price points, which is expected to drive future revenue growth by catering to a wider range of buyer preferences and market conditions.

- The company is strategically shifting towards a higher supply of spec homes to improve return on equity (ROE) and operating margins, by turning inventory faster and leveraging overhead costs more efficiently.

- Strong demographic tailwinds, including increased home buying by older and wealthier first-time buyers, along with move-up and move-down buyers who possess significant home equity, are expected to provide a stable revenue base and potentially improve net margins.

- The company's buyback program, which has returned significant capital to shareholders, is expected to continue with an additional $500 million in share repurchases planned for fiscal 2025, aiming to enhance earnings per share (EPS).

- Toll Brothers' emphasis on operational and capital efficiency, such as achieving a higher proportion of optioned land, is designed to maintain high ROE levels and bolster net margins over the long term.

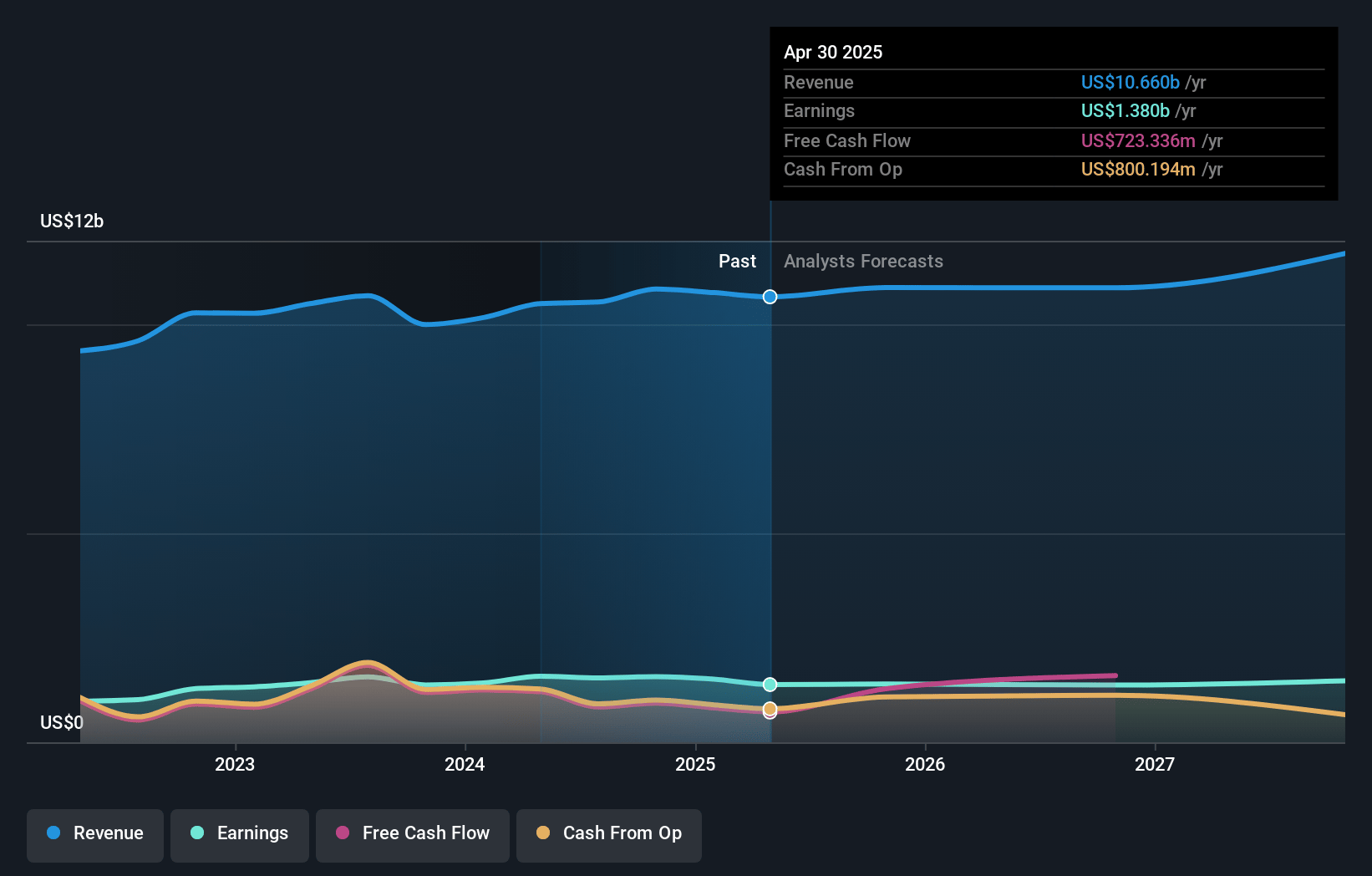

Toll Brothers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Toll Brothers's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.5% today to 12.9% in 3 years time.

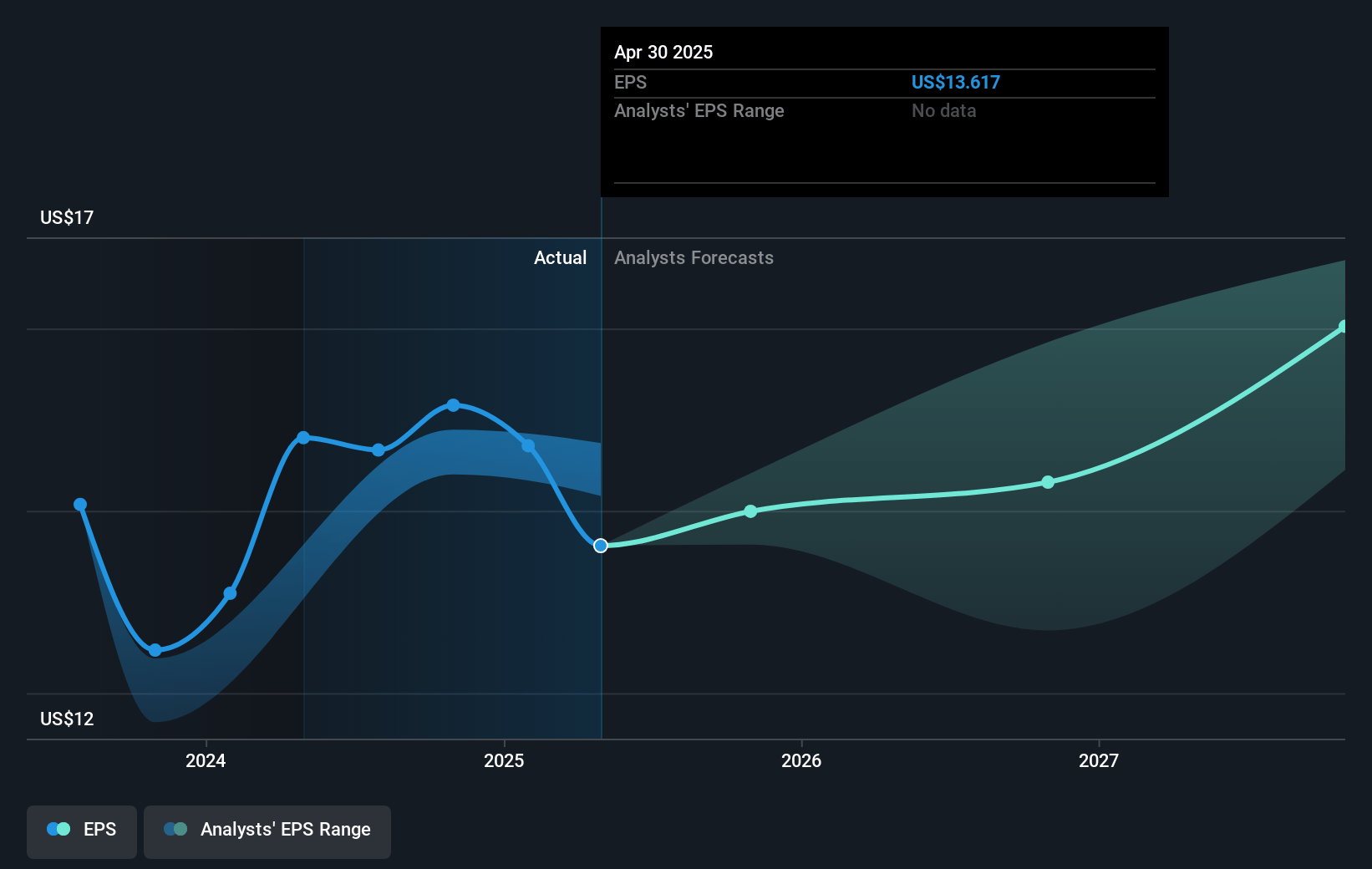

- Analysts expect earnings to remain at the same level they are now, that being $1.6 billion (with an earnings per share of $17.1). The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2027 earnings, up from 8.4x today. This future PE is greater than the current PE for the US Consumer Durables industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 2.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Toll Brothers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising mortgage rates and election uncertainties have previously impacted sales, and future economic or political changes could disrupt demand and affect revenue projections.

- A significant portion of home deliveries is relying on incentives that may not be sustainable long-term, which could compress net margins if market conditions do not improve as anticipated.

- If interest rates remain high or increase, the affordability considerations impacting the broader market might eventually affect even Toll Brothers' affluent buyer base, influencing earnings and margin projections.

- Geographical issues like softer markets in Florida and Phoenix, potentially inflated by recent price hikes and increased inventory, could present regional challenges that affect overall revenue growth.

- Potential tariffs on material imports could introduce cost increases, complicating supply chains and squeezing profit margins if Toll Brothers cannot pass these costs onto consumers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $160.12 for Toll Brothers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $192.0, and the most bearish reporting a price target of just $108.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $12.4 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $132.73, the analyst's price target of $160.12 is 17.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives