Narratives are currently in beta

Key Takeaways

- The strategic focus on quick-turning, move-in-ready homes and entry-level segments strengthens market position, aligning with demographic trends and boosting margins and revenue growth.

- Gulf Coast acquisition and land investment support entry into new markets and future expansion, enhancing operational efficiency and long-term financial stability.

- Volatile mortgage rates, competitive pressures, and construction delays challenge Meritage Homes' margins, earnings, and average selling prices through increased costs and incentives.

Catalysts

About Meritage Homes- Designs and builds single-family attached and detached homes in the United States.

- The Gulf Coast acquisition of Elliott Homes provides Meritage Homes with an entrance into new, underserved markets with a supply of over 5,500 lots, potentially increasing future home delivery volumes in 2025 and beyond, thereby positively impacting revenue growth.

- Meritage Homes' strategic shift towards quick-turning, move-in-ready homes allows them to better capture the market as traditional resale homes become more competitive, which could stabilize and improve net margins due to reduced cycle times and lower inventory holding costs.

- The focus on affordable, entry-level homes continues to be a significant growth driver, with 92% of Q3 2024 orders coming from this segment. This strategic positioning aligns with the demographic trends of millennials and Gen Z entering the housing market, likely boosting future revenue and market share.

- The company's approach to maintaining high backlog conversion rates and strategically aligning spec levels to optimally meet closing commitments enhances operational efficiency, potentially boosting earnings through improved gross margins and overhead leverage.

- Continued investment in land acquisition and development—projected at $2 billion to $2.5 billion for 2024—alongside efforts to engage off-balance sheet land financing, positions Meritage Homes for accelerated growth, supporting revenue expansion and long-term financial stability.

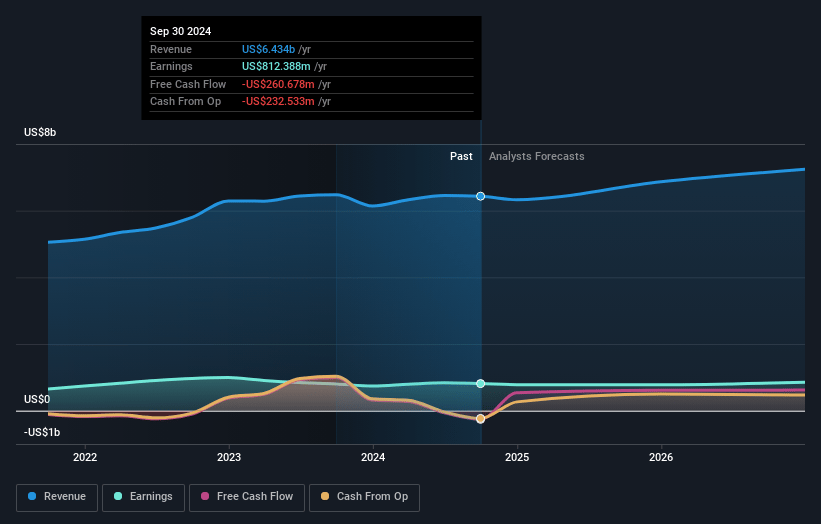

Meritage Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Meritage Homes's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.6% today to 10.9% in 3 years time.

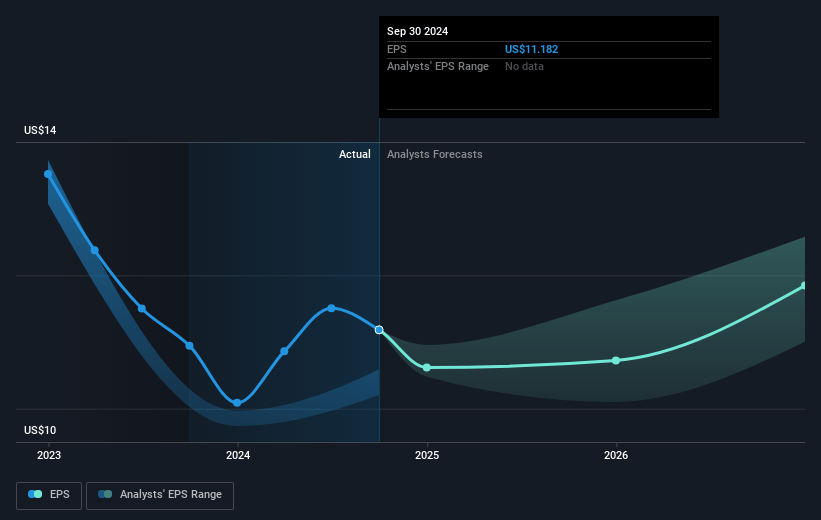

- Analysts expect earnings to reach $827.6 million (and earnings per share of $11.6) by about January 2028, up from $812.4 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $911 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, up from 7.2x today. This future PE is lower than the current PE for the US Consumer Durables industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

Meritage Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The volatile mortgage rate environment and the need to offer financial incentives, such as rate buydowns, could negatively affect Meritage Homes' net margins, as these incentives are necessary to maintain sales pace amidst higher rates.

- There is a risk of increased competition from existing home inventory, which could pressure Meritage Homes to reduce its prices or increase incentives, potentially impacting revenue and gross margins.

- Temporary construction delays and labor dislocation caused by events such as hurricanes may affect delivery timelines, elevating costs and potentially impacting earnings by delaying revenue recognition.

- The geographic and product mix shift, alongside increased financing incentive costs, has led to a decrease in average selling prices, impacting home closing revenues.

- Higher anticipated lot costs, increased utilization of financing incentives, and lower leverage on fixed costs on reduced revenue are leading to declines in gross margin, thus affecting overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $101.84 for Meritage Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $118.0, and the most bearish reporting a price target of just $76.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.6 billion, earnings will come to $827.6 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 8.4%.

- Given the current share price of $80.88, the analyst's price target of $101.84 is 20.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives