Key Takeaways

- Strategic expansion in high-demand regions, robust land position, and operational discipline position the company for outsized growth and market share gains as housing demand improves.

- Strong balance sheet and proactive cost management provide financial stability, downside protection, and set the stage for earnings outperformance as market conditions normalize.

- Rising costs, softening demand, increased inventory exposure, and heavy land investments are straining margins and profitability amid a challenging housing market environment.

Catalysts

About M/I Homes- Engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee.

- The company is strategically expanding its community count-up 5% year-over-year and planning continued growth in high-demand regions (Midwest, Southeast, and especially Southern markets like Texas and Florida) where demographic trends (millennial and Gen Z buyers, household formation) and migration patterns support long-term demand; this positions M/I Homes for outsized future revenue growth.

- Despite short-term headwinds from higher rates, the persistent U.S. single-family home undersupply relative to demographic demand means many buyers are still on the sidelines, suggesting there's substantial pent-up demand that could materialize as macro conditions improve-setting the stage for above-average future sales and revenue acceleration.

- M/I Homes maintains a robust land position with an owned and controlled supply equating to 5–6 years, which, along with disciplined acquisition and inventory management, minimizes financial risk, enables consistent earnings growth, and positions the company to seize market share during future housing upturns.

- Operational improvements such as better build cycle times, smart spec strategy, and tight cost controls-including leveraging incentives primarily through mortgage rate buydowns-are stabilizing gross margins despite current market pressure, setting the foundation for net margin expansion as demand normalizes.

- Strong balance sheet fundamentals (record-high equity, substantial cash reserves, low net debt, and aggressive share repurchases) not only provide downside protection but also amplify future earnings per share (EPS) and return on equity as demand and deliveries ramp up.

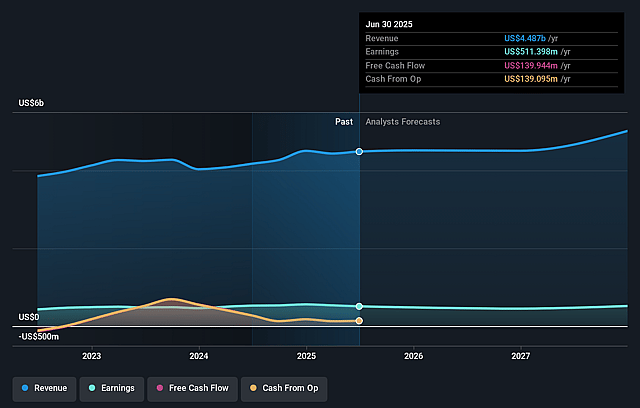

M/I Homes Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming M/I Homes's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 11.4% today to 9.7% in 3 years time.

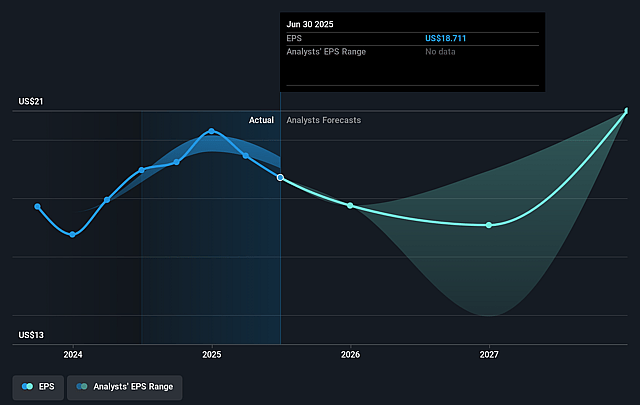

- Analysts expect earnings to reach $470.5 million (and earnings per share of $20.99) by about September 2028, down from $511.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from 7.9x today. This future PE is lower than the current PE for the US Consumer Durables industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 2.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

M/I Homes Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates remain a persistent headwind, as M/I Homes has had to rely on mortgage rate buydowns to spur sales, directly compressing gross margins (which declined by 320 bps YoY) and net profits, with pretax income and EPS down 18% and 14% respectively in the latest quarter.

- New contracts dropped 8% year-over-year (with even sharper double-digit declines early in the quarter), pointing to softening demand; if this trend persists, it will likely pressure future revenue growth and backlog conversion.

- Inventory risks are rising: the company has increased its inventory home production (73% of sales were inventory/spec homes) to drive near-term closings; this could result in greater exposure to potential price discounting and higher inventory holding costs if demand weakens, negatively impacting margins and earnings stability.

- SG&A expenses are rising faster than revenues (7% YoY SG&A growth on only 5% revenue increase), as community and headcount expansion outpaces top-line growth, threatening operating leverage and long-term profitability if volume does not accelerate.

- Heavy investment in land holdings (24,500 owned lots plus 26,000 controlled, a 5-6 year supply) exposes the company to significant risk of land devaluation during cyclical downturns, which could lead to impairment charges and damage future net margins and book value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $162.0 for M/I Homes based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $185.0, and the most bearish reporting a price target of just $150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.9 billion, earnings will come to $470.5 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 8.9%.

- Given the current share price of $152.96, the analyst price target of $162.0 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.